Big crypto mining companies have spent $747 million on facilities and equipment this month, ahead of next year’s Bitcoin halving. Overall, they have committed over $1.2 billion for machines to be delivered in batches next year, even as crypto execs wax bullish.

The new equipment purchases will add more computing power to the Bitcoin network, making it more difficult for smaller companies to compete. Last year, Iris Energy, Stronghold Digital, and Argo Blockchain had to restructure operations to remain in business after the bear market strangled profitability.

Bitcoin Halving May Kill Smaller Miners

Bigger miners also accumulate cash to buy smaller competitors that may not have enough capital to survive the next halving. Marathon Digital, for example, is keeping about $700 million for acquisitions.

Once every four years, the halving reduces the rate at which new Bitcoins are released into circulation. Previous halvings have proven bullish for the asset.

Read more: What Is Bitcoin Halving?

Excitement around the approvals of several Bitcoin exchange-traded funds (ETF) has recently seen Bitcoin’s price shoot up to over $44,000. Reports have surfaced that ETF applicants are in advanced talks with the US Securities and Exchange Commission (SEC), a sign some see as a strong sign of an imminent approval. The SEC has been reluctant to approve spot Bitcoin ETFs because of market manipulation risks.

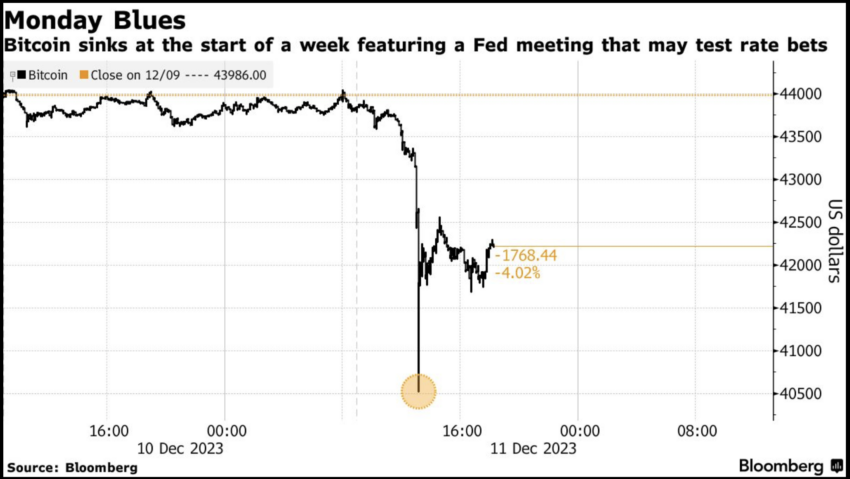

Bitcoin shed some of its gains during an Asian selloff on Monday morning. The asset dropped to $40,521 but recovered to $42,500 in London.

Bitcoin Could Reach $100K, Say Execs

Several crypto execs believe Bitcoin could rise significantly in 2024. Michael Saylor, chairman of MicroStrategy and Bitcoin maximalist, told CNBC in November that Bitcoin’s price could increase by 10x. He recently said,

“One day, we will all brag about buying five-figure Bitcoin.”

Adam Back, the CEO of mining infrastructure provider Blockstream, predicted Bitcoin would reach $100,000 before the halving. Cathie Wood, the CEO and chief investment officer of ARK Invest, predicted that an ETF tracking Bitcoin would outperform funds that track Bitcoin-related equities in the long term. Wood said ARK views Bitcoin as a ‘flight to safety” because Bitcoin has no counterparty risk.

ARK Invest predicts that Bitcoin could reach $1.25 million by 2030. The deadline for the SEC to approve or reject ARK’s ETF application is January 10, 2024.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Do you have something to say about execs’ crypto predictions, how Bitcoin miners buy equipment for the halving, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.