If you’re interested in global finance theories that paint a vivid picture of our economic future, you’ve likely heard of the Dollar Milkshake Theory. It’s an unconventional yet interesting prediction about the destiny of the U.S. dollar.

This guide delves into the dollar milkshake theory, explaining how it works and what it could potentially mean for the global economy.

What is the dollar milkshake theory?

The dollar milkshake theory is an economic thesis that predicts that the U.S. dollar will prevail against all other currencies, despite the current global economic uncertainties.

According to this theory, the U.S. dollar’s dominance will keep increasing as it sucks the liquidity out of other currencies.

Origin and key proponent

The theory was first coined by Santiago Capital’s CEO, Brent Johnson. Many economists and investors feel that the U.S. is a waning power and won’t hold the world’s reserve currency for long. Brent, however, believes the dollar isn’t yet at its peak.

Despite the grim economic conditions in the U.S., the theory suggests that the U.S. will leverage the global reliance on the USD to eventually weaken other currencies.

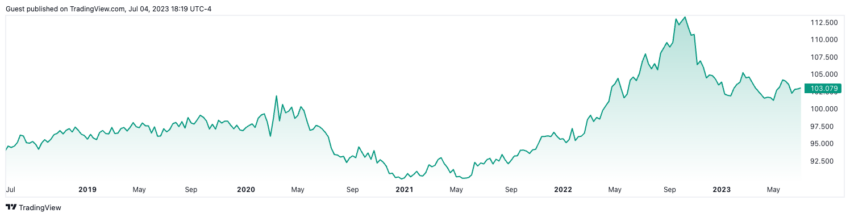

The Dollar Index Chart above shows that the dollar strengthened from its lows in late 2021. It then reached a five-year high in the second half of 2022. Then, it lost value again versus a basket of other major global currencies into 2023.

Why is it called dollar milkshake theory?

Brent Johnson used the milkshake analogy to describe the U.S.’s actions in times of global economic distress and how they would eventually lead to sovereign debt and currency crises.

Picture a milkshake in a glass; the froth and toppings represent different asset classes. The milk, cream, sugar, and other ingredients represent the cash flows into and out of the markets, while the straw stands for the Fed’s monetary policies.

The U.S. Federal Reserve turns to monetary easing to stimulate economic growth by lowering interest rates. This could be equated to adding milk and sugar to the glass, which raises the white froth. However, when the Federal Reserve switches to tightening policies, it turns the syringe injecting capital into the global market into a straw that sucks out the liquidity in the market, just as you would with a milkshake.

Understanding the theory’s core idea

The Dollar Milkshake Theory is based on two fundamental concepts: the global dependence on the US dollar for pricing and the long-term debt cycle.

Countries generally take on debt to fund government expenditures. These states then often have to take up more debt to repay the old debt. That starts the never-ending loop of long-term debt. Should it become too high, the countries may have to inflate their currency or default on the loan. Dependence on the dollar means that most debt pricing is done in USD because it is the world’s reserve currency.

Whenever the Fed lowers interest rates, countries are lured into taking up more U.S.-dominated debt. This move injects more dollars into the global market, making lending and investing easier. The result is a ‘milkshake’ of global capital.

However, when the interest rates increase, outstanding loans become more expensive to pay. Countries with USD-backed loans have to buy the dollar at higher prices, which causes a strain on their economies. The state currencies end up crushing as governments try to salvage the situation by inflating their currencies. This results in a sovereign debt crisis.

On the other hand, countries with strong credit ratings have investors abandoning to opt for U.S. debt as a safer bet, weakening the currency.

The role of the US dollar in the global currency landscape

The U.S. dollar has maintained an unrivaled dominance in the global currency market post World War II. Since then, it has been the preferred medium of exchange and store of value for global investors.

Here’s how it plays out in the global currency landscape.

Historical dollar dominance

The rise of the dollar as a global currency can be traced back to 1913. Back then, the U.S. economy surpassed Britain’s for the first time. Until then, the Great British Pound (GBP) was the world’s reserve currency and facilitated the majority of global transactions.

However, when World War I broke out in 1914, many countries had to abandon the gold standard, which was a framework to stabilize currencies. The war proved that the standard couldn’t hold its forte in adverse economic conditions, causing investors to lose confidence in it and instead turn to the British pound sterling and U.S. dollar as global reserves.

