The Chainlink (LINK) price has now dropped 15% from its yearly peak of $16.60 record 10 days ago. On-chain analysis explores the major drivers behind the correction and the prospects of an early rebound.

LINK bulls are showing early signs of fatigue after nearly a month of consistent buying pressure. Will the LINK price rebound toward $20 or retrace to $10?

Bullish Whales are Showing Signs of Fatigue

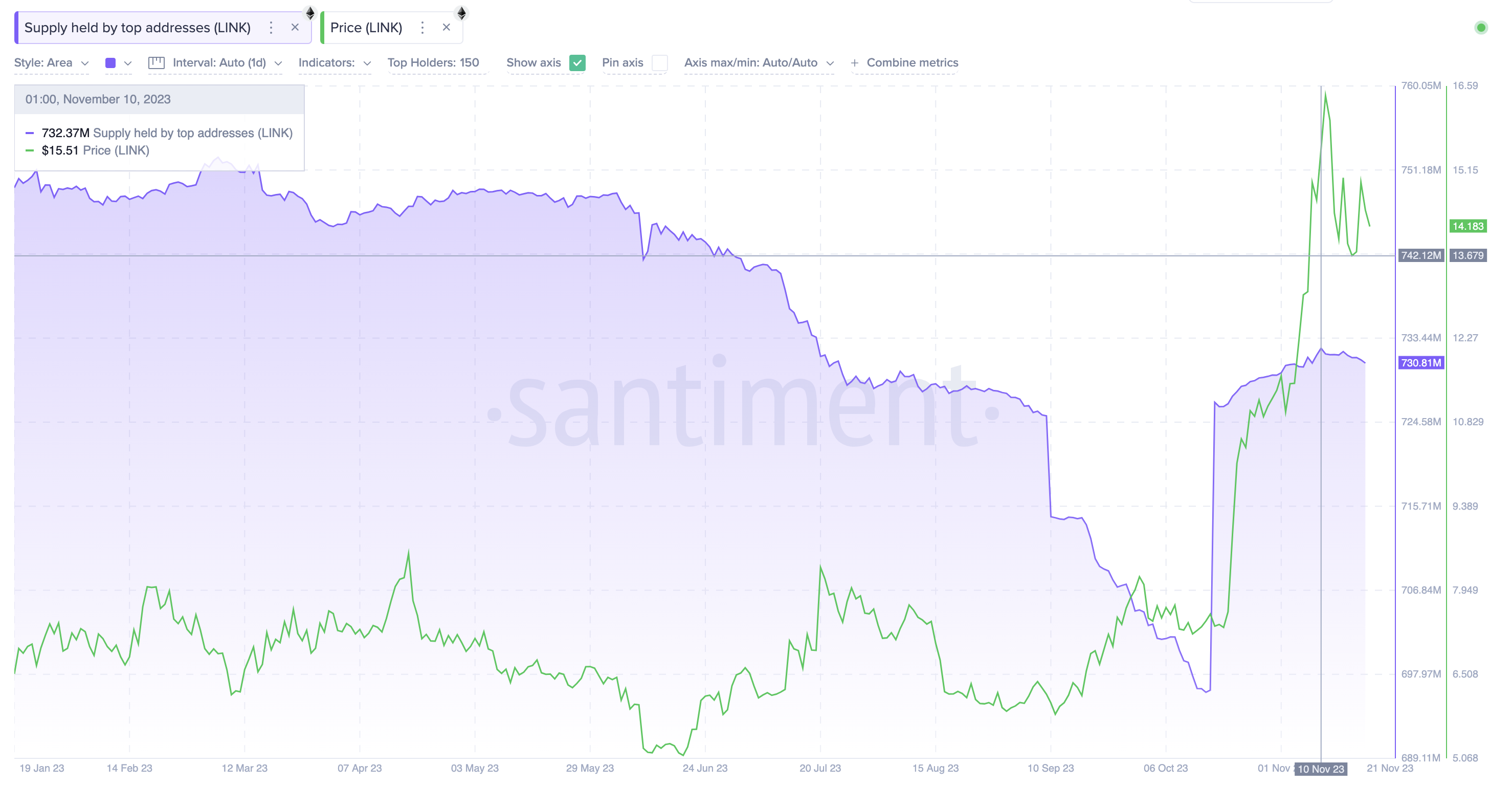

Recently, the Chainlink price entered a 130% breakout between October 17 and November 11. On-chain data trends show that Chainlink’s top 150 holders were pivotal in that rally.

According to Santiment, they rapidly accumulated 36.07 million LINK during that period, bringing their cumulative balances to a 4-month peak of 730.37 million tokens. But since the price peaked at $16.60 on November 11, they have slowed down the buying pressure significantly.

As depicted in the chart below, Chainlink investors held a total of 732.37 million LINK tokens as of November 10. Worryingly, the figure has now dipped to 730.81 million LINK. In essence, the bullish top 150 Chainlink investors have reduced their LINK holdings by 1.56 million tokens since the local top, raising fatigue concerns.

The supply held by top addresses metric tracks real-time changes in the number of LINK tokens in the custody of the wallets with the highest deposits. The chart above illustrates after nearly of month-long buying frenzy, the top 150 Chainlink holders have now sold 1.56 million LINK between November 11 and November 21. Valued at the current market value of $14.2, it means they have booked $22 million by selling.

