South Korea’s Gyeonggi province has implemented a clever system to combat crypto tax evasion dubbed ‘Arbitrator Virtual Asset Tracking Electronic Management System.’ This approach netted a substantial 6.2 billion won (~$4.7 million) in arrears last year alone.

The system can trace personal information like phone numbers for known tax delinquents and cross-reference this on crypto trading platforms.

Going After Crypto Tax Delinquents

This integration significantly streamlines the tracking and collection process, a leap forward from the previous method, which required around six months for each case.

Central to this success is the use of delinquent residents’ registration numbers by municipalities to trace mobile phone numbers. This strategy has drastically improved the success rate of detecting membership in virtual currency exchanges.

The system identified 5,910 tax delinquents with virtual asset accounts, such as Bitcoin, and successfully recovered arrears from 2,390 individuals over the past year.

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

“For those who trade in virtual assets but claim inability to pay taxes, we will continue to enforce strong collections. Our goal is to protect conscientious taxpayers and ensure fair taxation,” the director of the old tax bill commented (translated).

This initiative is part of South Korea’s broader commitment to regulating the cryptocurrency market and fostering a fair economic environment.

South Korea Tightens Crypto Industry Screws

The Financial Intelligence Unit (FIU) reported a 49% increase in suspicious crypto transactions in 2023 compared to the previous year. This uptick in scrutiny and the collaboration with enforcement agencies underscore the nation’s determination to curb illicit cryptocurrency activities.

The country is also poised for a significant regulatory shift with the upcoming Virtual Asset User Protection Act, set to take effect in July 2024. This act introduces severe penalties, including life imprisonment for illicit crypto gains exceeding $3.7 million.

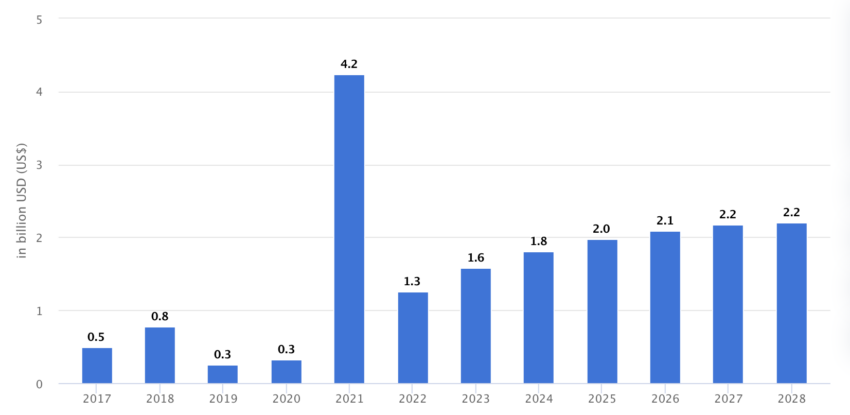

Such stringent measures align with South Korea’s vision to establish a transparent and accountable crypto market. Statista data projects it to generate $2.2 billion annually by 2027.

As it continues to refine its approach, the success of Gyeonggi’s tracking system offers a promising blueprint for other regions. The integration of technology and stringent legal frameworks exemplifies a dynamic strategy to safeguard the integrity of the financial system and the interests of lawful taxpayers.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.