Staking Cardano (ADA) allows users to earn passive income from their ADA holdings. This guide covers everything you need to know about earning ADA rewards, setting up wallets, and staking directly on exchanges. Here’s how to stake Cardano in 2024.

KEY TAKEAWAYS

➤ Cardano’s staking system uses the proof-of-stake (PoS) mechanism to validate transactions and earn ADA reward

➤ ADA holders can stake through wallets like Yoroi and Daedalus or on supported exchanges like Binance.

➤ Staking pools split rewards between stake pool operators (SPOs) and delegators based on contributed amounts.

➤ Choosing a pool with high performance and low fees maximizes staking rewards and network decentralization.

How to stake Cardano?

You can stake Cardano directly from a wallet or a cryptocurrency exchange that supports staking. We’ll cover three ways you can start staking Cardano immediately, providing all the necessary steps for each ADA staking method.

But before we get into the details, let’s quickly walk you through the overview of the basic steps:

-

- Choose a staking method.

- Download or set up a wallet or exchange account.

- Select a staking pool.

- Delegate ADA to the pool.

- Start earning staking rewards.

You need to hold ADA in the specific crypto wallet or exchange before starting to stake your coins.

The most popular ways to stake Cardano are using the Daedalus wallet, Yoroi wallet, and Binance crypto exchange. We will demonstrate the process associated with each.

Staking Cardano on Yoroi Wallet

Yoroi is a browser extension crypto wallet that runs on Chrome, Edge, and Firefox, besides Android and iOS. It allows you to stake ADA as a delegator.

