Financial regulators in Indonesia have initiated a comprehensive review of the country’s crypto tax regulations. This strategic reassessment underscores its commitment to fostering a robust digital economy while ensuring the sector contributes equitably to the nation’s coffers.

Since May 2022, Indonesia has levied a value-added tax (VAT) of 0.11% alongside a 0.1% income tax on all crypto transactions conducted within its borders.

Indonesia Ponders Beefing Up Crypto Tax Laws as Markets Boom

This tax regime is now being reevaluated to ensure its alignment with the industry’s growth.

Tirta Karma Senjaya, Bappebti’s Head of Market Development and Supervision, emphasized the critical juncture at which the crypto industry stands.

“As crypto transitions into a recognized sector within the financial industry, we anticipate the Directorate General of Taxes to undertake a thorough evaluation of the existing tax framework,” he articulated.

This call for reevaluation is driven by the recognition that, despite being in its nascent stages, the crypto sector is poised for significant growth. Consequently, regulators feel that it holds the potential to contribute substantially to Indonesia’s revenue through taxation.

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

The urgency for this review is further justified by the impressive tax revenue figures. Suryo Utomo, the Director General of Taxes, announced that the Directorate General of Taxes had amassed nearly $2.5 million between the crypto tax and VAT in January 2024. This sum underscores the significant fiscal contribution of the digital asset domain to the Indonesian economy.

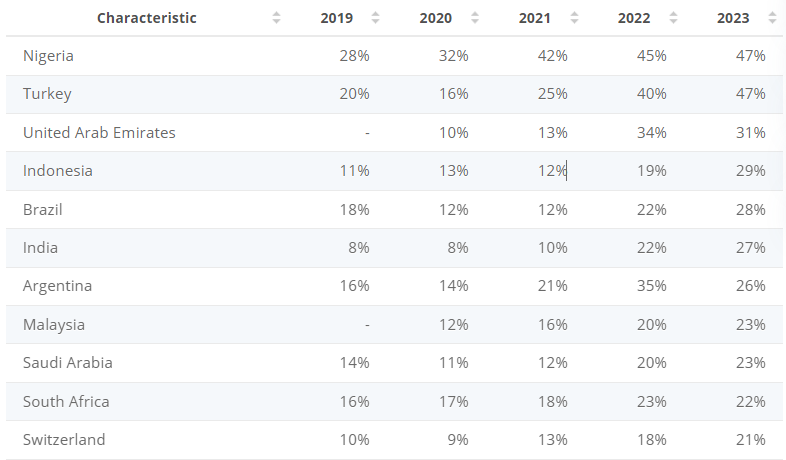

Data from Statista found that in 2023, Indonesia ranked as one of the top countries in terms of crypto ownership and use.

Indonesia has made significant strides in its digital finance sector over the years. July 2023 marked one of the most significant milestones with the launch of a national cryptocurrency asset exchange. According to the agency’s head, Didid Noordiatmoko

“The establishment of the exchange, clearing, and crypto asset storage place management is proof of the government’s presence in efforts to create a fair and just crypto asset trading ecosystem to ensure legal certainty and prioritize protection for the public as customers.”

The establishment of this exchange has been likened to the operational model of the New York Stock Exchange. It represents a pivotal step toward integrating safe and regulated crypto asset trading into Indonesia’s financial ecosystem.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.