The delicate balance between privacy and security is hard to maintain as the world becomes increasingly interconnected. Privacy cryptos have emerged as a response to growing concerns about the loss of financial privacy.

Let’s delve deeper into the world of these privacy-focused cryptocurrencies and explore how they aim to protect users’ identities in an era of increasing surveillance.

The Emergence of Privacy Coins: A Response to Surveillance

In the digital era, Big Brother seems omnipresent. The quest for information is relentless, from data-hungry tech giants to government agencies. Amidst this backdrop, the demand for financial privacy has fueled the invention of privacy coins – cryptocurrencies with a focus on anonymity.

While conventional cryptocurrencies like Bitcoin offer a certain level of privacy, their public ledgers leave room for prying eyes. Coins like Monero, Zcash, and Dash aim to bridge this gap with enhanced transaction obscurity.

Anonymity Pioneers

Each coin utilizes unique technologies to ensure confidentiality.

- Monero relies on ring signatures and stealth addresses. Ring signatures merge a user’s transaction with others, making it tricky to pinpoint the originator. Stealth addresses make one-time use addresses for each transaction, concealing the sender and receiver.

- Zcash leverages zero-knowledge proofs, specifically zk-SNARKs. This technology allows users to prove a transaction’s validity without disclosing information about the sender, receiver, or amount.

- Dash is not inherently private but offers an optional “PrivateSend” feature. This mixes transactions, making it difficult to trace funds to their sources.

Advantages for Users and Businesses

These coins offer a range of benefits, from safeguarding individual privacy to enabling secure transactions in uncertain economic climates. Their unique features make them attractive for users and businesses seeking enhanced security and discretion.

Protecting Individual Privacy

As data breaches become more frequent, privacy coins offer a safe haven for those seeking to protect their financial information. By obfuscating transactions, these cryptocurrencies provide an extra layer of security, ensuring that personal details remain concealed.

For example, a business owner may want to keep supplier payments confidential to maintain a competitive advantage. These coins make such transactions easy.

Navigating Unstable Economies

Privacy coins present an alternative in countries with fluctuating currencies or strict capital controls. Venezuela, for instance, has experienced hyperinflation and economic instability, leading citizens to seek alternative options. They can provide a degree of financial freedom and security in such situations, as their anonymous nature allows users to avoid repercussions while maintaining monetary autonomy.

Furthermore, these coins can help individuals and businesses conduct transactions in regions with weak or unreliable traditional banking infrastructure. In these cases, privacy coins can serve as a more secure and efficient means of transferring funds without fear of surveillance or interference.

The Dark Side of Privacy Coins: Risks and Challenges

Despite their advantages, some coins face criticisms, risks, and regulatory challenges due to potential misuse.

Illicit Activities: A Double-Edged Sword

While privacy coins protect users from surveillance, their anonymity also attracts nefarious actors. Critics argue that these cryptocurrencies enable money laundering, terrorism financing, and other illegal activities.

For instance, in January 2021, the darknet marketplace White House Market exclusively accepted Monero as payment, citing privacy concerns with Bitcoin. These instances raise concerns for regulators and governments struggling to monitor and control illicit transactions.

Regulatory Hurdles

The increased scrutiny has led to regulatory challenges. In recent years, multiple countries have imposed restrictions on privacy coins. In 2020, South Korea banned privacy coins, citing their potential use in money laundering.

The uncertain regulatory landscape could hinder mainstream adoption, as both users and businesses may be reluctant to engage with assets facing potential legal repercussions.

Overcoming Stigma

The association with criminal activities may deter potential users, limiting privacy coins’ reach. Overcoming negative perceptions is crucial for these cryptocurrencies to gain widespread acceptance.

For example, reports of Bitcoin’s use in illegal activities initially tarnished its image but eventually subsided as legitimate use spread.

Striking a Balance

Privacy coins face an uphill battle, balancing the benefits of anonymity with the potential for misuse. Their future hinges on finding an equilibrium between privacy and regulatory compliance.

Developing Responsible Privacy Solutions

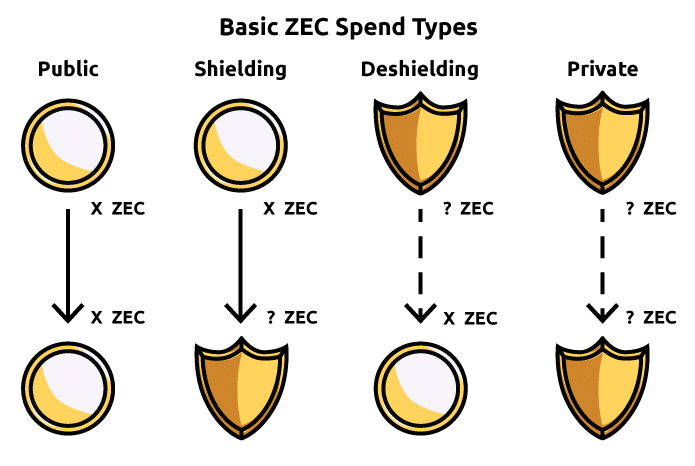

To gain legitimacy, privacy coins must demonstrate responsible privacy features. For instance, Zcash offers two types of transactions: shielded and transparent. This approach allows users to choose their privacy level while enabling potential regulatory oversight.

Implementing measures to prevent misuse without sacrificing anonymity is essential for their long-term success.

A Path Forward

Engaging with regulators and seeking compliance may be crucial for privacy coins. By working together, they can build frameworks that respect privacy while addressing concerns surrounding illicit activities.

In the European Union, the 5th Anti-Money Laundering Directive (AMLD5) has introduced stricter rules for cryptocurrencies, potentially influencing the future direction of privacy coins.

Dispelling Misconceptions

Public perception plays a significant role in the adoption of privacy coins. Advocates must educate potential users on these cryptocurrencies’ legitimate use cases and benefits.

By emphasizing the value of financial privacy and dispelling misconceptions, they can foster trust and encourage broader acceptance.

The Quest for Anonymity Continues

Privacy coins represent a bold attempt to reclaim financial privacy in an increasingly surveilled world. Their ability to navigate criticisms, risks, and regulations will determine their ultimate success. As the quest for anonymity continues, the development and adoption of privacy coins will spark debates and shape the future of digital finance.

Collaboration among developers, regulators, and users will be key to ensuring that privacy coins can fulfill their potential while addressing legitimate concerns.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.