DBS Bank in Singapore has launched an e-CNY-based merchant settlement service as part of the city-state’s push into tokenization.

The new service automatically settles client payments in e-CNY into corporate customers’ accounts.

DBS Settlement Services Targeting Underserved Areas

So far, one client has successfully used the service, but Ginger Cheng, CEO of DBS China, believes the technology will catch on rapidly.

“We received strong interest from several clients for the solution and have completed the first e-CNY collection for a client – a catering company in Shenzhen. By seamlessly integrating a CBDC collection and settlement method into our clients’ existing payment systems, this will help position their business for a digital future where consumers in China use e-CNY for their daily activities.”

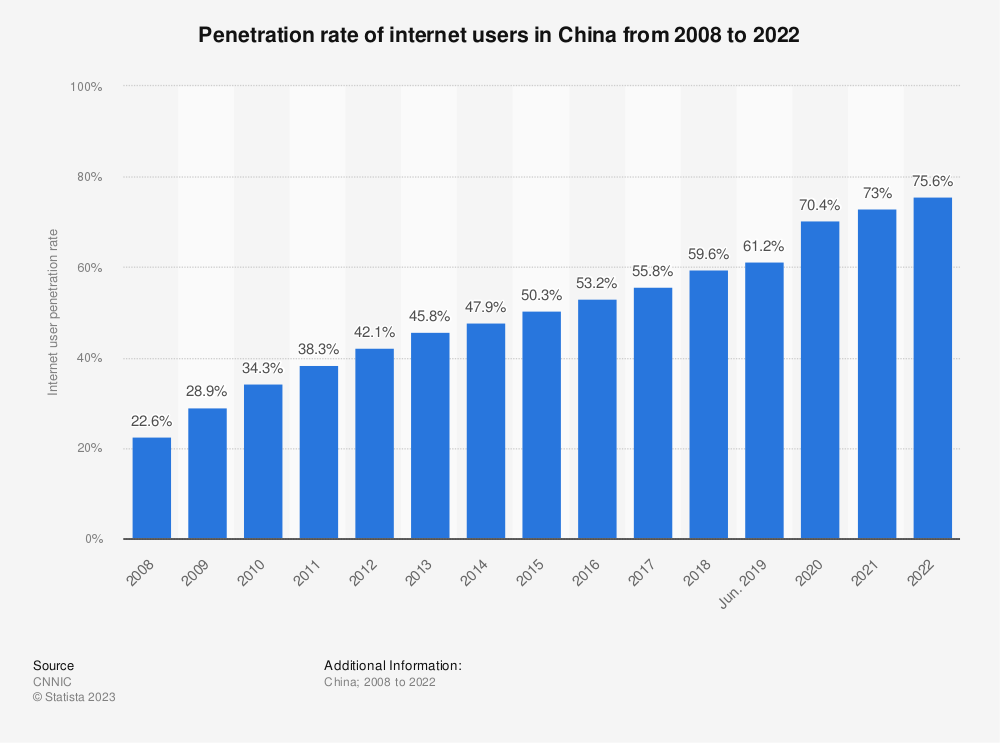

DBS’s new service will help businesses receive payments in regions with reduced internet availability.

Not only can the network settle transactions, but it can also compile reconciliations for merchants with individual client transactions in e-CNY.

The e-CNY payments are part of an extended trial of asset tokenization by the Singapore Monetary Authority and several major banks. One of the project’s early tests trialed the exchange of tokenized Japanese yen with US dollars in a permissioned Aave pool.

Find out more here about asset tokenization.

China’s central bank currency’s use has grown since its pilot in April 2020. The currency is accepted across 17 provinces and 26 cities. President Xi Jinping has tested the yuan’s potential to replace the US dollar in international trade with Russia.

Yesterday, the Chinese government appointed a Communist Party member as the top party official at the People’s Bank of China.

Pan, a 59-year-old Cambridge University alum, is a vocal Bitcoin critic, and his appointment may signal the country’s seriousness in getting rid of cryptocurrencies. People close to the matter said his appointment could see him become central bank governor.

Project Guardian Focusing on Improving Payment Efficiency

Blockchains settle payments faster than traditional rails and can be used outside banking hours. Their round-the-clock operation enables companies to pay vendors exactly when they need it. JPMorgan’s JPM Coin allows dollar and euro settlements between merchants and clients anytime.

Singapore’s recently-announced purpose-bound money protocol would also offer more flexible arrangements between clients and merchants. For example, clients can settle a merchant account when they receive acceptable goods or services.

Yesterday, the Monetary Authority of Singapore, the city-state’s de-facto central bank, released new proposals for digital asset exchanges. MAS says crypto exchanges must keep client funds separate from corporate funds and record when customers move money.

Got something to say about the DBS e-CNY settlement service or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.