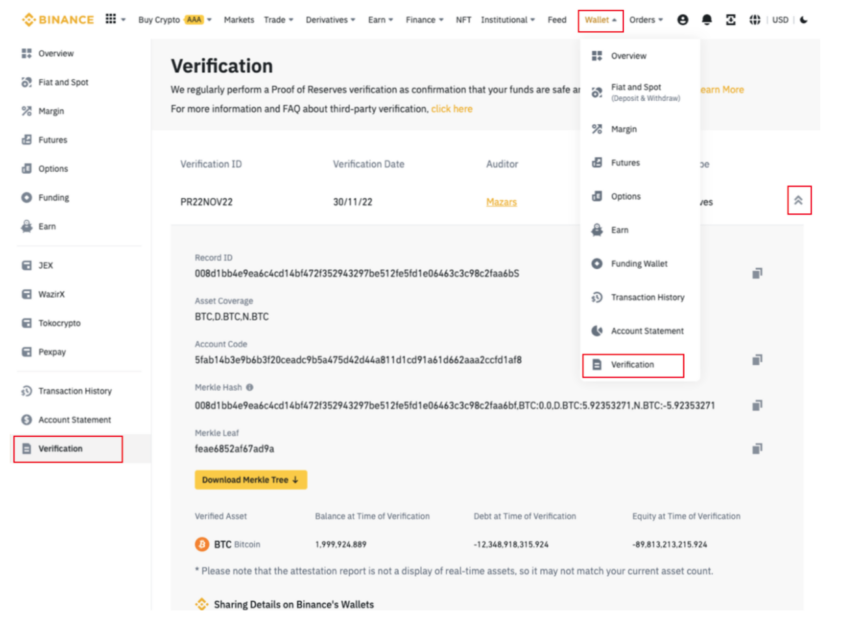

Binance released its latest proof-of-reserves report, proving it backs all customer assets 1:1. The new report uses so-called zero-knowledge methods to prove a user’s balance exists in Binance’s customer wallets.

Its report summarizes all user balances in a Merkle Root hash. The Merkle Root consolidates customer balance data from the Merkle Tree into a single seal that auditors can inspect.

Binance Touts Zero-Knowledge, but Reserves Report Appears Incomplete

A special type of zero-knowledge proof called a zk-SNARK can verify whether a Merkle Root calculation included a single user’s balance. A zk-SNARK system uses challenges and response questions between a prover and a verifier to verify that a dataset contains a unique piece of data.

Read our full guide on proof-of-reserves reports based on Merkle Trees here.

According to Binance, its proof-of-reserves (PoR) report proves it holds enough crypto assets to satisfy all customer withdrawals, with reserves available in the case of an emergency. Its most overcollateralized coins include its native BNB token (114%), USDT (118%), and the slowly deprecating BUSD stablecoin (107%).

It also holds 5% excess reserves for customers’ Bitcoin (BTC) and Ethereum (ETH) deposits. Notably, the exchange only lists the reserves for 31 tokens. Its website says it lists over 350 tokens.

Asset Segregation Into Different Wallets Can Protect Customers From Insolvency

Last year, the exchange garnered applause and criticism in equal measure after releasing an attestation of its report by auditing firm Mazars. While some hailed the move as a step in the right direction after the collapse of FTX, others pointed out the lack of standards and the narrow scope of the assessment.

Mazars announced shortly afterward they would cease assessing reserve reports.

Several exchanges, including BitMEX, Kraken, Deribit, and OKX, publish comprehensive reports regularly. Kraken publishes auditor-assisted reports semi-annually, while the others accompany reports at varying intervals with full liability disclosures.

Objections that PoR reports hide liabilities are negated by full disclosures. Customer assets can also be kept in separate wallets, protecting them from insolvency claims.

Want to ensure your assets are protected by disclosures or auditors? Read our roundup of Binance alternatives here.

A draft bill proposed in the Texas legislature recognizes quarterly PoR attestations and segregation of customer and corporate funds. Nascent legislation in Hong Kong and new proposals in Singapore mandate the separation of customer and corporate funds.

In January, Binance admitted to commingling funds backing customer tokens in a wallet holding corporate assets.

Got something to say about the latest Merkle-based Binance reserves report or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.