Coinbase will roll out crypto perpetual futures trading to non-US customers from its international platform registered in Bermuda. Derivative products, which account for around 75% of all daily crypto trading volumes, amassed $5.5 billion in notional institutional trading volume on Coinbase in Q2.

Coinbase, a registered US public company, will roll out trading for non-US customers as part of its “Go Broad, Go Deep” strategy to set up business in overseas markets. It is part of a move to partner with “high bar global regulators to build a crypto regulatory framework that allows crypto technology to continually drive innovation.”

Coinbase Launches Futures While it Fights for Regulations

The exchange said that while it established its business in US because it believed the country would lead advances in finance, the latest move is intended to advance the global financial system. The futures contracts will be available to customers who meet the Coinbase Advanced eligibility criteria.

Read more: What Are Bitcoin Futures?

Trading will commence in the coming weeks, the exchange said.

Coinbase is locked in an existential legal battle with the US Securities and Exchange Commission (SEC) over charges it operated as an unregistered broker-dealer. The company’s CEO Brian Armstrong has criticized the US for its slow approach to crypto regulation compared with other G20 countries.

Open Interest and Positive Flows Decline for Crypto ETFs

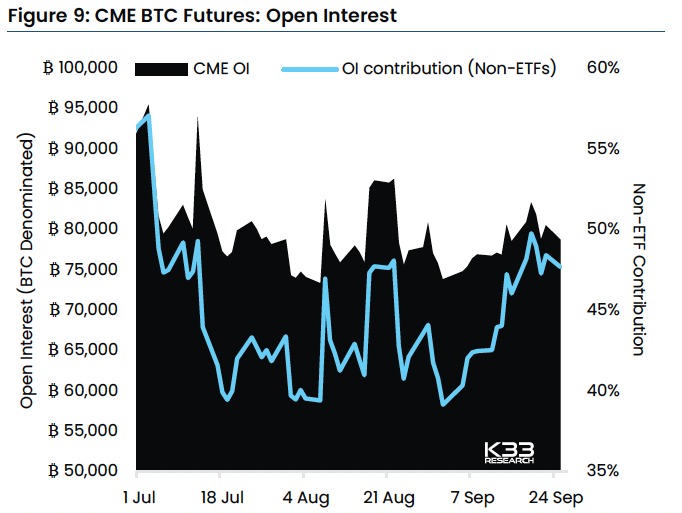

The launch of Coinbase’s non-US futures business comes at a time of relative indifference in crypto futures markets. In the last week, open interest and basis, key indicators of investor sentiment, were flat on the CME, the world’s largest derivatives trading exchange.

Read more: 10 Best Crypto Futures Trading Platforms in 2023

Open interest (OI) is the number of futures contracts that are held by market participants at the end of a trading day. Increasing open interest is usually a confirmation of a trend, while falling open interest means that a trend is weakening.

OI in Bitcoin (BTC) futures on the CME fell to 78,755 BTC at the time of writing, after peaking at 83,350 on Sept. 19. The broader BTC perpetual futures market also saw a relatively quiet week, with open-interest fairly flat at 274,000 BTC.

The futures exchange-traded fund (ETF) market experienced its fifth consecutive week of outflows since last week, a trend that seems unlikely to reverse unless macro conditions change. Since July 13, in 42 out 50 trading days, ProShares’ crypto futures ETFs have recorded negative outflows.

However, despite the bearish outlook for futures-based ETFs, contributions from non-ETF-related futures products are near quarterly highs of 48%.

The SEC has fueled macro uncertainty by pushing back approval deadlines for more than seven ETFs that track the spot price of Bitcoin. An approval would cause companies to buy and hold the asset on behalf of clients, reducing its circulating supply and increasing its price.

Do you have something to say about Coinbase launching its crypto perpetual futures product to non-US customers or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.