The Wall Street Crash of 1929 only expedited the U.S. dollar’s rise to the top. The few countries still holding gold stock tried increasing interest rates to incentivize investors against converting them to gold. However, things only became worse, and the U.S. became the preferred lender for states seeking dollar-denominated bonds. By 1931, Britain also had to abandon the gold standard, solidifying the dollar’s position as the world’s reserve currency.

When the U.S. government revalued gold in 1934, buyers now needed more paper money to buy an ounce of gold. The increase in the price of gold drove more countries to convert their remaining gold holdings into U.S. dollars. Although this led to the currency’s valuation, the U.S. amassed a significant amount of gold. As a result, it became the owner of most of the world’s gold by the end of World War II.

In 1944, several allied countries of the second world war met in New Hampshire to lay down the Bretton Woods agreement. The agreement would peg the world’s currencies to the U.S. dollar, seeing as it was directly linked to gold. Central banks would trade their currencies and the dollar at fixed rates. The U.S. would redeem the dollars for gold on demand to help countries regulate their money supply and, by extension, the value of their currency.

The Brenton Woods Agreement officially sealed the U.S. dollar’s position as a reserve currency, which it remains to date.

Impact on financial markets and trade

The greenback’s dominance in the global market has significant effects on the financial markets and international trade.

As the global reserve currency, the dollar fulfills many other roles. While most state currencies are only used within a country’s borders, the U.S. dollar is used widely in cross-border transactions. Its qualities as a store of value, medium of exchange, and unit of account make it the preferred currency for most countries.

Thanks to the dollar’s dominance, many governments and international institutions use the dollar as their funding currency. Central banks hold most of their foreign exchange reserves in USD, resulting in a large portion of assets in dollars outside of the U.S.

Because of the dollar’s role in the financial markets and trade, any move by the Fed could affect the global economy. An increase in interest rates reduces global market liquidity. Investments in the financial markets could decrease as higher discount rates make it more challenging to borrow debt.

Additionally, the Dollar Milkshake Theory impacts global trade by making it cheaper for the US to import goods and services it needs. However, exports from the U.S. become more expensive with a strengthening dollar, which could potentially lead to a trade imbalance.

Effects of fiat currency and monetary policy

Monetary policies refer to the mechanisms that central banks take to regulate the money supply and maintain price stability. Because of the greenback’s dominance, monetary policies by the Federal Reserve often result in macroeconomic distress. That is especially the case in developing countries that use dollar-invoiced prices.

The U.S. Fed uses three tools for its monetary policies:

- Changing short-term interest rates: Whenever inflation is high, the U.S. Fed turns to tightening policies to hike interest rates. This makes it even more difficult for banks and institutions to take up more loans, thereby reducing the money supply. The Federal Reserve eases up on its policies and reduces interest rates when economic growth slows down to encourage more lending.

- Open-market operations (OMO): The Fed can choose to either buy back or sell its bonds to control the money supply. In OMO, the Fed trades government securities in the open market to adjust the level of reserve balances.

- Reserve requirements: These are funds that banks must hold against their deposits. The Federal Reserve can manipulate this amount to encourage or discourse lending. Lower reserve requirements allow banks to loan more money, which they can, in turn, lend to their customers, increasing the overall money supply in the market.

Evaluating the dollar milkshake theory’s Implications

The dollar milkshake theory has some implications for several factors affecting the global markets. Let’s take a look at some of those.

Liquidity crisis and the federal reserve

The global liquidity crisis is one of the cornerstones of the dollar milkshake theory. As the U.S. central bank, the Federal Reserve is responsible for controlling inflation in the superpower and managing the short-term and long-term interest rates.

The latter monetary policy affects the liquidity available in the global market. By lowering the discount rate on short-term loans, the Fed increases liquidity as the money supply increases in the market. These conditions boost economic growth as more banks and international institutions are able to borrow more debt to finance economic activities. However, the Fed has to be careful not to keep the rates super low as prolonged decreases can spur inflation.

Conversely, a hike in interest rates reduces liquidity. Central banks struggle to service their debts and cannot take up more, thereby decreasing the supply of the dollar in the global market.

Quantitative easing and inflation concerns

Quantitative easing (QE) is a form of monetary policy implemented when economic growth slows down and interest rates get close to zero. Central banks execute QE by buying securities, such as government bonds, to increase the money supply and reduce interest rates.