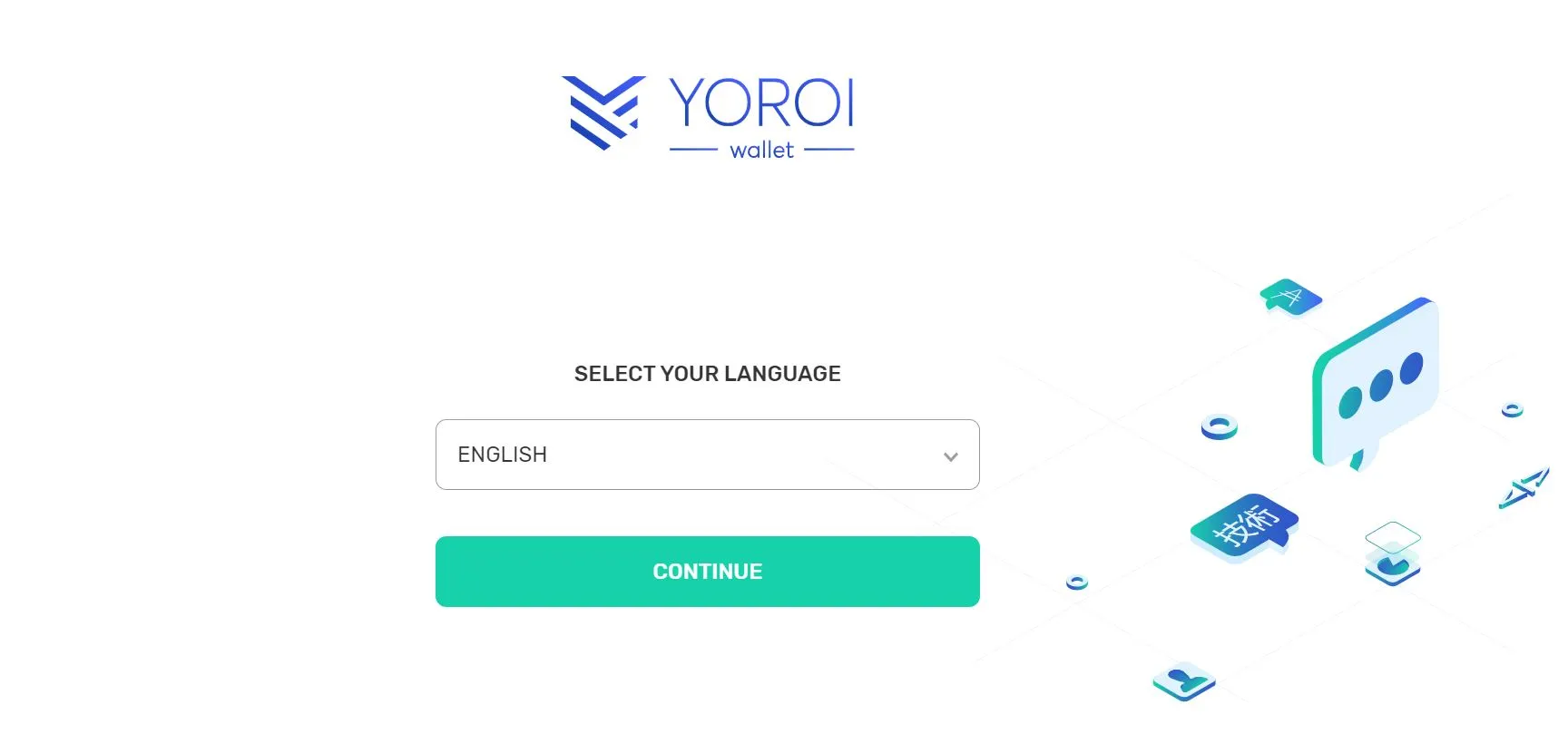

1. Download Yoroi wallet. Make sure to use the official Yoroi website.

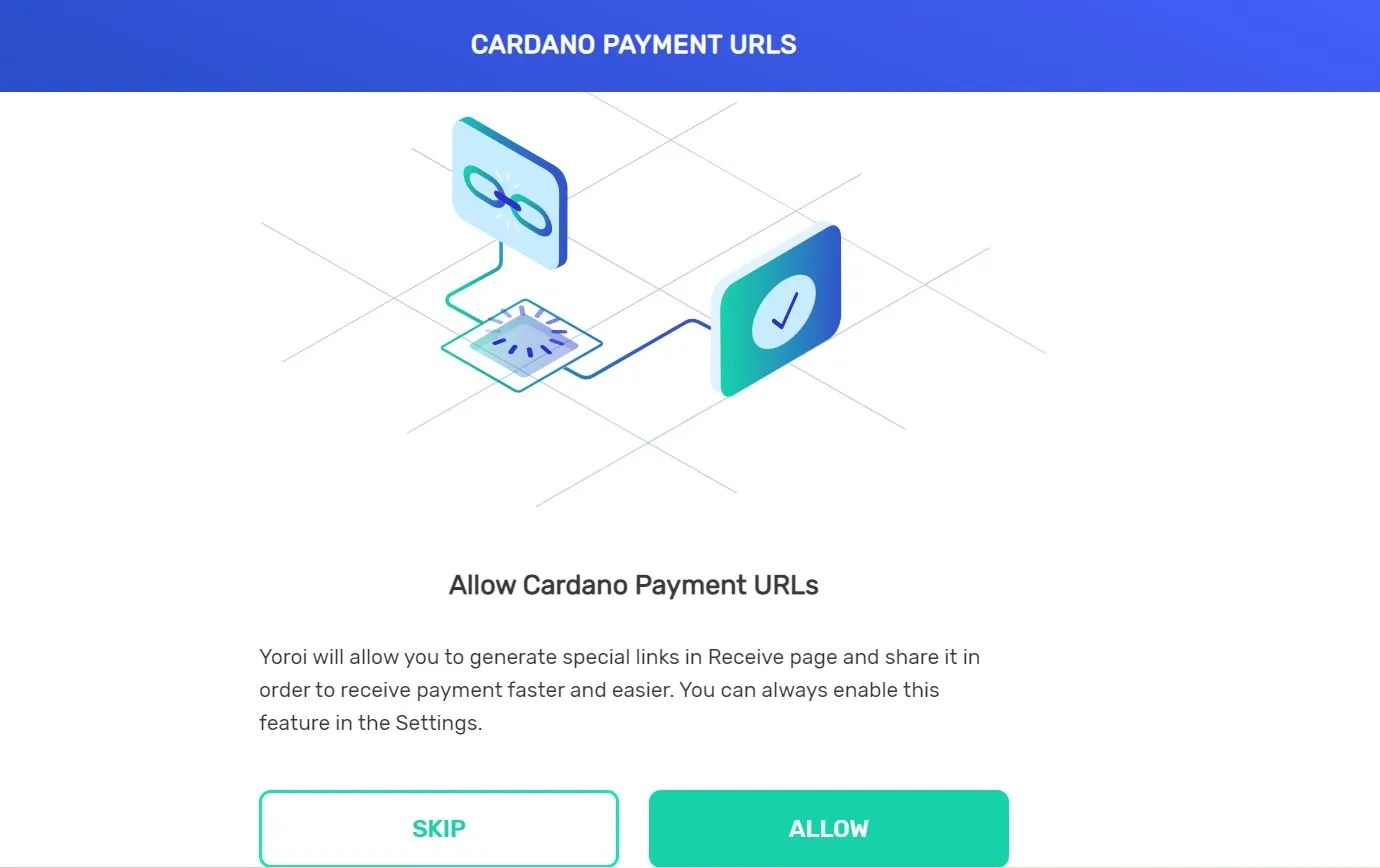

2. Allow Cardano payment URLs.