Typically, it is a bearish indicator when top addresses start selling during a price rally. It implies that the biggest investors in the ecosystem are growing cold feet. Firstly, their buying frenzy over the past month was closely correlated to the triple-digit percentage price bounce. Hence, if they start selling, it could have a similar impact in reverse.

But more importantly, strategic retail investors could take on bearish positions, too, if the whales keep selling for a prolonged period.

Read more: What Is Chainlink (LINK)?

The Buying Fatigue is Spreading Toward the Retail Market

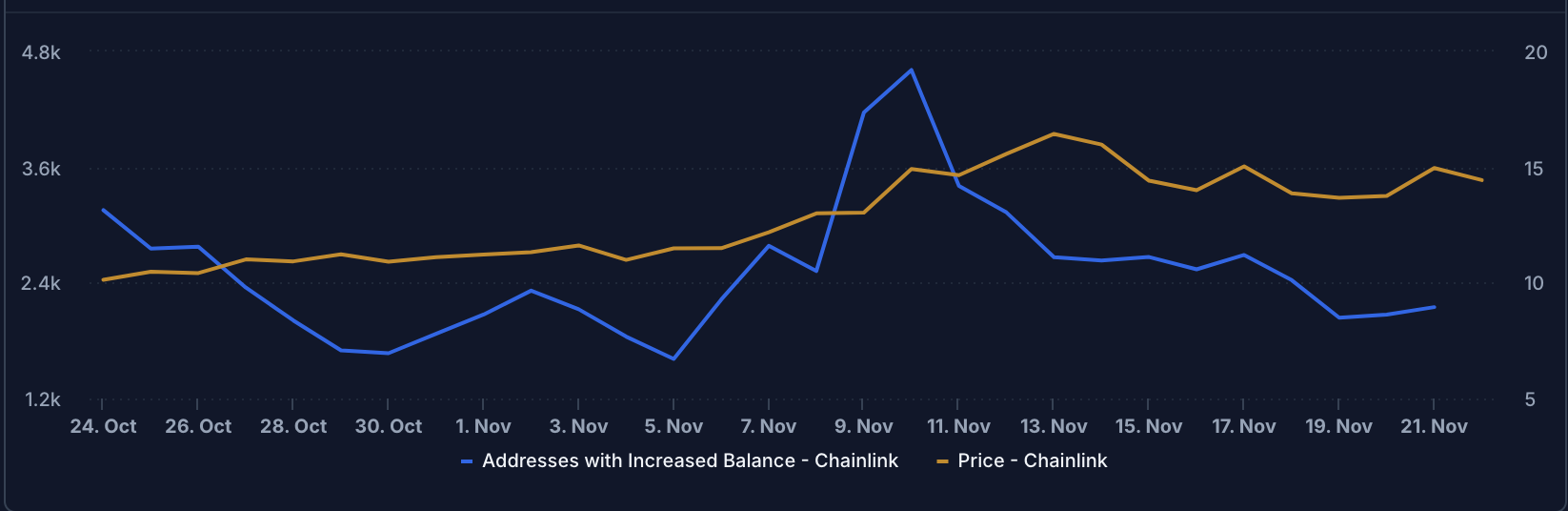

The LINK price has been in a steep downtrend since dropping from its yearly peak of $16.60 last week. However, on-chain data trends show that in addition to whales who have started taking profits, retail investors are also buying less.

According to on-chain data tracker TheTie, 4,610 Chainlink Active Addresses increased balances around November 10. But since then, the number of investors adding more LINK to their holdings has dropped continuously, hitting 2,150 wallets on November 20. This implies a 53% decline in overall buying pressure among existing LINK holders.

The active addresses with increased balances on-chain metric tracks the intensity of buying activity within a cryptocurrency ecosystem. It tracks the daily number of unique wallets that ended the day with tokens higher than their opening balances.

Intuitively, when a network records a consistently declining number of active users increasing their balances, it implies growing disinterest and waning buying pressure. Unsurprisingly, LINK price has dipped 15% since the investors began buying less around November 10.

Read more: 14 Best No KYC Crypto Exchanges in 2023

In conclusion, the bullish investor’s fatigue has slowed down the price rally significantly. Chainlink will require a boost from a bullish news event of fresh capital from new entrants to make another attempt at the $20 area.

LINK Price Prediction: Further Consolidation Before $20 Rally

Based on the vital on-chain metrics analyzed above, Chainlink could consolidate around the $12 – $15 area if the bulls’ fatigue persists.

The Global In/Out of the Money (GIOM) data, which groups the current LINK token addresses according to their entry prices, also affirms this prediction.

It shows that the bulls could mount a formidable support buy-wall around the $12 area. As depicted below, 50,660 addresses had bought 42.9 million LINK at the average price of $12.50. If those addresses stand firm, they could prevent a major price downswing.

But if the bears can overturn that support area, Chainlink’s price could tumble toward $10.

On the upside, the bulls could seize control of the market again if Chainlink’s price scales to $15. But, in that case, the 52,880 addresses that bought 23.84 million LINK at the minimum price of $15.20 could form a strong resistance. But if bulls can muster more buying pressure to scale possible break-even sellers and early profit-takers, the Chainlink price could finally push toward $20.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.