The class action lawsuit against crypto exchange Bitfinex and its sister company, the USDT stablecoin issuer Tether, has concluded, with the plaintiff deciding not to appeal the judgment.

Stablecoins are constantly under the public and regulators’ scrutiny regarding their backing, maintaining the peg, illicit transfers, and other reasons. USDT, being the largest stablecoin, has also been subjected to frequent lawsuits and regulatory actions.

Tether Calls Class Action Lawsuit Meritless After Final Dismissal

Through a blog post, Tether announced that the class action lawsuit filed by Shawn Dolifka and Matthew Anderson has been completely dismissed. The dismissal came as Dolifka decided not to appeal the judgment of Chief Judge Laura Taylor Swain.

In August, Judge Swain of the US District Court for the Southern District Of New York issued an order dismissing the class action lawsuit, which was filed in 2021. Dolifka and Anderson alleged that USDT was not backed one to one by the US dollar.

Read more: 8 Best Crypto Wallets to Store Tether (USDT)

Tether believes that the class action lawsuit was meritless and said:

“Quite unlike Dolifka’s ill-advised decision to file the action in the first place, his decision to forego his appeal rights was the correct decision. His claims were entirely meritless, and no amount of further litigation would have resulted in Dolifka or his attorneys realizing anything monetarily or otherwise.”

While this lawsuit was in Tether’s favor, it has previously paid heavy penalties to regulators.

For instance, in 2021, Tether signed an $18.5 settlement with the New York Attorney General over USDT’s backing. Also, in October 2021, the US Commodity Futures Trading Commission (CFTC) imposed a $41 million fine against Tether regarding the same matter.

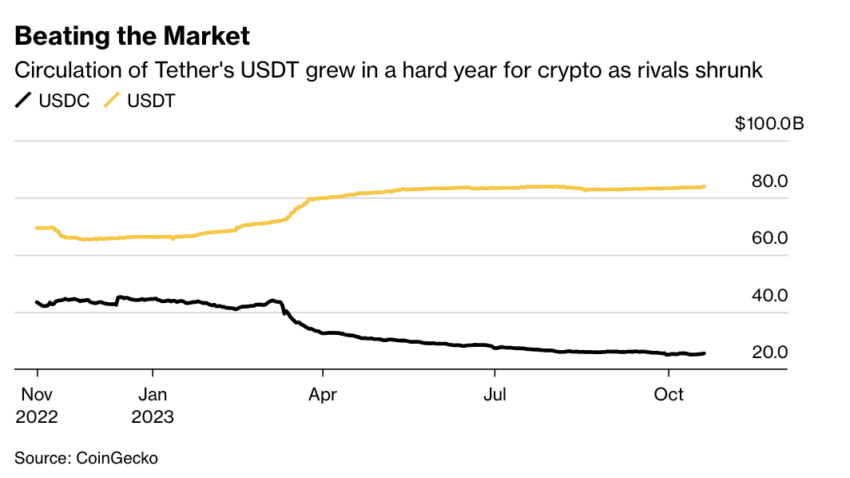

The controversies around USDT’s backing might possibly cool down in 2024, as new CEO Paolo Ardoino declared that the firm would start to publish real-time data on its reserves. Despite the legal challenges, USDT’s circulation has increased compared to its largest rival, USDC.

Read more: What Is a Stablecoin? A Beginner’s Guide

Do you have anything to say about the Tether lawsuit or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.