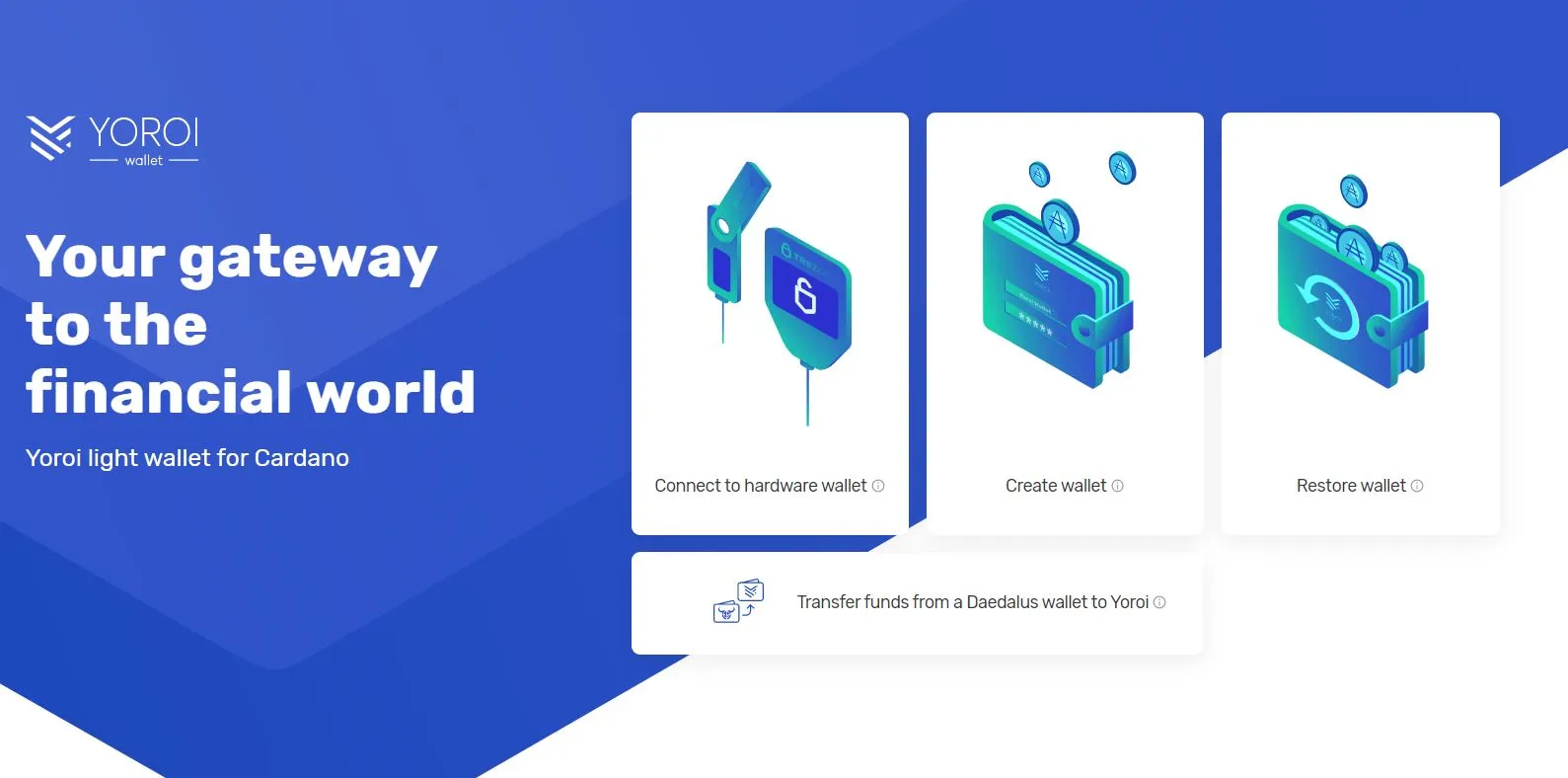

3. Connect wallet/ transfer ADA to Yoroi. You will have to transfer funds from a Daedalus wallet to start the staking process. Choose from one of the options.

