This week’s Federal Reserve Open Markets Committee meeting could reveal when the Fed will cut rates, which could have implications for Bitcoin exchange-traded fund (ETF) strategies. Despite favorable jobs and economic data, Inflation has not dropped the Fed’s 2% goal, making this week’s announcement tricky for Chairman Jerome Powell.

When the Federal Reserve meets from Tuesday to Thursday, it is expected to decide whether to keep the federal funds rate elevated or change it. Experts mostly agree that the US may not enter a recession, but the timing of when the Fed starts to cut rates will play a crucial role for Bitcoin and stocks in 2024.

Economists Say Fed Target Still Elusive

Speaking on Bloomberg Wall Street Week on Friday, PIMCO Multi-Asset Strategies Portfolio Manager Erin Browne said that before US jobs numbers came out, some investors were pricing in a 1.27% reduction in interest rates next year. Later, they tempered their expectations as the jobs report revealed increasing wage growth and portending rate cuts in the fourth quarter.

“But right now, at least, I’m not pricing in a recession for next year, but I do expect a slow growth environment in the US with the potential for recession risk, particularly outside of the US, that could open the door for rate cuts towards the end of next year.“

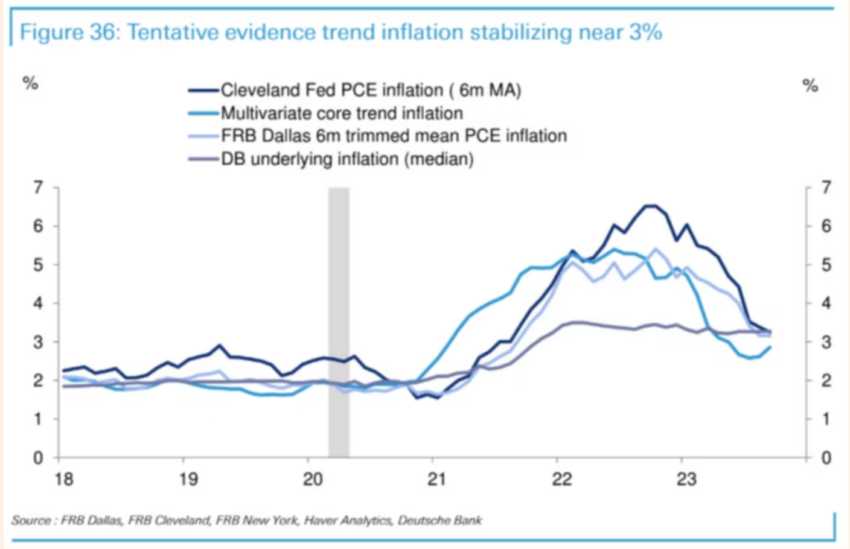

Indeed, some experts say it is too early to break out the champagne. Fed inflation metrics are still above the Fed’s 2% target and have declined less recently than earlier this year.

Also, premature cuts may accompany a slower economy. An economist at Strategas, Dan Rissmiller, cautions that a soft-landing thesis still faces many obstacles, namely below 4% unemployment and whether the US economy can grow unhindered amid higher interest rates.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Others say the re-entry of workers after the recent autoworkers and Hollywood strikes make the job numbers less robust than they appear at first glance, while others point to an inverted yield curve as the sign of an end–of–year recession in 2024.

How Bitcoin Could Ride Fed Policy

Recession fears still abound, but the Fed will unlikely start cutting rates tomorrow. Any hints as to the timing of future cuts may spur a Bitcoin rally, provided the asset doesn’t fall below $40,000, some experts predict.

Bitcoin could also rally independently of the Fed policy if the US Securities and Exchange Commission approves exchange-traded funds starting in January. If the Fed cuts rates in Q1, this would lower bond yields and make Bitcoin attractive to investors through ETFs.

The Bitcoin halving, expected in late April, could boost prices further by reducing the emission rate of Bitcoins, even as lower bond yields stimulate ETF demand. The Bitcoin halving also makes it a deflationary asset and a potentially safer store of value, considering how the Fed policy can devalue fiat currency at will.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Do you have something to say about the Fed policy could be bullish for Bitcoin or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.