With all attention focused on the premise of a spot Bitcoin ETF, the steady increase in collateral locked on Ethereum layer-2 networks has gone unnoticed. L2 TVL has reached an all-time high this week, but will ETH prices start to move yet?

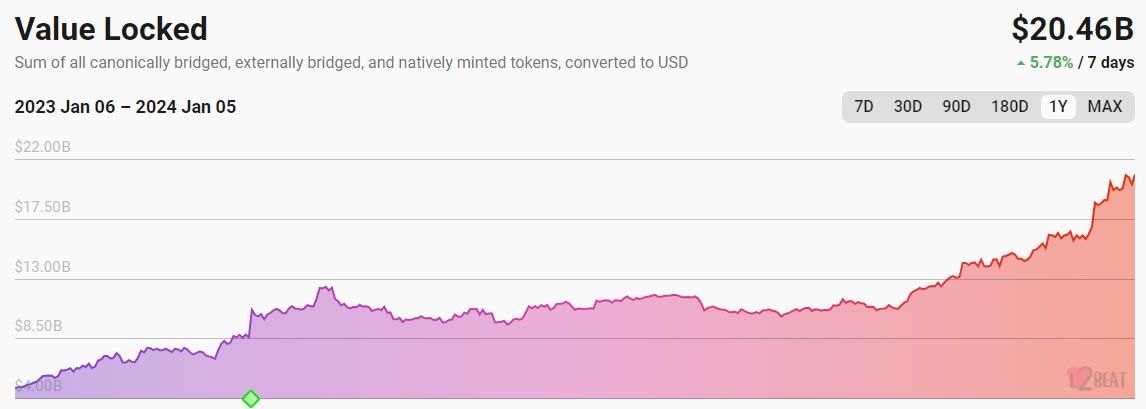

According to layer-2 ecosystem platform L2beat, the total value locked across all platforms hit a record $21.16 billion on Jan. 3.

Ethereum Layer-2 Surging

To put this into perspective, this is the same amount that was locked in all decentralized finance (DeFi) protocols in January 2021.

Moreover, layer-2 TVL has surged 34% over the past month to its current level of $20.8 billion, just off the peak.

Over the past year, L2 TVL has surged a whopping 333% from around $4.8 billion in early January 2023.

By comparison, DeFi markets have gained just 38% in terms of TVL over the same period, according to DeFiLlama.

Arbitrum One is the market leader with around $10 billion in TVL giving it a market share of almost 50%. Optimism (OP Mainnet) is second with $5.8 billion TVL and a market share of 28.7%

The rest of the layer-2 platforms are comparatively small with Metis Andromeda and Base occupying third and fourth with around $750 million TVL each.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

On Jan. 4, analyst Metaquant called this a rotation from alternative layer-1 blockchains back into Ethereum and layer-2. Ethereum competitors Solana and Avalanche have been surging in recent weeks but they have started to cool now.

In addition to the L2 TVL peak, daily active addresses, layer-2 fees, and layer-2 stablecoin market capitalization have also been steadily increasing, he noted.

Moreover, ETH prices have been lagging as attention was elsewhere, he said before adding:

“Once [ETH] price goes up, everyone will move again on Ethereum and L2s,”

Ethereum L2 TVLs have surpassed other layer-1 chains combined, reported analyst “Josh”. “Remember, they will buy back their ETH,” he added.

ETH Price Outlook

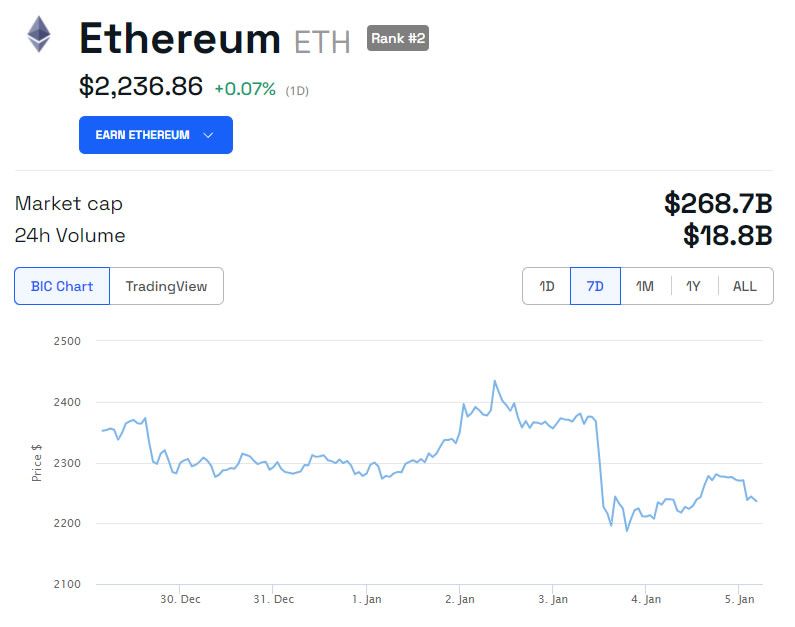

Ethereum prices haven’t moved much over the past 24 hours remaining at $2,245 at the time of writing.

The asset has hit resistance at $2,430 twice in the past fortnight and has failed to break it. Moreover, ETH has now fallen back 8% from that high.

Ethereum remains down 54% from its November 2021 all-time high of $4,878. However, the long-term outlook for the asset in 2024 is bullish.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.