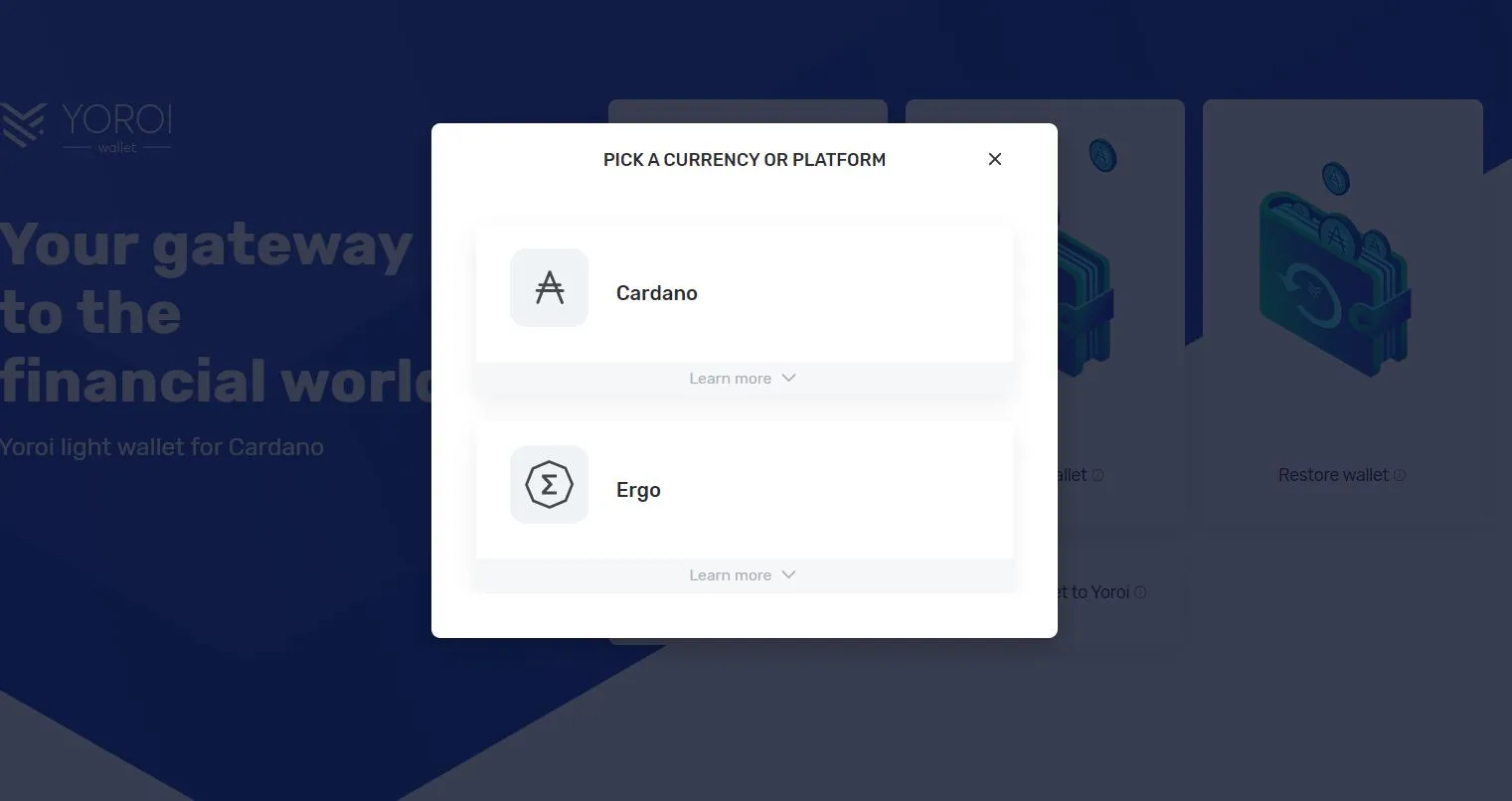

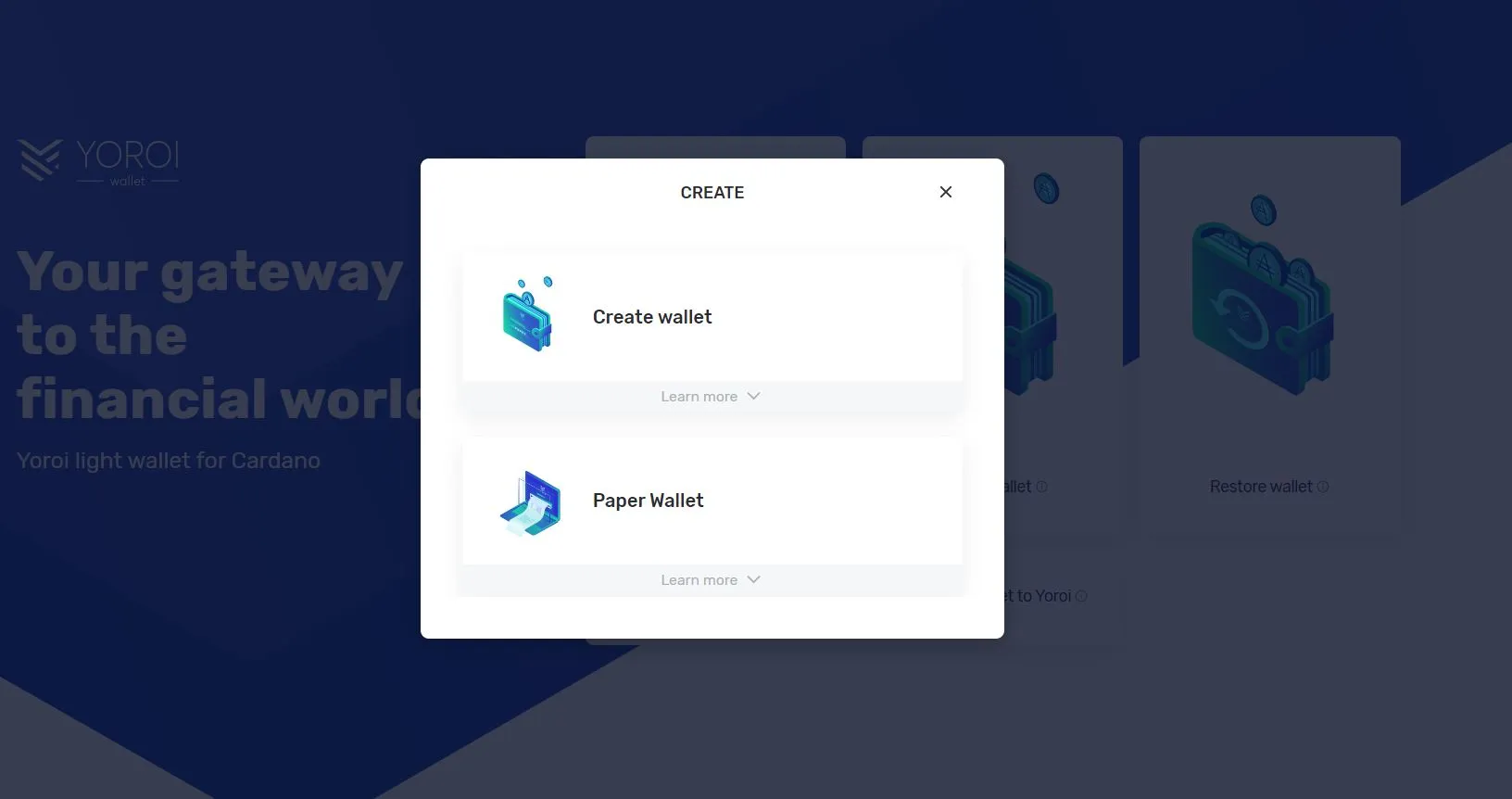

4. If you have no funds, choose Create a Wallet. Choose Cardano when asked.

5. Click “Create wallet,” not the paper wallet.

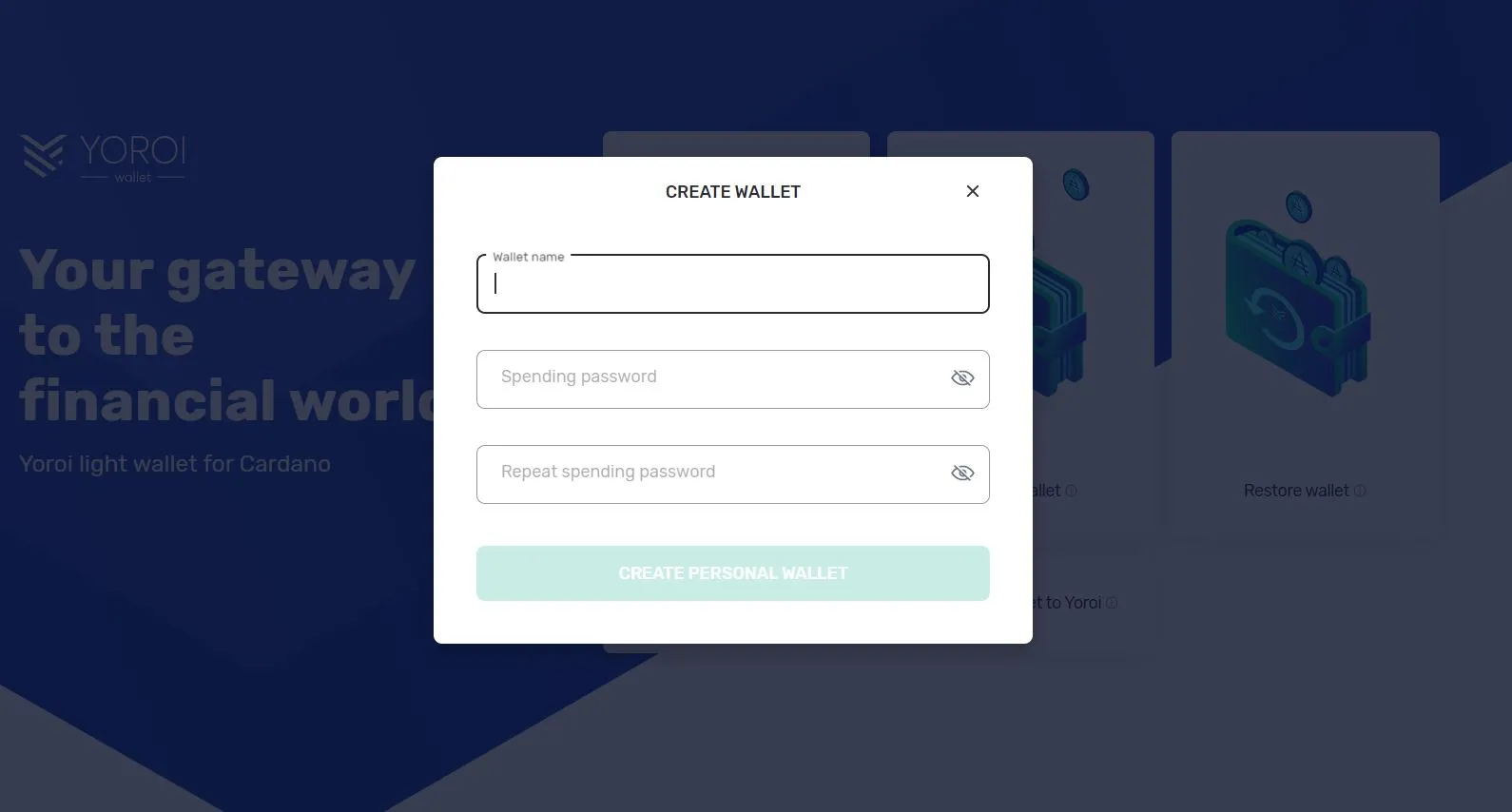