Quantitative easing increases liquidity by creating new bank reserves. The liquidity provision by the Fed through QE provides easier terms for banks, encouraging lending and investment. An excellent example of QE in play was during the Covid-19 pandemic. During that period, the Fed increased its reserve holdings to about 56% of securities issued by the Treasure in Q1 of 2021.

One of the biggest concerns of using QE as a monetary policy is the looming risk of inflation. Many experts believe that it occurs as a result of an increased money supply. The Federal Reserve needs to remain watchful over the QE tools implemented to avoid such adverse effects.

The quantitative easing implemented during the pandemic saw the Federal Reserve acquire $700 billion in assets. As a result, inflation rates skyrocketed in 2021. The Federal had to switch its monetary policy strategy to counter inflation by hiking the interest rates.

Central banks’ response and currency devaluation

Countries take up loans for several reasons. Some countries have good credit ratings because they accrue large debts and still pay on time. Therefore, they have a good standing with investors, attracting money flow into the country. As a result, these countries have a strong currency.

Other countries have a bad credit history, owing to a scorecard of defaulted debts. These states tend to have a weaker currency because of this since investors have no confidence in it.

When the U.S. Fed raises interest rates, the latter countries accrue more interest on their debt. The central banks feel the pressure of the strengthening dollar as it becomes even more difficult to pay back their dollar-denominated debt. They might take up more debt to repay the old ones but can’t keep up with the strengthening dollar.

Eventually, the countries are forced to mimic the Fed’s move and inflate their currencies. However, demand for the dollar keeps growing as the U.S. sucks liquidity from the global market. Debts become more expensive, and the countries’ local currencies lose their value against the dollar.

Although countries with good credit scores will not collapse under the weight of long-term debt, they lose investors who instead put their money into the U.S. debt, thus weakening the state currency.

Safe havens and asset allocation strategies

A safe haven asset is one that is expected to withstand harsh economic times and market turmoil. For many investors, the U.S. is the world’s safe haven currency for several reasons, including its backing by the world’s largest economy.

In times of market instability, investors with cash holdings will opt to convert them into dollars. Demand for the USD increases, resulting in a value increase. Therefore, as other countries struggle to repay their U.S.-backed loans, the U.S. dollar keeps gaining value.

For this reason, many investors seek out safe havens to minimize their losses in turbulent markets. Other assets considered safe havens include gold, treasury bills, and defensive stocks. The euro, Japanese yen, and Swiss franc are also considered safe haven currencies. However, the dollar is a preference for most investors. Notably, bitcoin is slowly establishing itself as a safe haven, too.

Considerations for global economic conditions

Because of the dollar’s hold on the global market, any drastic moves by the Federal Reserve could result in macroeconomic distress, particularly in developing countries that rely heavily on dollar-dominated debts.

A strengthening currency would make it more difficult to service these loans, leading to debt distress. Because of its position as the world’s reserve currency, about half of the world’s debt is in dollars, and such a situation would cause an imbalance in the global economic landscape.

Additionally, as the U.S. continues siphoning capital from the global market, countries with weaker currencies face pressure, which could lead to currency depreciation. States that rely on exports face financial challenges as it becomes even more difficult to export their goods. The U.S., on the other hand, could possibly have cheaper imports and expensive exports, causing a trade imbalance.

Alternative investments and diversification

Increased demand for the dollar causes its value to strengthen against other currencies. This could potentially lead to the U.S. sucking up the liquidity of the global market as economies with weaker currencies struggle to keep up with the rising dollar.

To protect themselves against currency devaluation, investors start opting for alternative investments to diversify their holdings. As a result, the demand for alternative assets like gold and bitcoin increases, driving their prices up as well.

Criticisms and counter-arguments to the theory

The dollar milkshake theory has been the source of many debates in economic circles ever since it was first coined in 2018. While some experts agree with Brent’s sentiments, others remain adamant that the U.S.’s days of power are coming to an end.

Assessing the validity of the dollar milkshake theory

There have been various concerns raised over the validity of the Dollar Milkshake theory.

- For starters, the only sources of information on the economic hypothesis have been the interviews that Brent Johnson has gone on and social media exchanges. He has never published a paper on the same, making it even more challenging for other financial analysts to have a reference point for the theory.

