Bitcoin markets have already started to move, but will today’s big BTC options expiry lift them higher? Almost a billion dollars worth of crypto derivatives are set to expire, and maybe markets will be jolted into action.

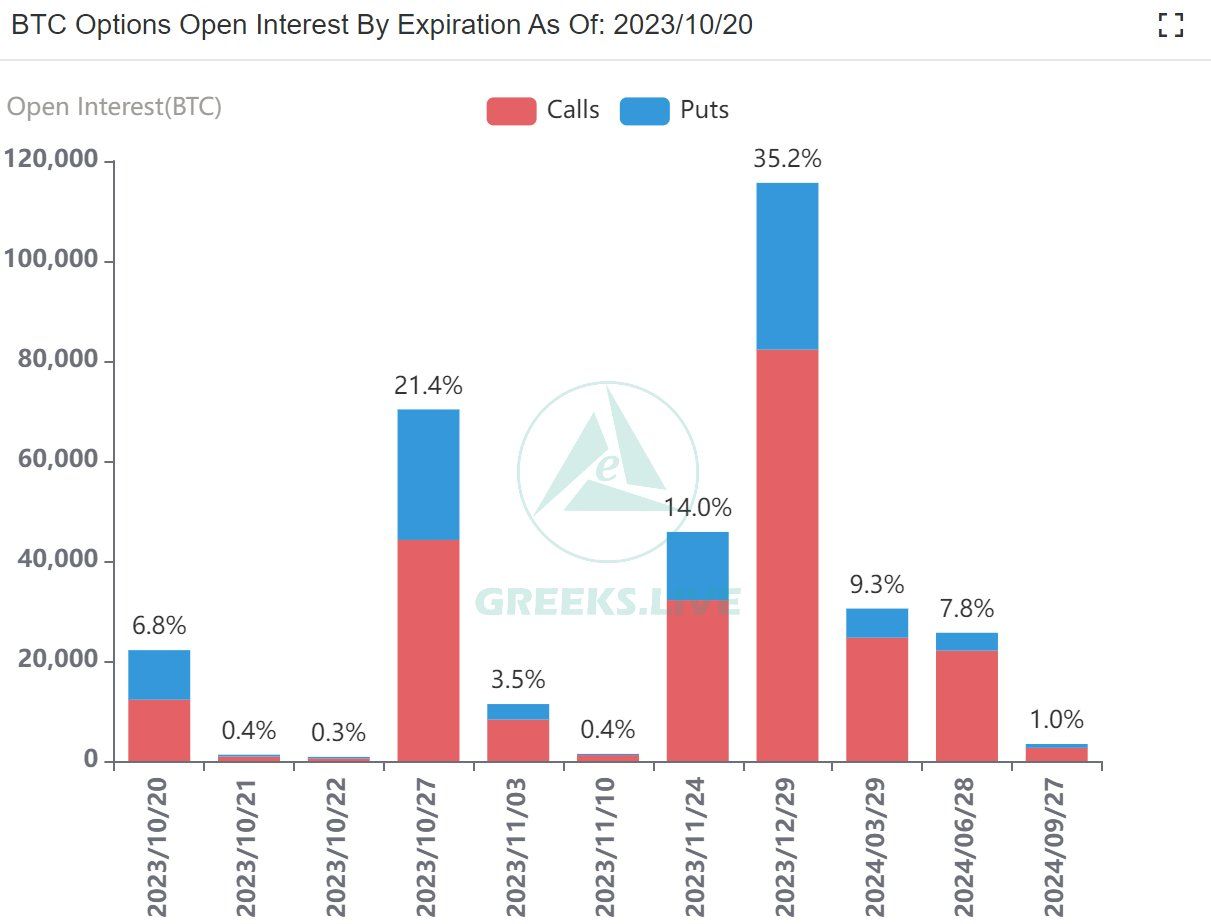

On October 20, around 23,000 Bitcoin options contracts will expire with a notional value of around $640 million. Moreover, this Friday’s expiry is about the same as last week’s event, the difference being that BTC prices are already on the move.

Bitcoin Options Expiry Day

The put/call ratio for today’s Bitcoin options is 0.82, meaning there are slightly more sellers of long contracts than shorts.

Moreover, the max pain point for today’s batch of Bitcoin options is $28,000, around a thousand dollars lower than current BTC spot prices.

The max pain price is the level with the most open contracts and the level where most losses occur when the contracts expire.

Bitcoin continues to lead the market, said Greeks Live, commenting on today’s expiry. It added that the “put share of BTC options is significantly lower, and market sentiment has turned significantly better.” Greeks added,

“Especially in the last two days, the options market picked up significantly as giant whales started to add to their forward call positions.”

It also noted that implied volatility of all major terms still remains at historically low levels. This situation has lasted for a quarter, “and after such a long bear market, a big market could be just around the corner,” it said.

Ethereum Contract Expiry

Around 210,000 Ethereum contracts will also expire today with a notional value of $320 million. Moreover, these derivatives have a max pain point of $1,600 and a put/call ratio of 0.84.

Ethereum contract trading has been lackluster in recent months as spot markets have been in the doldrums.

However, the same cannot be said for Bitcoin, which broke above $29,000 during the Friday morning Asian trading session.

BTC is currently trading up 3.2% on the day at $29,228 at the time of writing. Momentum is building as the asset has gained an impressive 9% over the past seven days.

Ethereum has managed just 2%, taking it to $1,584, still deep within bear territory. Furthermore, some of the altcoins are also posting impressive gains, with XRP up 6% and Solana (SOL) surging 11%.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.