6. Next, name your wallet. This is purely for easy identification.

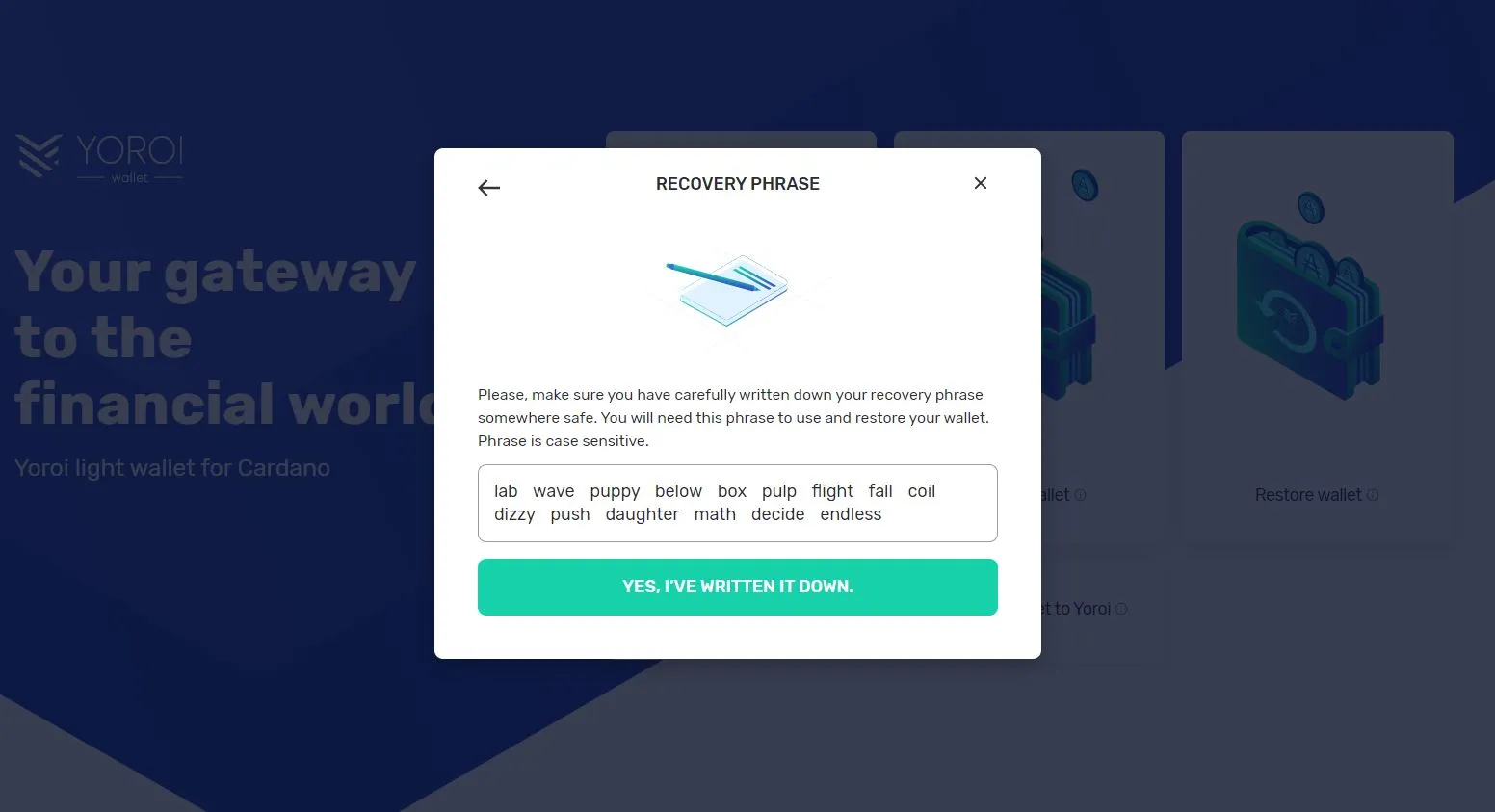

7. Next, set a spending password. Click “Create Wallet.” Write down your wallet backup phrase. You’ll need this 15-word recovery phrase to restore your wallet if you want to access it from a different device.

You cannot copy the recovery phrase. Write it down using a pen and paper. Next, choose the words in the correct order to create your wallet.

