Is the crypto market now echoing the 2008 financial crisis scenario, given the uncertainty within the nascent industry? The latest development comes after the CEO of Binance raised questions over Coinbase’s Bitcoin reserves disclosure. This feature investigates solutions to potentially redeem the crypto market using analogies with traditional ‘financial bailouts.’

Doubt is a poisonous seed. Sowing seeds of doubt can inject uncertainty into someone’s mind and heart which adds on and spreads to the entire community. Be it in the traditional financial market or the upcoming niche cryptocurrency sector.

But both sectors have a shared history in the form of the 2008 Financial Crash, while the former regrouped following the shakeout, the latter saw the first ray of light at the end of the tunnel.

A famous saying goes, ‘History never repeats itself, but it does often rhyme.’ This might be true considering the latest demise in the crypto market, which possesses a small resonating factor to the 2008 Great Depression.

Using the same feedback and taking inspiration from the fallout, can the crypto market recover as the traditional financial market did post the crisis? Here’s a small analogy overlooking such aspects.

A post-2008 financial crisis world

The 2008-09 financial crisis was a turning point that led to numerous measures to improve modern-day finance. Factors such as doubt, fear, greed, or an amalgamation of all, created havoc that sent the world into the ‘Great Recession.’

At the time, it was the most significant economic downturn since the Great Depression. But yet again, the market learned that nothing was ‘too big to fail.’

The doubts were planted during years of rock-bottom interest rates and loose lending standards that fueled a housing price bubble in the U.S. and elsewhere. Greedy investment banks crippled the economy by offering Collateralised Debt Obligation (CDO).

A behemoth like Lehman Brothers was reduced to nothing. Merill Lynch was sold to Bank of America, and the Federal Reserve even bailed out AIG. The shock waves crippled stock markets across the globe. And all this began with some banks getting greedy.

That said, the market did recover. Governments increased their spending to stimulate demand and support employees, guaranteed deposits and bank bonds to shore up confidence in financial firms, and purchased ownership stakes in some banks and other financial firms to prevent bankruptcies.

This is quite a bit trickier when trying to apply the same fixes to a decentralized industry like cryptocurrency.

Compared to crypto

Following the dawn of the 2008 crisis, Satoshi Nakamoto revealed their Bitcoin vision to the world in 2009. But despite efforts, Bitcoin and the larger crypto market still follow in the troubled footsteps of traditional finance. While it’s true that the cryptocurrency market cap has dropped more than 70% from its all-time high, overleveraged and overexposed crypto companies are now facing death sentences.

A wave of collapses has hit centralized “crypto banks” that used customer funds to make leveraged stakes. Investment funds exploited the opacity of their centralized balance sheets to hide their risk profiles and harvest loans that left creditors in the lurch.

Lending entities such as BlockFi, Celsius, and Three Arrow Capital are just a few of the names that top this list. Retail investors, many of whom were lured by high-yield returns, were the ones left to face the music. And just like the 2008 financial crisis, opacity, unconventional financial instruments, and a largely unregulated space made it reasonable for those firms to take excessive risks.

Meanwhile, some fell to greed while others laid seeds of doubt within the crypto market. Ergo, adding more question marks to the volatile conditions post-FTX bankruptcy.

In a CNBC interview, Carson Block, the founder of short-selling investment firm Muddy Waters, asserted that the collapse of FTX under former CEO Sam Bankman-Fried is a “great example of greed and FOMO.”

Sizing up the competition

The ongoing adverse conditions and bankruptcies within the crypto market saw billions of dollars worth of crypto exiting. But they all have one common denominator.

Standing tall in the epicenter was the CEO of the largest crypto exchange, Binance.

Changpeng Zhao, popularly known as ‘CZ,’ played a critical role in shedding light on troubles at FTX, which ultimately led to its demise. The failed exchange and related institutions are now facing the repercussions and have severely set back the crypto industry.

But the climax was yet to come. Two weeks after the fall of FTX, CZ raised some concerns regarding another competitor’s financial situation—but these concerns were swiftly retracted.

