The Maker (MKR) price has been on a tear since the beginning of June, reaching a new yearly high of $1,250 on July 21.

However, the price has not yet confirmed its bullish reversal since it has reached a close above a crucial horizontal resistance area. Moreover, while the daily timeframe readings are bullish, they suggest a local top will be reached soon.

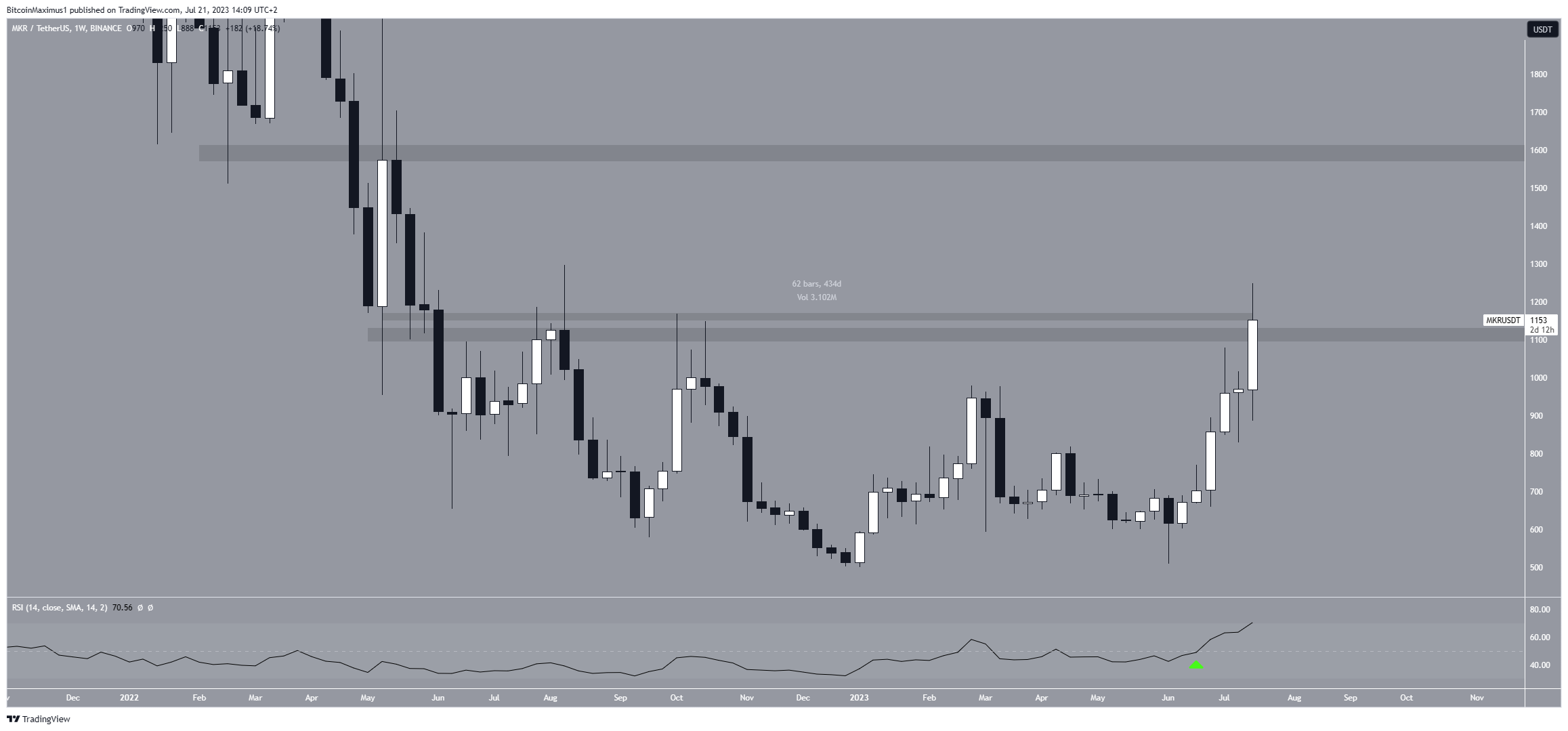

Maker Price Clears 430-Day Resistance

The MKR price has increased significantly since falling to a low of $511 at the beginning of June. The increase culminated with a new yearly high of $1,250 on July 21.

More importantly, the MKR price seems to have broken out from the $1,150 horizontal resistance area. The resistance has been in place for 434 days. Therefore, a breakout above it could greatly accelerate the rate of increase and will confirm the legitimacy of the bullish trend reversal.

The weekly RSI is also bullish. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite. The indicator is above 50 (green icon) and moving upwards. These are both signs of a bullish trend, legitimizing the possibility of a breakout.

Read More: Best Crypto Sign-Up Bonuses in 2023

MKR Price Prediction: How Long Will the Increase Continue?

