Crypto and traditional finance find themselves in the spotlight once more as investors prepare for significant announcements in the United States.

The tech giants will release their earnings after the close of trading on Tuesday. Meanwhile, the Federal Open Market Committee (FOMC) will shed light on the future of interest rates during its July 25-26 meeting.

Tech Titans to Signal End to Slowdown?

The economic health of the United States presents an interesting backdrop for Big Tech. Particularly Alphabet and Microsoft, as they gear up to reveal their quarterly earnings.

Despite prevailing market uncertainties, these tech stalwarts are expected to indicate a halt to the almost year-long deceleration in their cloud businesses. The surge in technology expenditure and digital advertising could offset this lull.

Indeed, their stocks already showcase this anticipation, with Alphabet registering a 0.40% decline and Microsoft a 0.65% uptick.

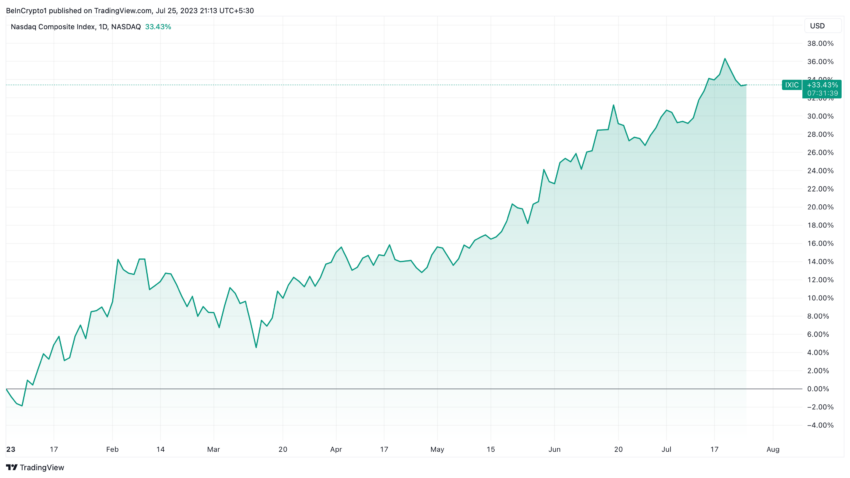

The Nasdaq Composite Index, a technological barometer, has also flourished, registering an impressive rise of around 33.40% this year. A significant portion of this rally can be attributed to large-cap growth firms that are rate-sensitive.

The bullish trend is further fueled by the immense promise of artificial intelligence, combined with expectations of the culmination of the US Federal Reserve’s rigorous tightening cycle.

“The real test will be for companies that have significant exposure to artificial intelligence as investors are eager to see if these companies can report strong enough results to support their significantly elevated share prices in recent months,” said James Demmert, CIO at Main Street Research.

FOMC: Economic Indicators and Decisions

With inflation rates tapering and a gentle economic retreat, the Federal Reserve faces a pivotal decision. Will it heed the softer economic data and decide against additional rate hikes?

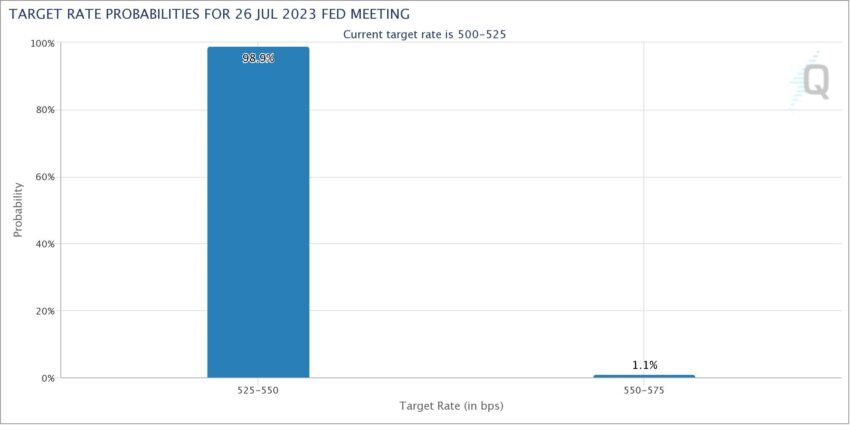

The market anticipates a 25-basis point rate increase, marking the highest level in approximately 17 years.

“If inflation does not continue to show progress and there are no suggestions of a significant slowdown in economic activity, then a second 25-basis-point [quarter-point] hike should come sooner rather than later, but that decision is for the future,” said Christopher J. Waller, member of the Board of Governors at the Fed.

As the FOMC wades through its deliberations, it is evident that inflation remains a formidable concern.

“While things seem to be heading in the right direction with inflation, we are only at the start of a long process,” said Karen Dynan, economist at Harvard University.

Crypto Market Braces for Impact

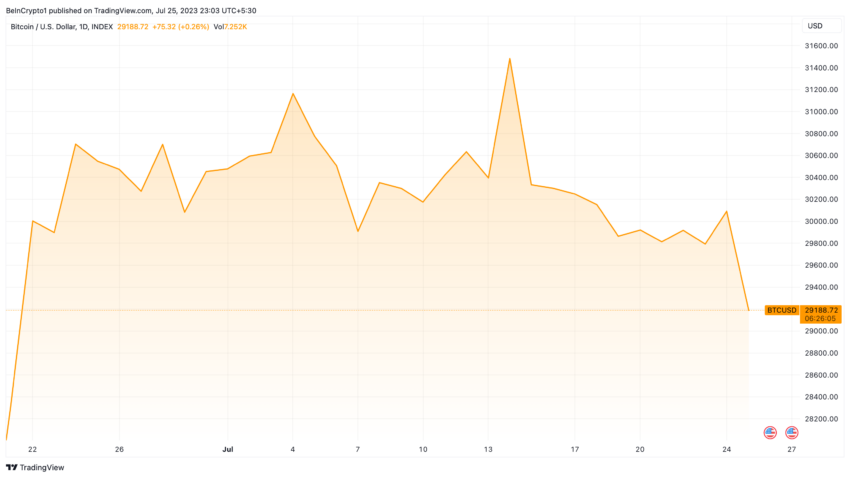

Despite fluctuating macroeconomic directives, Bitcoin has largely maintained its trading range, oscillating between $29,000 and $31,500.

“Bitcoin is still fluctuating within a narrow range for a little more than a week, and it will likely continue to do so until the conclusion of this week’s FOMC meeting,” said Yuya Hasegawa, analyst at Bitbank.

While traditional markets await the verdict from tech giants and the FOMC, the crypto industry also watches closely as the impending rate hike could have further implications for inflation.

“The FOMC’s rate decisions henceforth will likely continue to be ‘live,’ and Bitcoin may not successfully break out of $31,500 for another while,” concluded Hasegawa.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.