Binance will shut down its fiat-to-crypto payment portal enabling Mastercard and Visa crypto payments. Binance Connect, previously Bifinity, will be discontinued due to “changing market and user needs” as smaller exchanges attract traders.

The move, set to take place On Wednesday, follows the termination of agreements with payment providers in Europe and Australia. The exchange faces a shrinking pool of infrastructure partners as reputational damage sustained by several investigations hurt short-term volumes.

Venues With Higher Risks Assume Volumes as Binance Fails to “Connect”

The market share of Binance alone has fallen from about 60% at the start of the year to 40% at present. While the exchange is still the largest venue for spot and derivatives, the ground is shrinking beneath its feet.

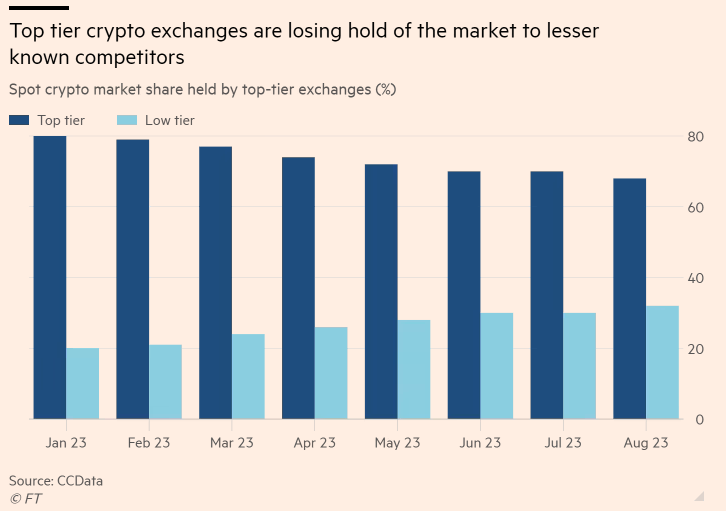

A recent report by CCData found smaller exchanges perceived to pose higher risks to customers are experiencing higher trading volumes. Huobi and KuCoin, the former of which reportedly faces insolvency, saw their shares of trading volumes rise this year.

Upbit led Korean exchanges’ July surge with $29.8 billion in volume, beating Coinbase’s $28.6 billion. Other Korean businesses, Bithumb and CoinOne, also saw year-to-date spot volume increases of 27.9% and 4.7%.

Want to trade without disclosing sensitive information? Read our list of the best crypto exchanges that allow no-KYC trading.

However, large venues like Coinbase and Binance have seen their collective share of volume decline from 80% to 68% in the same year. Additionally, Binance recently announced the delisting of several trading pairs, including CKB/BUSD, FARM/BUSD, ORN/BUSD, REN/BUSD, SKL/BUSD, UFT/BUSD, ZEN/BUSD, and ZRX/BUSD.

Both companies face lawsuits from US regulators.

Smaller Exchanges Can Attract Traders With Higher Risk Appetites

Smaller venues that have seen a surge in trading activity are deemed risky according to several metrics. According to CCData, these exchanges pose a higher risk to customer funds and have lower anti-money laundering standards.

According to CK Zheng of ZX Squared Capital, the trend toward these smaller companies may also occur because their sizes don’t concern regulators. Elliptic’s Tom Robinson opines some traders may be willing to forego safety to invest in coins that bigger exchanges avoid.

Got something to say about Binance shutting its payment portal or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.