The STEPN (GMT) price is trading inside a short-term channel from which a breakout is expected.

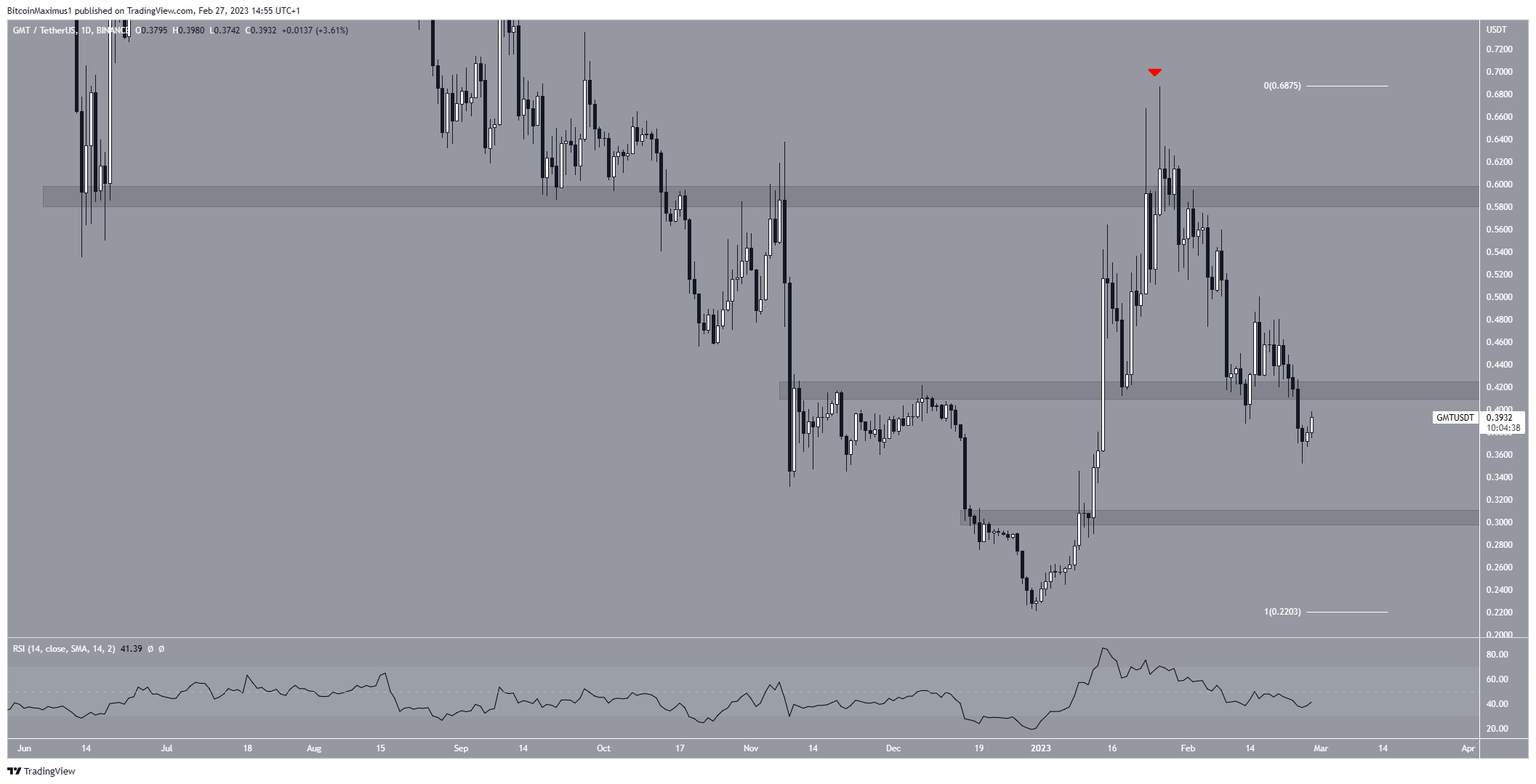

The GMT price increased rapidly in January, reaching a high of $0.686 on Jan. 26. However, it created a long upper wick (red icon) and has fallen since. The price failed to close above the $0.59 horizontal resistance area, which had previously acted as support in June 2022. The trend can only be considered bullish once the price exceeds this area.

The drop led to a low of $0.352 on Feb. 25, also causing a breakout from the $0.415 resistance area. Therefore, the GMT price now trades below two important resistance areas. On the other hand, the closest support area is at $0.31.

Additionally, the daily RSI is decreasing and is below 50. Therefore, the most likely price forecast is for GMT to drop to the $0.31 support area.

On the other hand, reclaiming the $0.415 resistance could lead to the STEPN price moving upward toward $0.59.