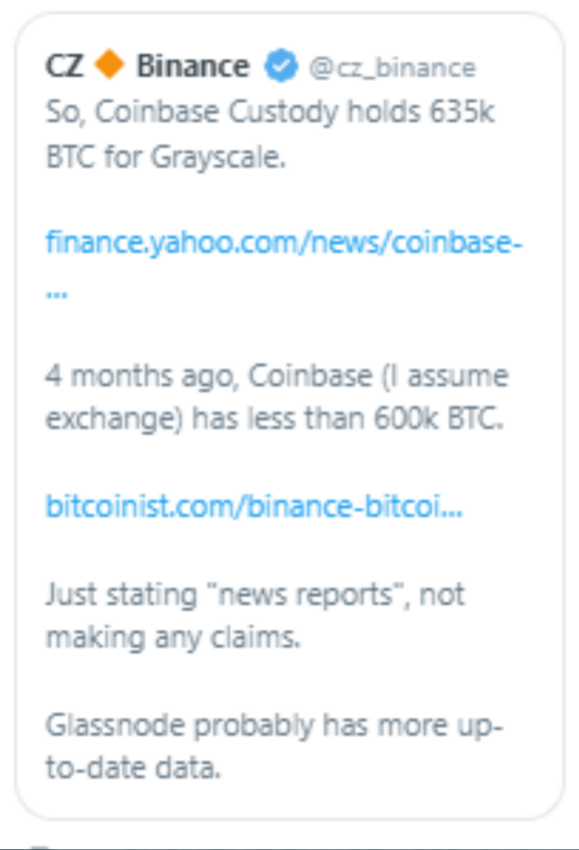

In a now-deleted tweet, CZ brought attention to Coinbase’s claims about its BTC reserves.

The first was a statement from Coinbase Custody CEO Aaron Schnarch, stating that the company held 635,000 BTC on behalf of the Grayscale Bitcoin Trust (GBTC). The second, by contrast, was a 4-month-old headline about Coinbase holding less than 600,000 BTC.

These concerns were aggravated, especially after Grayscale, the operator of the largest Bitcoin trust, refused to show its proof of reserves.

Nonetheless, both entities took to Twitter to curb the growing concerns. Coinbase CEO Brian Armstrong called CZ’s instigation ‘FUD’ and included Coinbase’s Bitcoin holdings report in the same thread.

Fighting back

The shareholder letter released by the Coinbase CEO revealed that the company holds a whopping $39.90 billion worth of Bitcoin.

Following this, CZ deleted his ‘controversial’ claim and tried to calm the situation. Meanwhile, Grayscale reiterated a similar stance to inject more transparency.

Contrary to CZ’s claims, ‘Grayscale’s digital asset products are stored under the custody of Coinbase Custody Trust.’

Various crypto enthusiasts quickly called out Binance and its CEO for creating chaos and targeting another rival exchange.

Dishing out the damage report

The crypto community didn’t take it well, and the event caused a stir. Will Clemente, the co-founder of digital asset research firm Reflexivity Research, shared on Twitter: “That latest tweet CZ made about Coinbase’s Bitcoin holdings that he just deleted wasn’t a great look. I get the argument that he’s trying to protect the industry, but CZ is more than smart enough to know that exchange and custody wallets are separate.”

Mario Nawfal, Founder and CEO of IBCgroup.io, tweeted: “Is CZ implying Coinbase custody does NOT hold 1 to 1 BTC on behalf of Grayscale Trust???? See his latest tweet. This is a concern I never had til now. This is a VERY serious question (implied accusation?) to ask.”

Other traders/investors added their narratives on the microblogging platform – demanding answers to the questions raised. For instance, BobLoukas criticized CZ for taking a rather hypocritical point of view.

CZ’s claims created a ruckus by fanning the flames of unrest. What it needs is a solution to offset the volatility within the situation.

Damage Control

The crypto industry may not be dying, but it’s certainly on life support. Nevertheless, steps could be taken to save crypto from another crash or possible bankruptcy.

Rumors and speculation around bailouts highlight the extent to which the crypto market is still misunderstood.

News site Barron’s said in a blog:

“Crypto was designed without a mechanism for bailouts. In traditional finance, taxpayer dollars or monetary issuance can save banks that are large enough to merit a rescue. But crypto doesn’t have a centralized party to catch industry-native firms when they fall. Bitcoin, among many other crypto assets, has a fixed supply and can’t be inflated. These bailout-averse characteristics are in place to keep crypto as free a market as possible.”

Unlike the traditional finance industry, crypto was created as an alternative verse, echoing the decentralization aspect out loud. Even lending strength to retail.

“The only way to make sure another market-upending crisis of this nature doesn’t happen again is to set a precedent of moving forward without saving the institutional actors fundamentally at fault.”

Once again a lesson can be taken from the power of retail GME stock as an example of the short squeeze against hedge funds. The power of the people proves that retail holds strength. A crypto bank run from retail alone can sink any centralized exchange (CEX). This has already been established.

Joining the dots

The 2008 financial crisis was banking institutions being greedy, the 2022 crypto crisis was CEXs being greedy. The best solution for building confidence in this market stems from retail traders, not hedge funds, VCs, institutional investors, or regulations. This is not the same industry. Financial bailout in crypto is centralized. It’s up to the people to build confidence by building, growing, and developing this nascent industry.

Although the crash within the crypto market wasn’t as significant as the 2008-09 crash, there are lessons to be learned from it. Moving away from speculation, or in the crypto-speak, FUD, and incorporating a somewhat optimistic approach.

Overall, there are lessons to be incorporated from the 2008 cycle in the crypto industry. While some firms would fall, given their unsustainable foundation, let the shakeouts be shakeouts.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.