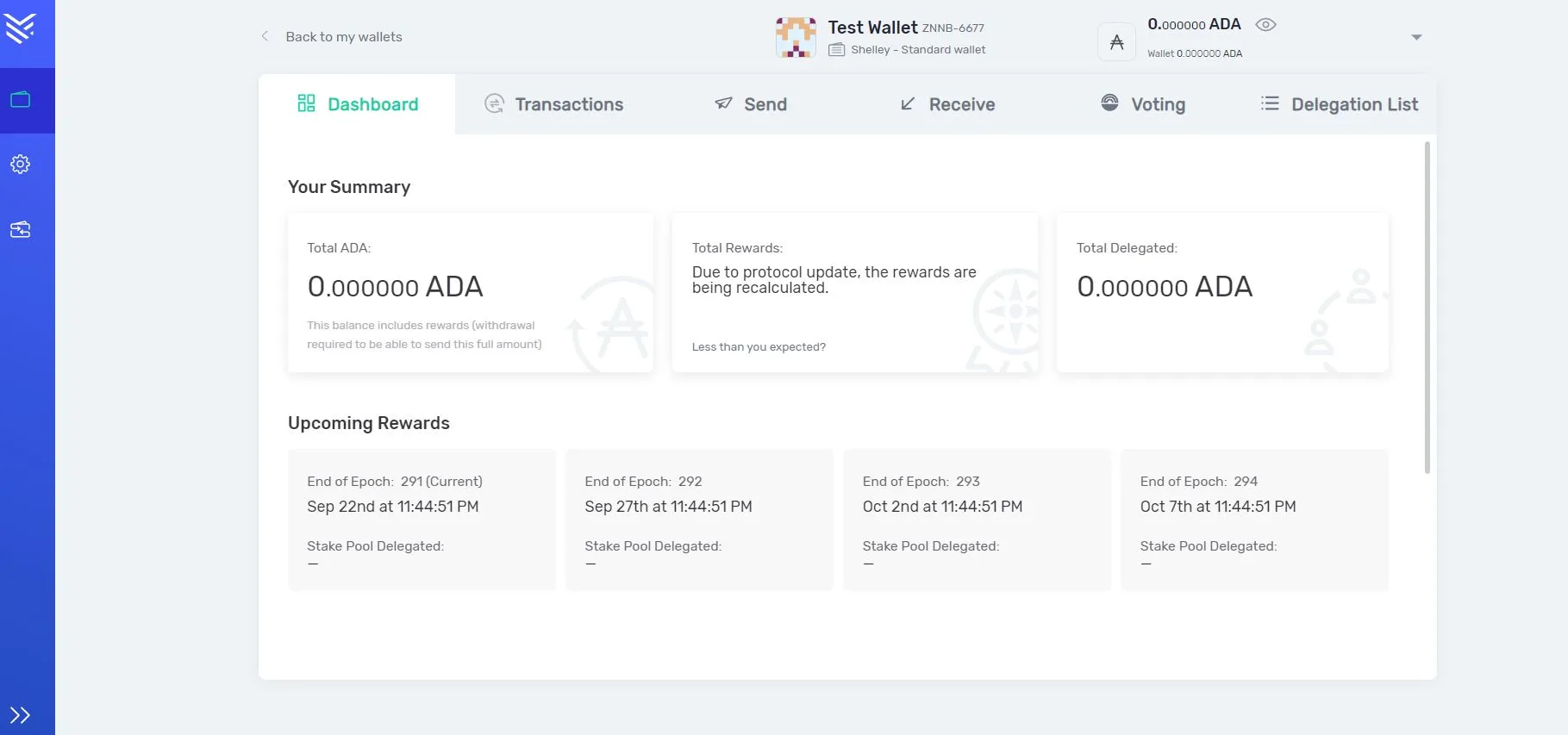

8. Next, you will be taken to your dashboard, where you will find the “Receive” tab and instructions on how to add ADA funds.

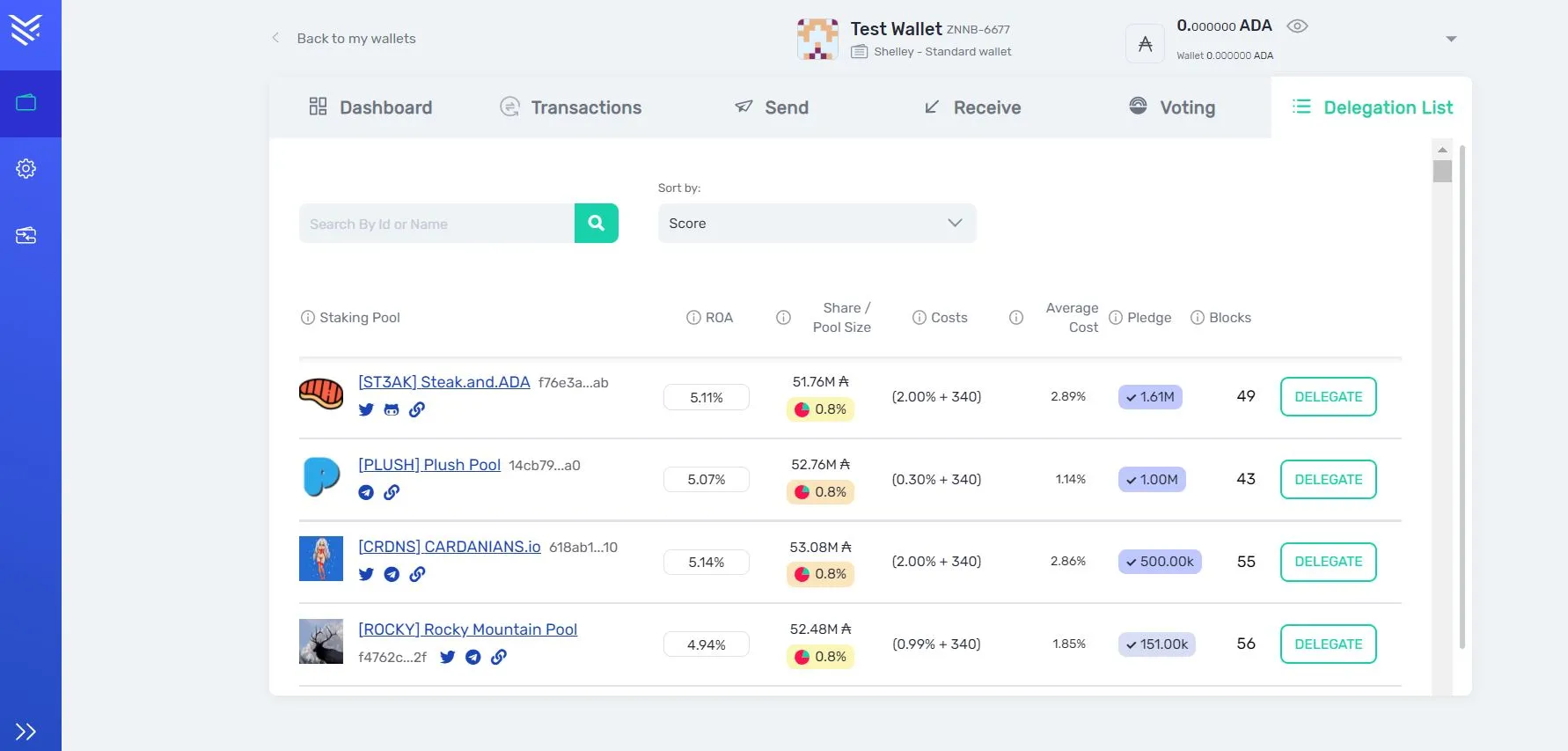

9. After you add funds, you can stake Cardano by choosing one of the staking pools from “Delegation list”.

10. Now that you know all about how Cardano’s staking pools work, you can choose a particular pool.

Each pool has an operation fee, which varies between pools. After delegation, you will be eligible to start collecting rewards.

