The cryptocurrency market sentiment has turned bullish with the potential of a spot Bitcoin ETF (exchange-traded fund). While appealing, this innovative financial product comes with a suite of risks that investors must carefully consider.

BlackRock, the world’s largest asset manager, has highlighted several crucial risk factors that spot Bitcoin ETFs pose.

The Risks Spot Bitcoin ETFs Pose

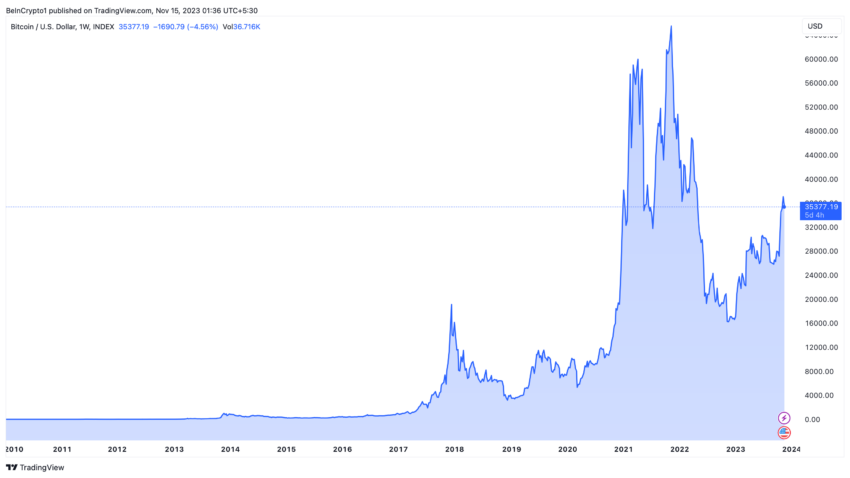

Extreme volatility stands as the foremost concern. Cryptocurrencies, notably Bitcoin, have historically experienced dramatic price fluctuations. This pattern of parabolic uptrends followed by rapid declines has been a recurring theme. For instance, this was evident in 2011, 2013-2014, 2017-2018, and 2021-2022.

Such unpredictable volatility directly impacts the potential value of spot Bitcoin ETF shares, posing a risk of substantial losses.

“There is no assurance that Bitcoin will maintain its value in the long, intermediate, short, or any other term. In the event that the price of Bitcoin declines, the [BlackRock] expects the value of the Shares to decline proportionately,” the registration statement reads.

Recent market events have further compounded these risks. The bankruptcy of key players like Celsius Network, Voyager Digital, and Three Arrows Capital, along with the collapse of FTX in November 2022, significantly disturbed the market. These developments triggered extreme price volatility and eroded confidence in the stability and liquidity of the crypto market.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Regulatory and enforcement actions add another layer of complexity. Increased scrutiny by authorities like the US Department of Justice, the SEC, and the CFTC has introduced an element of uncertainty. This regulatory environment could further market volatility, create additional hurdles for cryptos, and spot Bitcoin ETFs.

Technological risks are also paramount. The reliance of cryptocurrencies on blockchain technology, which is still nascent, introduces several vulnerabilities. Issues such as the loss or theft of private keys, Internet dependency, potential network forks, and scalability challenges can significantly impact the security and functionality of digital assets.

“Digital assets such as Bitcoin were only introduced within the past 15 years, and the value of the Shares is subject to a number of factors over time relating to the capabilities and development of blockchain technologies, such as the recentness of their development, their dependence on the Internet and other technologies, their dependence on the role played by users, developers, and miners and the potential for malicious activity,” the registration statement reads.

According to BlackRock, environmental concerns related to Bitcoin mining, notably its substantial energy consumption, cannot be overlooked. The public and regulatory backlash against high-energy-consuming mining operations could negatively impact the Bitcoin market. Moreover, a decrease in mining rewards could dissuade miners, potentially affecting the price and security of Bitcoin’s network.

The market concentration of Bitcoin, where a few wallets hold a large portion of the total supply, also raises concerns about market manipulation. Large transactions by these holders could result in significant market movements, further contributing to Bitcoin’s price volatility.

Other Factors Investors Must Consider

Investing in a spot Bitcoin ETF requires careful consideration of the risks. The combination of market volatility, technological uncertainties, regulatory dynamics, environmental factors, and potential market manipulation presents a complex investment.

To make informed decisions, potential investors must also weigh the following additional risks against their investment goals and risk tolerance.

- Stablecoin Risks: The market is influenced by stablecoins like Tether and USDC. Issues with these stablecoins, such as regulatory actions or operational problems, could disrupt Bitcoin prices and market stability.

- Miner Dependence and Transaction Fees: Bitcoin’s value and network security depend on miner participation. Changes in mining rewards or costs could influence miner activity, impacting transaction fees and network stability.

- Scaling Challenges and Network Forks: Bitcoin faces scaling challenges. Attempts to increase transaction volume may fail or cause network forks, creating new digital assets and potentially diluting Bitcoin’s value.

- Lack of Historical Data: The relatively short history of digital assets like Bitcoin makes it difficult to predict future performance or assess long-term viability.

- Reliance on Internet and Technologies: Bitcoin’s dependence on the Internet and other technologies exposes it to risks related to online security, cyberattacks, and technological obsolescence.

- Governance Issues: Bitcoin’s decentralized governance could lead to a lack of consensus or clarity in decision-making, impacting network utility and growth.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

The allure of a spot Bitcoin ETF demands a nuanced understanding of the intricate risks involved. BlackRock’s comprehensive analysis of these risks reveals that extreme volatility, technological uncertainties, regulatory dynamics, environmental concerns, and potential market manipulation intertwine, forming a complex market that potential investors must navigate cautiously.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.