The Ethereum (ETH) price has outperformed Bitcoin (BTC) during the past four weeks, even though the ETH/USD price has fallen.

The wave count and indicator readings from the daily time frame suggest that the price will continue to outperform BTC, reaching highs not seen since 2018.

Ethereum Price Fails to Sustain Increase

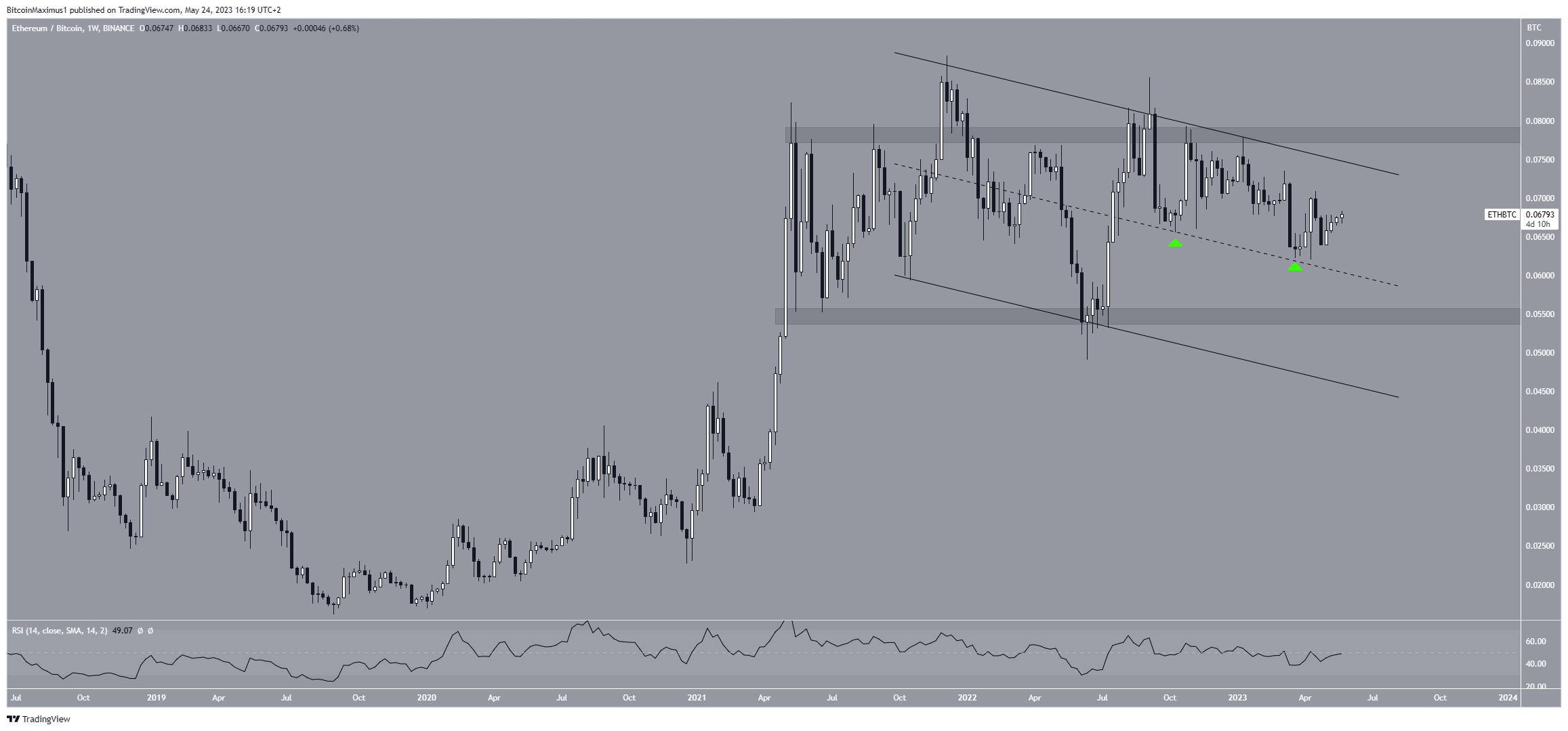

The technical analysis for the weekly time frame in the ETH/BTC pair is mixed. The price has traded in a range between ₿0.055 and ₿0.078 since May 2021.

A trading range is a neutral sign since the price usually bounces between the support and resistance lines before an eventual movement outside of its confines.

It is possible that the price is trading inside a descending parallel channel. However, the pattern’s support line has not been validated sufficiently.

If the pattern gets confirmed, the fact that the price trades in its upper portion would be a bullish sign. Unlike the support line, the midline has been validated numerous times (green icons).

Moreover, the weekly RSI gives a mixed reading. By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage, but if the reading is below 50, the opposite is true. The indicator is increasing but is still below 50, providing no clues as to what the trend’s direction is.

