Arbitrum, a leading Ethereum Layer 2 scaling solution, experienced a substantial asset shift among investors after its recent token unlocking.

This movement has markedly influenced its price over the past day.

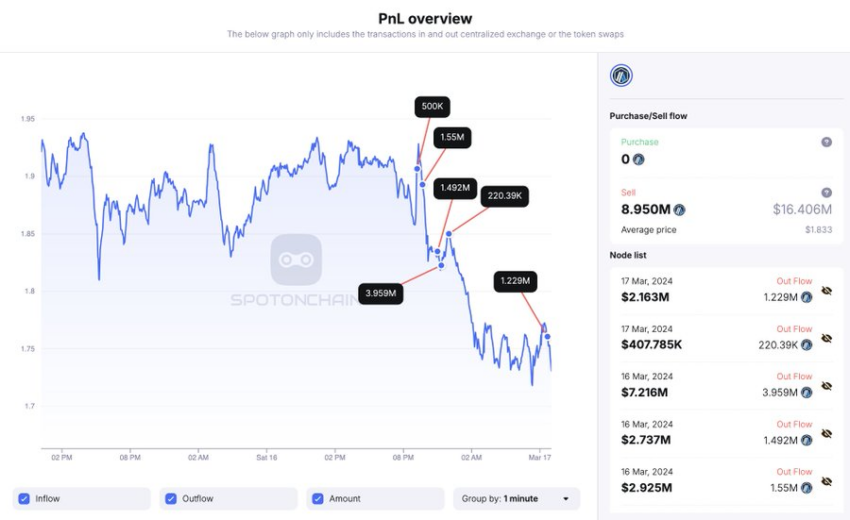

Crypto Whales Send 8.95 Million ARB to Binance

On March 16, amid much anticipation, the Layer 2 network finally released over 1 billion ARB tokens, valued at more than $2 billion. This event had been closely watched, with the crypto community offering diverse perspectives on its potential impact.

Immediately following the token unlock, blockchain analytics firm SpotOnChain identified six wallets receiving tokens from the network’s vesting contracts, subsequently transferring them to crypto exchanges. SpotOnChain’s data revealed that these addresses moved 8.95 million ARB tokens, valued at approximately $16.4 million, to Binance. Notably, these wallets still retain 32.95 million ARB tokens, worth around $56.7 million.

Usually, transfers to exchanges are seen as a bearish event because it suggests that the holder wants to divest their crypto holdings.

Read more: Arbiscan: A Comprehensive Guide to Arbitrum Blockchain Explorer

These transfers, coupled with the broader cryptocurrency market’s downturn, contributed to ARB’s price dropping to $1.62, marking its lowest level since January. However, there has been a slight recovery, with the price rebounding to $1.70. Nonetheless, the recent price decline reflects a significant loss of approximately 20% in value over the past week.

Despite this, market observers view the current downturn as an opportunity for investors to bolster their holdings, considering Arbitrum’s potential. DeFiLlama data shows that Arbitrum is the largest Ethereum Layer 2 solution. The protocol dominates the market, evidenced by its substantial decentralized exchange volume and total value locked (TVL) of $4.087 billion.

Read more: Arbitrum (ARB) Price Prediction 2024/2025/2035

In addition, blockchain analytical firm IntoTheBlock revealed that it accounts for more than 55% of the total transactions of Ethereum-based Layer 2 networks.

“There are over 1.8 million daily transactions among top Ethereum L2s, with Arbitrum accounting for over 1 million of the total,” IntoTheBlock said.

The protocol’s recent integration of the Dencun Upgrade has notably reduced transaction fees, further enhancing its competitiveness.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.