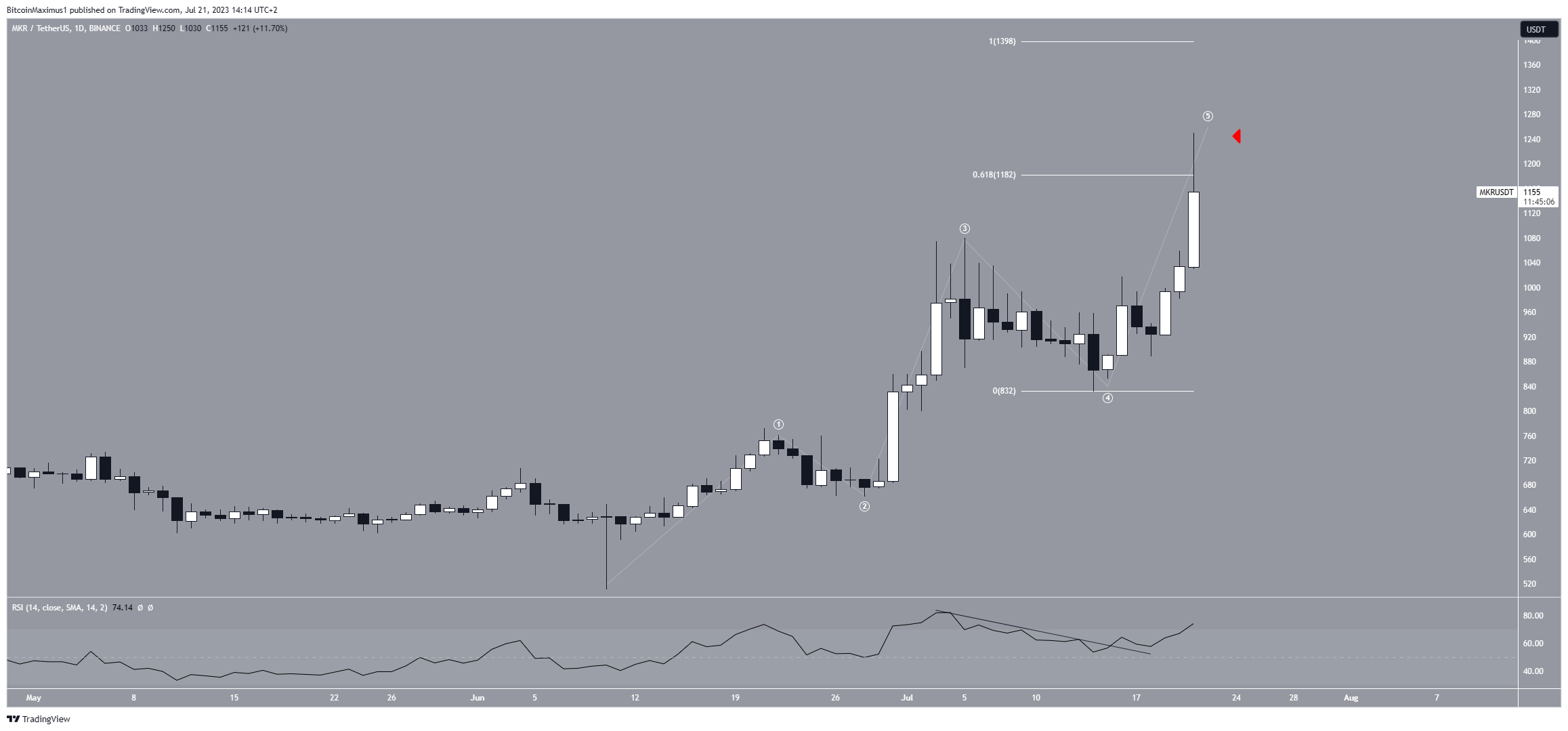

Similarly to the weekly time frame, the daily time frame technical analysis provides a bullish outlook. But, it suggests that a top could be reached soon. The reasons for this come from the wave count and RSI readings.

Elliott Wave theory involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend. The most likely wave count suggests that the price is in the fifth and final wave of an upward movement that began on June 10.

If the count is correct, the price could reach a high of $1,400. The target is found by projecting the length of waves one and three to the bottom of wave four.

After the increase is complete, a significant correction could ensue.

This daily RSI supports this since it has broken out from its bearish trendline and is increasing.

However, the price is currently struggling with the 0.618 Fib length of waves one and three at $1,180. The rejection from this level created a long upper wick (red icon), a sign of selling pressure.

So, if the price fails to close above this region, it will indicate that the upward movement is complete and a correction has begun.

In that case, the MKR price will be expected to drop to the $840 horizontal support area.

Read More: Best Upcoming Airdrops in 2023

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.