As Bitcoin (BTC) hovers around the $30,000 prize zone analysts give their price targets for the new year based on historical price analysis and forecasts,

Bitcoin has surged 70% so far this year. It was fueled by financial turmoil and expectations surrounding the approval of a spot Bitcoin ETF (Exchange-Traded Fund) in the United States.

Historical Bitcoin Price Fractal: Towards $50,000?

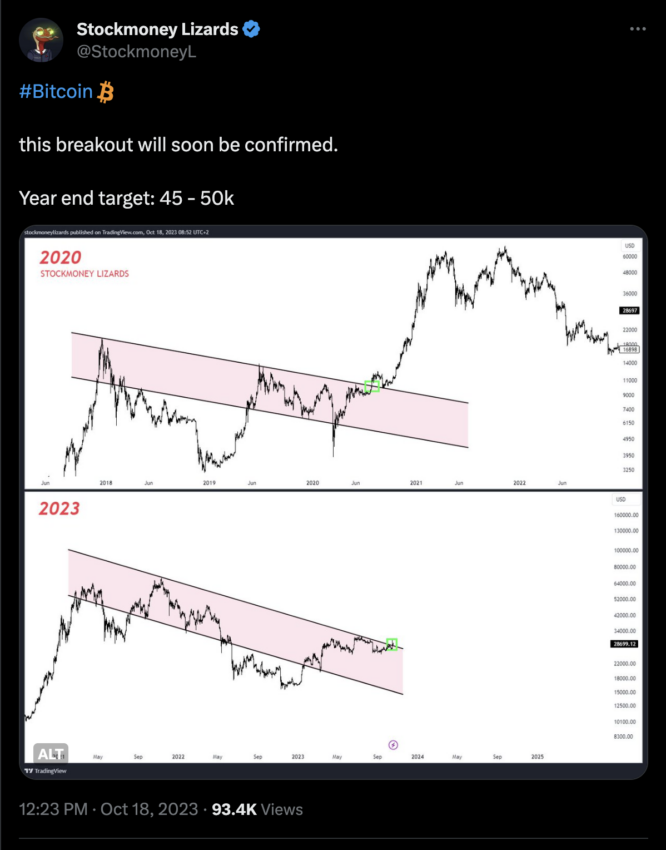

The current Bitcoin market trend bears remarkable similarities to the price movement from 2017-2020. According to the analyst Stockmoney Lizards, this could lead to a key breakout moment, similar to the green area on the chart, and a decisive bull market.

A similar pattern in 2020 led to a record high of $69,000 in November 2021. If this trend repeats, Bitcoin could rise to the $45,000-$50,000 range by the end of the year.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

However, it is important to note that Bitcoin is currently facing challenges, mainly due to the policies of the US Federal Reserve. This led to reduced liquidity in the market. Bitcoin’s price is down by over 30% compared to April 2022, when the Federal Reserve’s balance sheet peaked.

Bitcoin Predictions from Standard Chartered

Standard Chartered, a renowned financial institution, also predicts that Bitcoin will reach $50,000 by the end of the year. Geoff Kendrick, global principal researcher and chief strategist at Standard Chartered, says rising miners’ profitability will reduce their need to sell BTC, which could lead to lower supply relative to potentially rising demand.

Interestingly, the number of Bitcoins held by miners increased during the Ordinals hype in May 2023 and has remained stable since then.

Read more: Bitcoin NFTs: Everything You Need To Know About Ordinals

Analysts are, therefore, optimistic about the possibility of the price breaking the $50,000 barrier. Both historical price fractals and reduced supply due to miners’ profitability suggest a positive outlook. However, it is important to remember that the cryptocurrency market is dynamic and subject to many factors, so investors should exercise caution and stay up to date with the latest developments.

Do you have anything to say about Bitcoin analysis for the year-end or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.