STEPN (GMT) Price Could Break out Soon

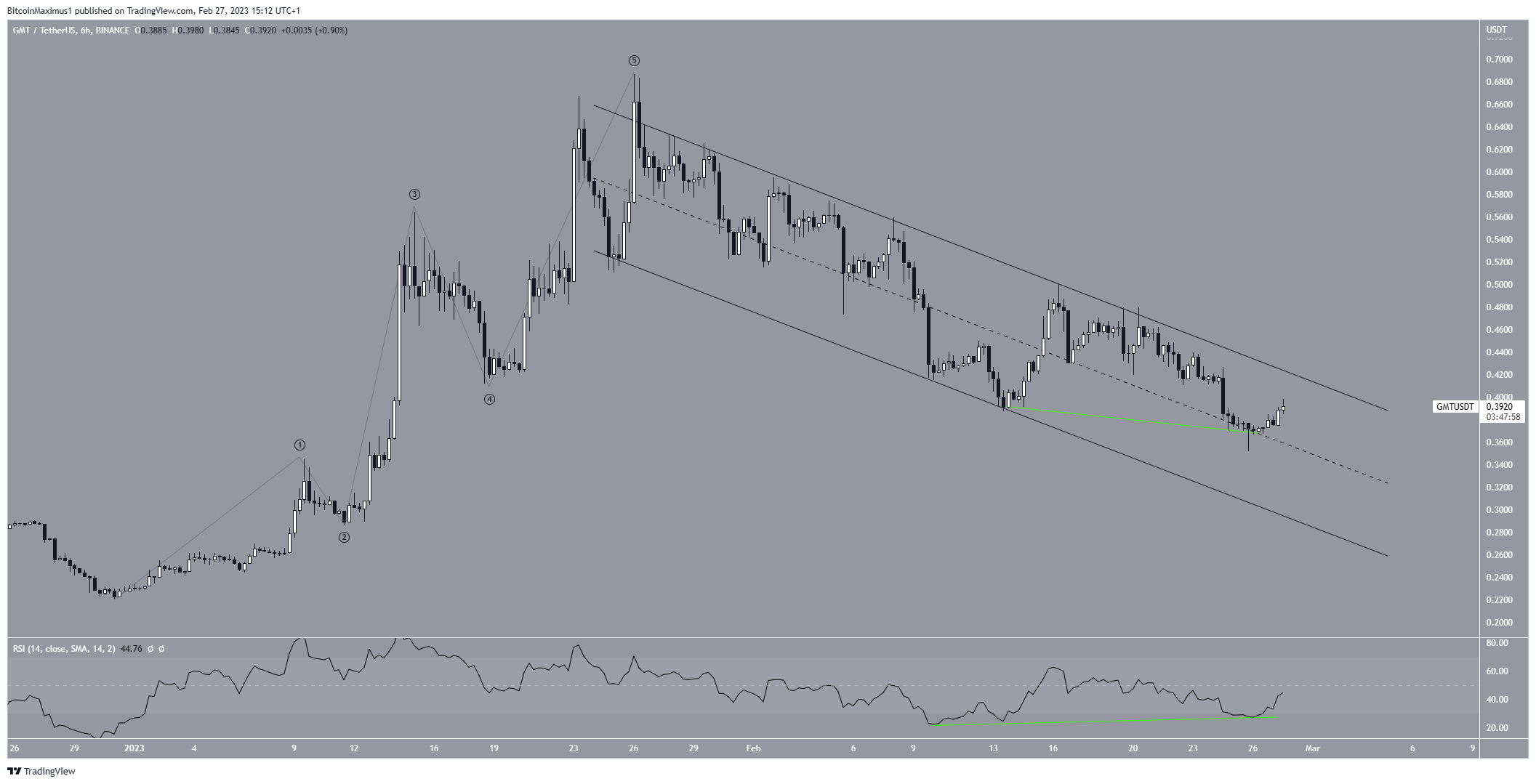

Despite the relatively bearish outlook from the daily time frame, the technical analysis from the six-hour one provides a more bullish outlook. There are three reasons for this.

Firstly, the GMT price is trading inside a descending parallel channel. Such channels usually contain corrective movements. The price is currently trading in its upper portion, increasing the chances of a potential breakout.

Secondly, the six-hour RSI has generated bullish divergence (green line). Such divergences often precede price breakouts.

Finally, the preceding increase resembles a five-wave upward movement (red). This fits perfectly with the presence of the channel.

Therefore, the STEPN price is likely to break out from the channel and move toward $0.595.

However, a fall below the channel’s midline would invalidate this possibility. In that case, the GMT price could fall to $0.31.

To conclude, the most likely GMT price forecast is a breakout from the short-term channel and an increase to $0.590. However, a fall below the channel’s midline would invalidate this bullish forecast and could cause a drop to $0.31.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.