It is Friday again, which means Bitcoin options expiry day, and today’s tranche could induce a little market movement. Crypto markets have been on the backfoot all week as the majors retreat. Will the derivatives expiry event make a difference?

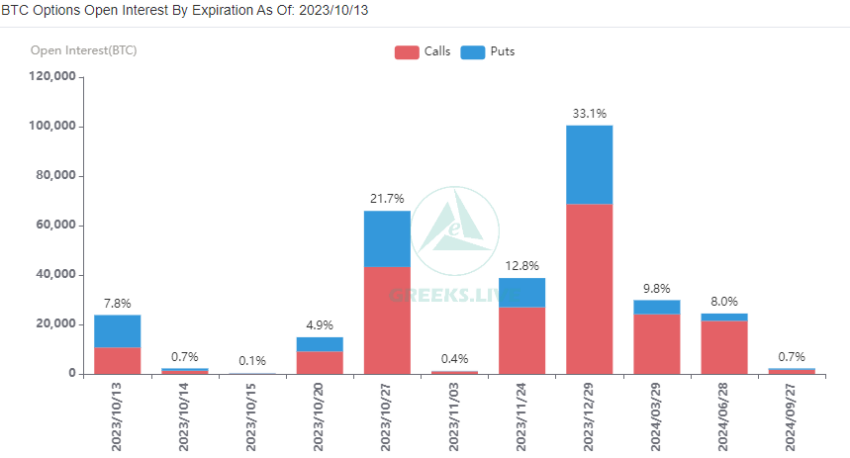

On October 13, around 24,000 Bitcoin options contracts will expire with a notional value of around $640 million. Moreover, this Friday the thirteenth options expiry event is about 50% larger than last week’s expiry.

Bitcoin Options Expiry Day

The max pain point for today’s batch of Bitcoin options is $27,000, exactly the same as it was last week. It is also slightly above current spot prices.

The max pain price is the level with the most open contracts. It is also the level where most losses occur when the contracts expire.

The put/call ratio for today’s Bitcoin options is 1.23, meaning there are more sellers of short contracts than longs.

Greeks Live said that Bitcoin continues to be the market leader, with weekly positions in BTC options up nearly 70% this week.

Moreover, BTC Put positions accounted for 60% of the total, which is “a relatively rare occurrence,” it said before adding, “ETH continues to languish.”

Referring to implied volatility, which is volatility derived from future expiring contracts, it added:

“IVs across all major terms remain at all-time lows with no sign of a rebound, and with liquidity continuing to deteriorate of late, the big one looks to be getting closer.”

The “big one” may refer to a final flush out which has also been predicted by crypto market analysts.

Ethereum Contracts Details

In addition to the BTC contracts, a batch of 190,000 Ethereum options will expire today. These have a max pain point of $1,600 and a notional value of $290 million.

Furthermore, the Ethereum contracts have a put/call ratio of 0.71, which means more calls are being sold than puts as ETH remains bearish.

This week’s options expiry event is unlikely to shake spot markets, which have declined $54 billion over the past seven days.

Total capitalization is currently $1.08 trillion, with very little movement over the past 24 hours. However, sentiment and direction remain bearish, so there could be further losses over the weekend.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.