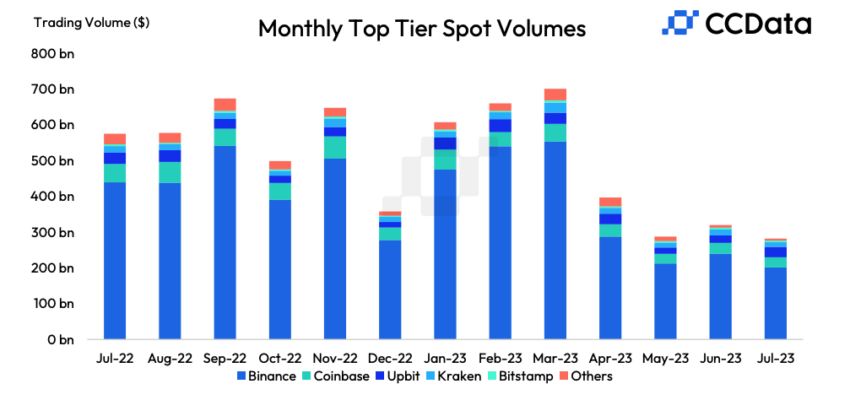

Upbit led Korean exchanges’ July surge with $29.8 billion in volume, beating Coinbase’s $28.6 billion, as the US exchange fights a lawsuit from the Securities and Exchange Commission (SEC).

The 42.3% month-on-month spike saw Upbit become the second-largest exchange by trading volume after Binance, which faces legal scrutiny in multiple regions.

Crypto Traders Abandon US For Korean Exchanges

Other Korean businesses, Bithumb and CoinOne, also saw spot volume increases of $27.9% and 4.7% to $6.1 billion and $1.4 billion, respectively.

Upbit’s share of global trading volumes has also risen almost 3% year-to-date.

New to trading? View our beginner’s guide here.

The boon for Korean exchanges is unsurprising, given the region’s recent passage of a Virtual Asset User Protection bill. By contrast, the lack of clear rules in jurisdictions like the United States has seen major players struggle to sustain engagement.

Coinbase, the largest exchange in the United States, has seen its volumes fall as it prepares to fight SEC charges it ran an unregistered brokerage. CEO Brian Armstrong confirmed the exchange would also fight an order to delist all assets except Bitcoin.

Binance Edges Derivatives Specialist Deribit But Market Share Shrinks

Binance’s trading volume fell for the fifth consecutive month as regulators in France and America circle.

The exchange saw its share of global spot volume fall to 40.4%, the lowest since August 2022. Its recent slide started in March when the exchange withdrew a promotion offering free BTC trading for spot pairs.

Subsequent SEC and US Commodity Futures Trading Commission lawsuits saw several key staff departures in the last few months. The exchange is also under French investigation for an alleged role in ‘aggravated money laundering’ and recently exited other European jurisdictions after failing to comply with anti-money laundering standards.

However, it remains the largest global spot trading venue, with a $208 billion volume in July.

It also processed $1.06 trillion in derivatives volumes, beating specialist venue Deribit and Asian competitors OKX and Bybit.

Got something to say about the increase in Upbit volumes or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.