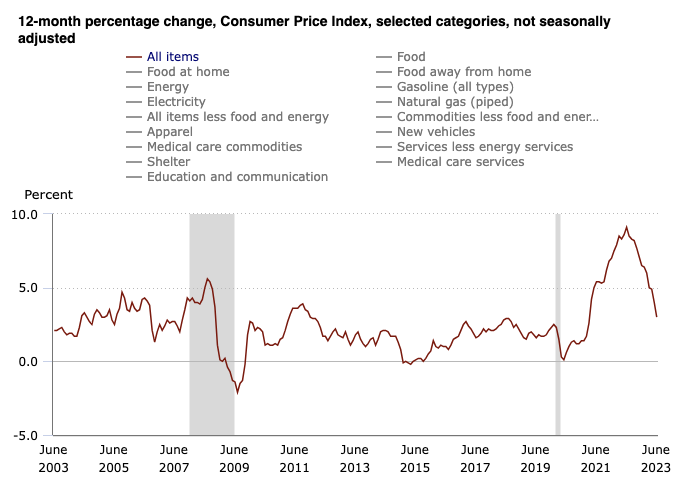

The financial markets’ recent wobbles have dominated headlines ahead of the July Consumer Price Index (CPI) report, with the S&P 500 dipping by 0.6% and the Nasdaq Composite witnessing a 1.3% decrease. The Dow Jones and Bitcoin were not far behind, enduring a 0.4% and 0.2% dip, respectively.

Against this seemingly gloomy backdrop, Fundstrat’s Tom Lee offers hope. The analyst projects a significant rebound post the imminent release of the July inflation report.

A Big Bull Rally Ahead

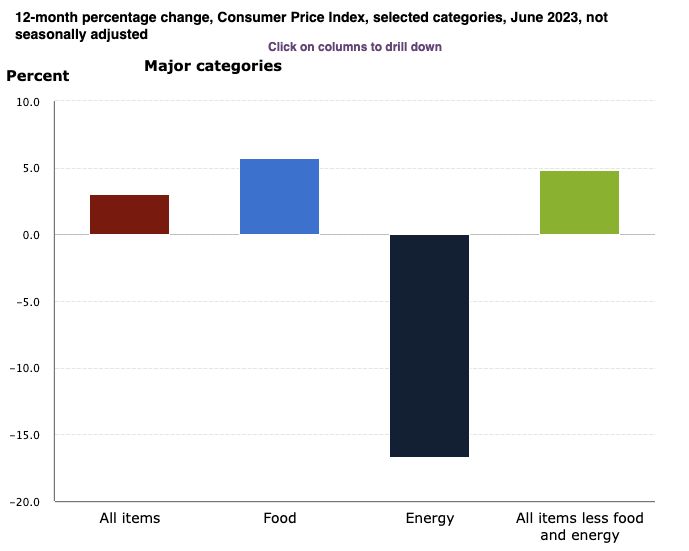

A noteworthy mention, the consensus estimate pegs the Core CPI at a healthy 0.22%. However, contrary to popular opinion, the data science maestros at Fundstrat anticipate a slightly cooler reading, expecting inflation to undershoot to 0.15%.

This translates to an annualized rate of 1.8%, conveniently brushing past the Federal Reserve’s long-standing inflation target of 2%. The deviation is subtle, but its implications are profound.

Read more: How to Protect Yourself From Inflation Using Crypto

Not long ago, Wall Street echoed Lee’s cautionary advice on a potential short-term market sell-off. His concerns were rooted in the historically poor performance in August and the emergence of an ominous technical sell signal.

This forecast did manifest, with the S&P 500 witnessing a 2.5% setback.

However, Lee’s recent optimism, sparked by the forthcoming July CPI report, promises to change this narrative.

“A positive surprise of +0.15% versus consensus would counterbalance the ‘tape bombs’ from Tuesday, which had investors anxious,” Lee said.

Lee alluded to Moody’s downgrading several regional banks due to potential recession fears and disconcerting economic insights from China, signaling a deflation relapse.

Read more: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

His bullish stance is not without basis. Lee draws attention to the decreasing inflationary pressures from auto and shelter prices. Since the close of 2019, both sectors combined accounted for a significant 66% uptick in inflation.

With these prices stabilizing, Lee suggests that the inflationary tide might be just turning.

“The significant contribution of used cars and housing to inflation often goes unnoticed. As these elements simmer down, we shouldn’t automatically expect a resurgence in core inflation,” Lee added.

Bitcoin Looks Bullish

There is a similar optimism resonating from Fundstrat’s corridors about crypto. Bitcoin might soar to an impressive $180,000 by its April 2024 halving.

Read more: Why Bitcoin Will Hit $100,000 Before the Next Halving

Fueling this prediction is the potential launch of a Bitcoin ETF. This could inject an additional $100 million in daily demand, reshaping the demand-supply dynamics and catalyzing a significant price upswing.

Sean Farrell, Fundstrat’s head of digital asset strategy, weighs in on this, emphasizing a “multiplier effect” of 4.0x to 5.0x for the Bitcoin network. This means that for every dollar of demand, there is a potential for a $4 to $5 surge in market cap.

Farrell also highlights the likelihood of a BlackRock Bitcoin ETF, potentially one of the most impactful ETF launches, overshadowing the Invesco QQQ ETF’s inaugural inflow record.

“We anticipate [a Bitcoin ETF] would attract new investors and generate increased demand for Bitcoin…. “Bitcoin ETF eventually could become >$300 billion category,” Farrell said.

Read more: BlackRock and Invesco Spot Bitcoin ETFs a Matter of ‘When, Not If,’ Expert Says

Such a surge could place a three-digit price tag on Bitcoin, an analysis not isolated to Fundstrat alone. Earlier this month, Standard Chartered foresaw Bitcoin’s trajectory touching $120,000 in the coming year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.