- That aside, the Dollar Milkshake Theory proposes various predictions for the dollar and other currencies without explicitly mentioning the time frame. While the theory may be true for some investors, the predictions may not hold for others as there is no clear timeframe.

- Besides, the theory assumes that monetary policies from the Federal Reserve will help increase capital inflow into the US. However, it’s worth pointing out that the effectiveness of these policies will vary depending on various factors. The measures taken by other central banks in the world could potentially affect capital flows.

- Finally, the US dollar is expected to keep gaining strength against other currencies. While this may hold in certain situations, keep in mind that currency movements are affected by a range of factors. Market sentiments, geopolitical events, and other unforeseen economic fundamentals make it even more challenging to predict currency movements.

Contrasting perspectives and expert opinions

Because of the factors pointed out above, not all analysts agree with the dollar milkshake theory. For example, economist Zoltan Pozsar counters Brent’s hypothesis with a theory of his own called the Bretton Woods III Theory.

According to this theory, a new world monetary order will emerge. Commodity-based currencies in the East will be at the heart of it all and possibly weaken the Eurodollar system.

Although Pozsar doesn’t predict the complete fall of the dollar from the high ranks, he argues that it will be on a decline, especially after the Russia-Ukraine war. This will happen as countries move away from the dollar and reconsider what they deem as a reserve, and turn to hard assets and commodities.

In his paper documenting the theory, Pozsar says, “From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities). After this war is over, “money” will never be the same again… …and Bitcoin (if it still exists then) will probably benefit from all this.”

Experts such as Mohamed El-Erian, the Chief Economic Advisor at Allianz, have also raised their skepticism over the entire theory. Mohamed argues that the Dollar Milkshake Theory oversimplifies the global economic landscape. Brent’s model doesn’t take into account the influence of other major central banks and currencies.

Potential risks and limitations

The inherent risk of the dollar milkshake theory is that it could lead to a sovereign bond and currency crisis as other states try to keep up with the U.S. dollar. Here are some of the risks and limitations presented by the dollar milkshake theory.

- Global market complexities: One of the biggest limitations of the theory is its reliance on the Federal Reserve’s monetary policies. Global economics is complex and influenced by interconnected factors, which the theory massively downplays.

- Geopolitical factors: As mentioned earlier, geopolitical events impact currency movements significantly, affecting global capital flows. The dollar milkshake theory doesn’t account for such events, which could influence the dollar’s performance.

- Unpredictable market outcomes: Economic predictions centering around currency movements are usually uncertain. The theory’s assumptions on the strengthening dollar and debt burdens may not align with actual outcomes. Market sentiments shift, and unforeseen events influence global economies.

- Arbitrage opportunities: While the theory suggests that market participants will behave in a certain way, efficient markets could present arbitrage opportunities. These could potentially adjust prices and counter the effects of the theory.

What does the dollar milkshake theory mean for crypto?

The dollar milkshake theory focuses on the dynamics of global fiat currencies, specifically the U.S. dollar. However, its potential implications for the world of cryptocurrencies can be inferred.

If dollar milkshake theory plays out, here’s how it could affect cryptocurrencies.

- Bitcoin could see an influx of funds as a safe haven asset; even more so if it manages to establish itself as a superior form of currency to fiat.

- An increase in the value of the U.S. dollar could lead to a decline in cryptocurrency prices. Prices could decline if investors flock towards a strong (and safe) dollar and out of risky assets, such as digital currencies.

However, it’s difficult to predict how a strengthening U.S. dollar would affect the likes of bitcoin and ether, given how young and volatile the cryptocurrency market is. For example, if crypto is in a full-blown bull market, how the dollar is faring may have little to no effect on the prices of crypto assets.

The shake-out

The dollar milkshake theory offers an interesting perspective on the potential future of the global economy. It paints a picture where the U.S. dollar’s strength could precipitate an economic crisis. While the theory draws on understandable mechanisms such as interest rate differentials and global capital flows, it remains one viewpoint among many. Its predictions aren’t universally accepted and face considerable debate.

As with all economic theories, real-world outcomes will inevitably be influenced by a wide range of factors, some of which will be entirely unforeseen. So only time will tell if the dollar milkshake theory will play out in real life.

Frequently asked questions

What is the dollar milkshake theory hedge?

What is the dollar milkshake theory of bitcoin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.