The Stellar Lumens (XLM) price increased significantly on March 21 and is trading inside a crucial yearly resistance.

XLM is the native digital currency of the Stellar network, which was created by the Stellar Development Foundation. Its founder is Jed McCaleb, who was previously a co-founder of Ripple. XLM offers an improved alternative relative to fiat currencies when it comes to cross-border payments, offering much lower transaction costs combined with higher speed.

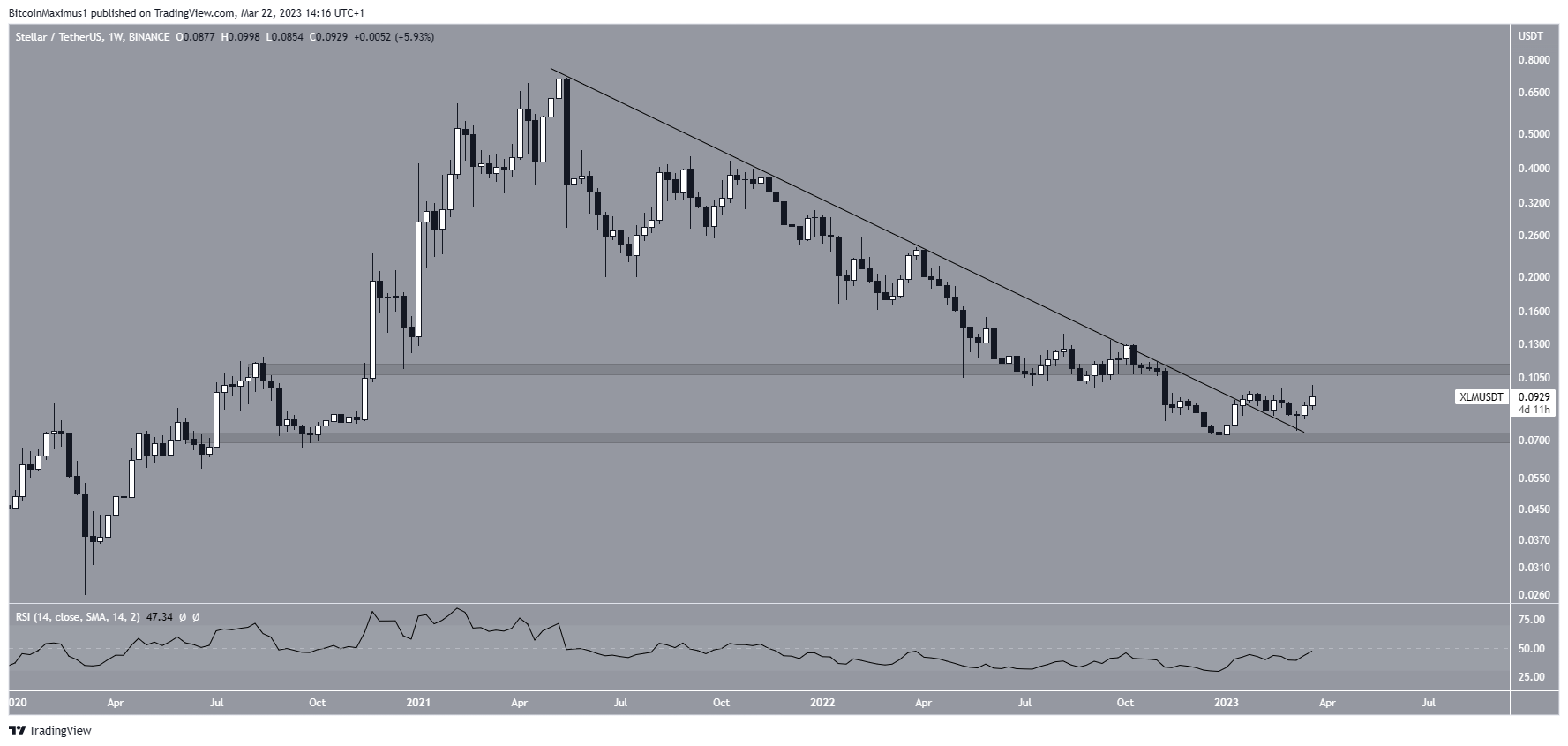

The Stellar price has fallen since April 2021, when it reached a high of $0.80. The decrease culminated with a low of $0.070 in December 2022. The price has been increasing since, validating the $0.072 horizontal area as support.

Shortly afterward, XLM broke out from the resistance line and validated it as support during the week of March 6-13, creating a long lower wick (green icon) and a higher low in the process. Both the wick and the breakout are considered bullish signs.

Since the Stellar price has broken out from its main diagonal resistance area, it is now trading in a horizontal range between $0.072 and $0.110.

The weekly RSI is increasing but is still below 50. Therefore, the direction of the long-term trend is still undetermined.

Stellar (XLM) Price Reaches Crucial Resistance

The technical analysis from the daily time frame shows that the XLM price has followed an ascending support line since the beginning of the year. More recently, it bounced at the line on March 10 (red icon), initiating the current increase.

On March 21, the Stellar Lumens price created a bullish engulfing candlestick and reached a new yearly high of $0.099. Moreover, the daily close was the highest since Nov. 10. Finally, the daily RSI broke out from its bearish divergence trend line and increased above 50.

However, the price failed to break out from the $0.094 resistance area, which has been in place since January. It has decreased in the 24 hours since. While the numerous bullish signs support the possibility of a breakout, the trend cannot be considered bullish until the price action confirms this.

In that case, the XLM price could increase to the long-term resistance line at $0.110. However, if the rejection continues, XLM could fall back to the ascending support line at $0.080.

To conclude, the most likely Stellar price forecast is the continuation of the increase toward $0.110. However, if the price fails to close above $0.094, it could fall to the closest support at $0.080.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.