ETH Price Prediction: Has the Price Reached a Bottom?

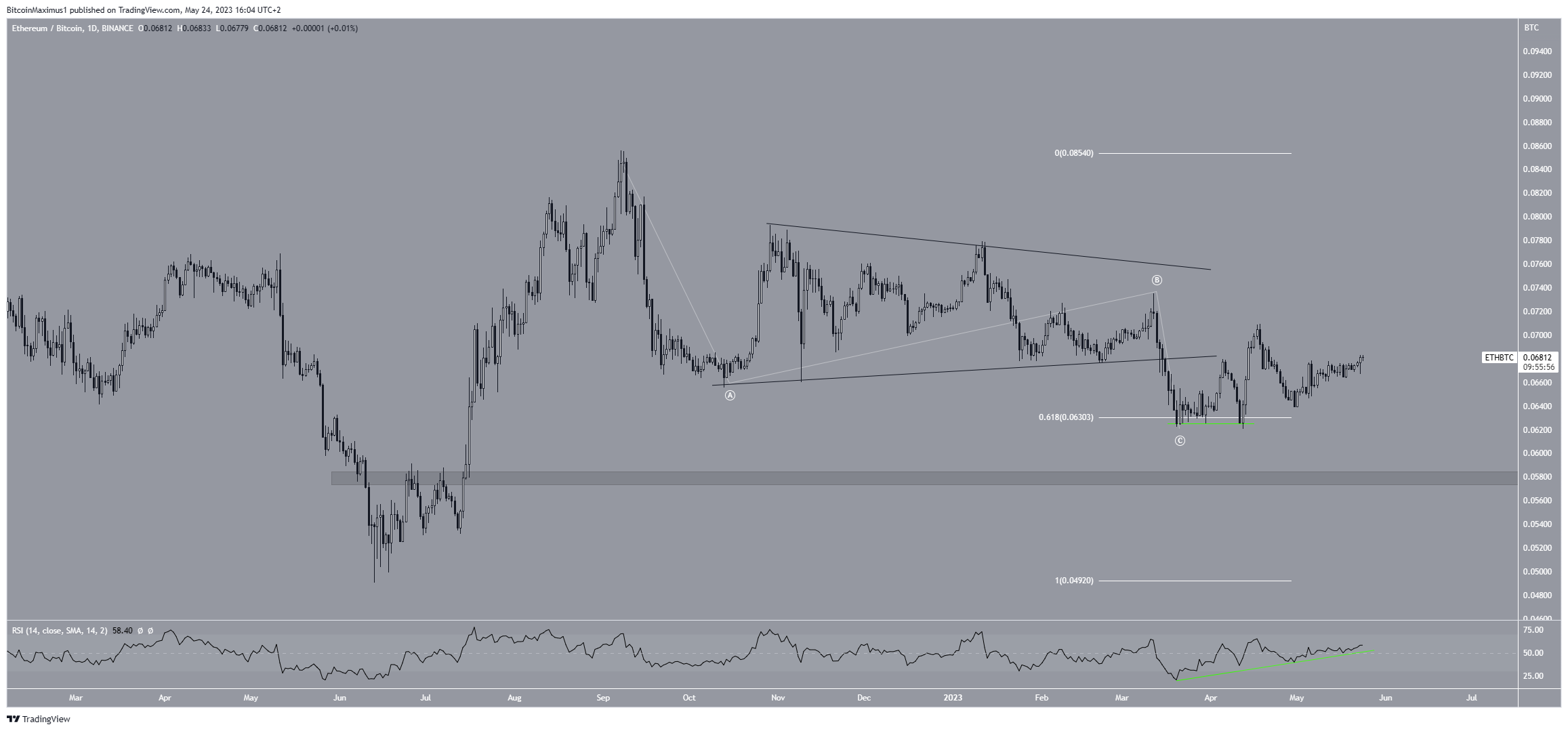

The daily time frame outlook provides a bullish outlook for numerous reasons.

Firstly, the wave count suggests a bottom has been reached. Utilizing the Elliott Wave theory, technical analysts examine long-term price patterns and investor psychology that recur to determine the direction of a trend.

According to the count, the price has completed an A-B-C corrective structure (white), in which wave B took the shape of a triangle.

The fact that the correction ended right at the 0.618 Fib retracement support level supports this possibility.

Next, the daily RSI has generated a bullish divergence. This is an occurrence in which a momentum decrease does not accompany a price decrease. It often leads to bullish trend reversals.

Moreover, the indicator is now above 50, another sign of a bullish trend.

Despite this bullish ETH price prediction, a fall below the wave C low at ₿0.062 will mean that the trend is still bearish.

In that case, a decrease to the ₿0.058 support area will be the most likely scenario.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.