A Dutch court said that De Nederlandsche Bank (DNB) could not impose supervisory costs for 2021 on crypto companies that registered in 2020. Such fees fall outside the scope of the European Union’s (EU) fourth anti-money laundering directive under which these exchanges secured permission to operate.

However, the court disagreed with complaints from crypto companies that they were unfairly charged supervisory fees in 2020. Prevailing laws, it affirmed, do not allow the central bank to waive supervisory costs at its discretion.

Binance and Coinbase Fined for Overseas Service

The judge also refuted the plaintiffs’ claims that DNB’s supervisory charges violate general legal and good management principles. Both parties can lodge an appeal with the Appeals Tribunal for Business within six weeks of the ruling.

Several crypto businesses, including Bitvavo, Digital Currency Services, and former Binance regional competitor Coinmerce, filed a joint lawsuit against the Dutch regulator in May. The digital asset firms disputed the fees they were charged in association with the laws under which they secured registration.

The DNB does not permit exchanges to serve Dutch customers from abroad and fined Binance, which recently exited the Netherlands, $3.3 million for operating without a license in 2022. It later imposed a $3.6 million penalty on Coinbase for unregistered trading.

Read more: Top Crypto Exchanges and Trading Platforms in Europe

Shortly after Binance’s exit, DNB awarded Crypto.com a license. Before exiting the market in July, Binance offloaded its customers to Coinmerce, an exchange that secured a license in 2020.

EU MiCA Compliance Costs

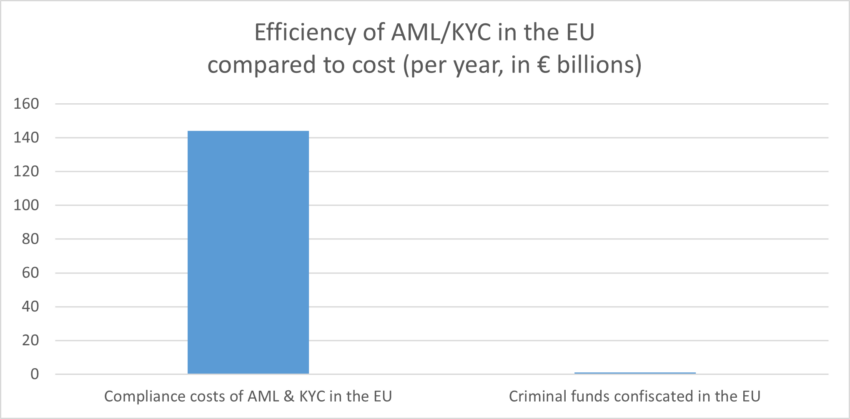

Under the recently passed Markets-in-Crypto-Assets (MiCA) laws, exchanges can operate in the EU with a license from one member state. Among the requirements for registration are adequate compliance with anti-money laundering regulations, which some companies have struggled to satisfy.

Read more: 14 Best No KYC Crypto Exchanges in 2023

There are also costs that may make operating in certain regions unprofitable. In Europe, regulators are generally not funded by taxpayer money but secure revenue through fees.

According to an EU Commission impact assessment, companies could pay between $3 million and $19 million in once-off compliance costs, while ongoing compliance costs could reach $28 million. MiCA also imposes million-euro penalties for noncompliance that could be as high as 12.5% of an exchange’s annual turnover.

Do you have something to say about the Dutch court ruling on supervisory costs, compliance under the new EU MiCA regulations, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.