El Salvador President Nayib Bukele rattled many on Wall Street by embracing Bitcoin two years ago. However, some skeptics are starting to pay attention to the bumper yields being generated by bonds in the country.

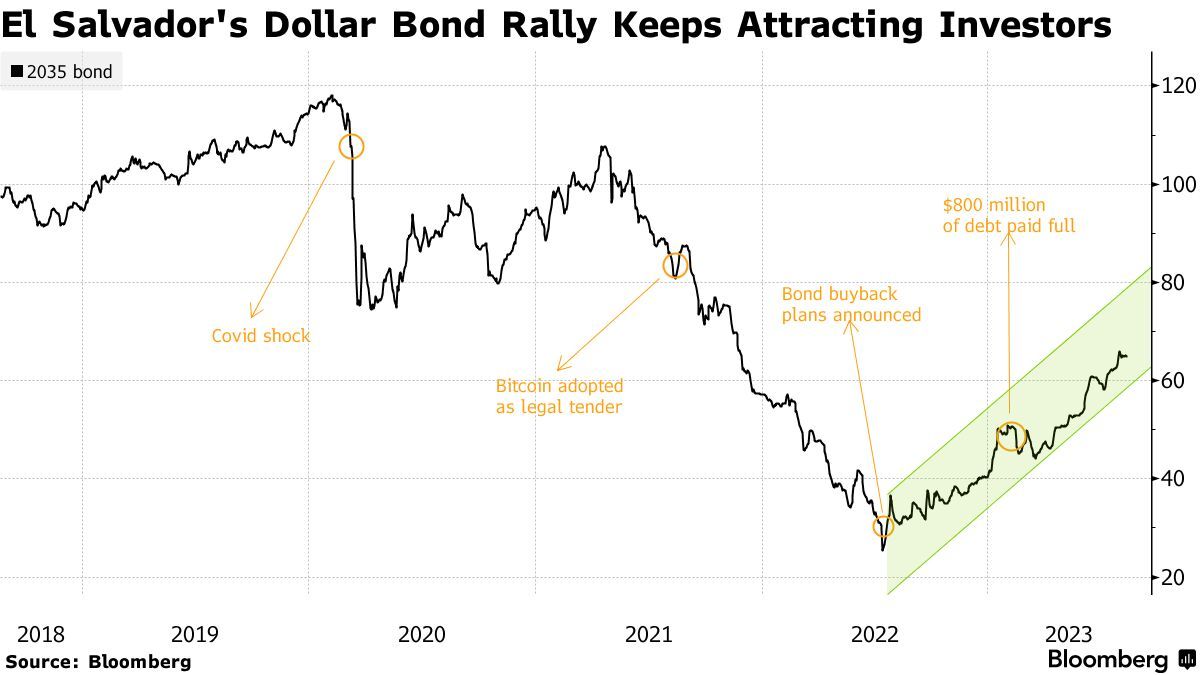

El Salvador’s bond markets are attracting more investors as they are outperforming all dollar bonds from emerging markets this year.

El Salvador’s Dollar Bonds Paying Off

Bukele’s dollar bonds are returning an impressive 70% per year, as reported by Bloomberg on Aug. 15. This is making Wall Street giants pay attention following their initial derision.

JPMorgan Chase, Eaton Vance, and PGIM Fixed Income are among those now buying the bonds, according to Bloomberg.

In a July note, JPMorgan research strategists wrote,

“Although we missed a significant share of the rally, we still think there’s value across El Salvador’s curve. There’s room for this credit to keep outperforming.”

Bukele has shown commitment to debt repayment through buybacks and hiring an IMF veteran as an advisor, easing fears for bondholders.

Dollar bonds are bonds denominated in USD rather than the currency of the country or company issuing the bond. The main advantage of dollar bonds is diversification into foreign assets, Bitcoin in El Salvador’s case, without currency risk.

Zulfi Ali, a portfolio manager at PGIM, commented:

“The story continues to be positive on the fiscal accounts and Bukele has continued to be very consistent in signaling to bondholders that he’s serious about paying the debt.”

Other firms such as Lord Abbett & Co, Neuberger Berman Group, and UBS Group have also added exposure, seeing El Salvador as underpriced despite risks.

Mila Skulkina, a money manager at Lord Abbett, commented,

“El Salvador has benefited from proactive and prudent management of its balance sheet, including a debt buyback during the second half of 2022.”

In January, El Salvador’s legislative assembly approved a digital securities bill that permits the issuance of Bitcoin bonds, colloquially called “volcano bonds.”

Bukele Bitcoin Tracker

El Salvador made its first Bitcoin purchase in September 2021, two months before the bull market peak.

However, he also bought more BTC when it topped $60K in October 2021. The purchases continued all the way down during the big bear market of 2022.

On Nov. 17, 2022, Bukele announced that they were buying 1 BTC every day from then on.

El Salvador has a Bitcoin treasury of 2,924 coins valued at around $85.3 million. However, the investment is down almost 30%, with a dollar cost average of $41,240 per BTC.

Nevertheless, more crypto companies are eyeing El Salvador, including Binance, Strike, and Tether.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.