There’s a waiting time of 20 days for approval after you first start delegating. This is to prevent spamming. After approval, you earn ADA every five days.

Another network fee must be paid each time upon claiming.

Staking Cardano on Daedalus wallet

Daedalus is a desktop wallet created by IOHK that runs on Windows, macOS, and Linux. It is a full-node wallet for those who want to become a staking pool operator or create a node on the network. The wallet is more suitable for knowledgeable users.

Similar to the Yoroi wallet, you will have to install the Daedalus wallet on your device. Make sure to securely store your seed passphrase, which you will need to recover your wallet in the future in case your device is damaged.

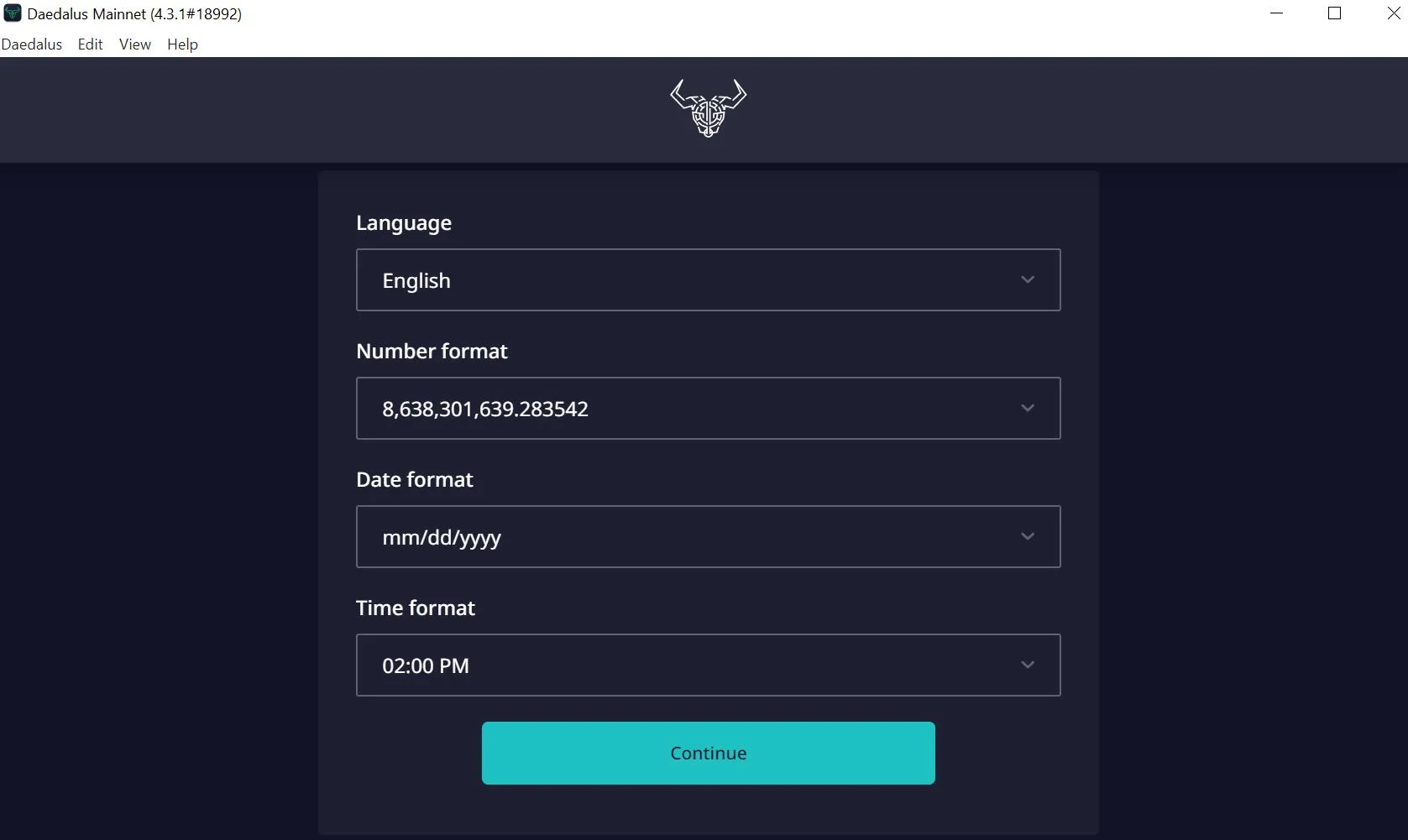

1. Install Daedalus wallet on your device. Make sure to download the legitimate wallet from the official Daedalus website. Set your preferred setting and accept the terms of service.

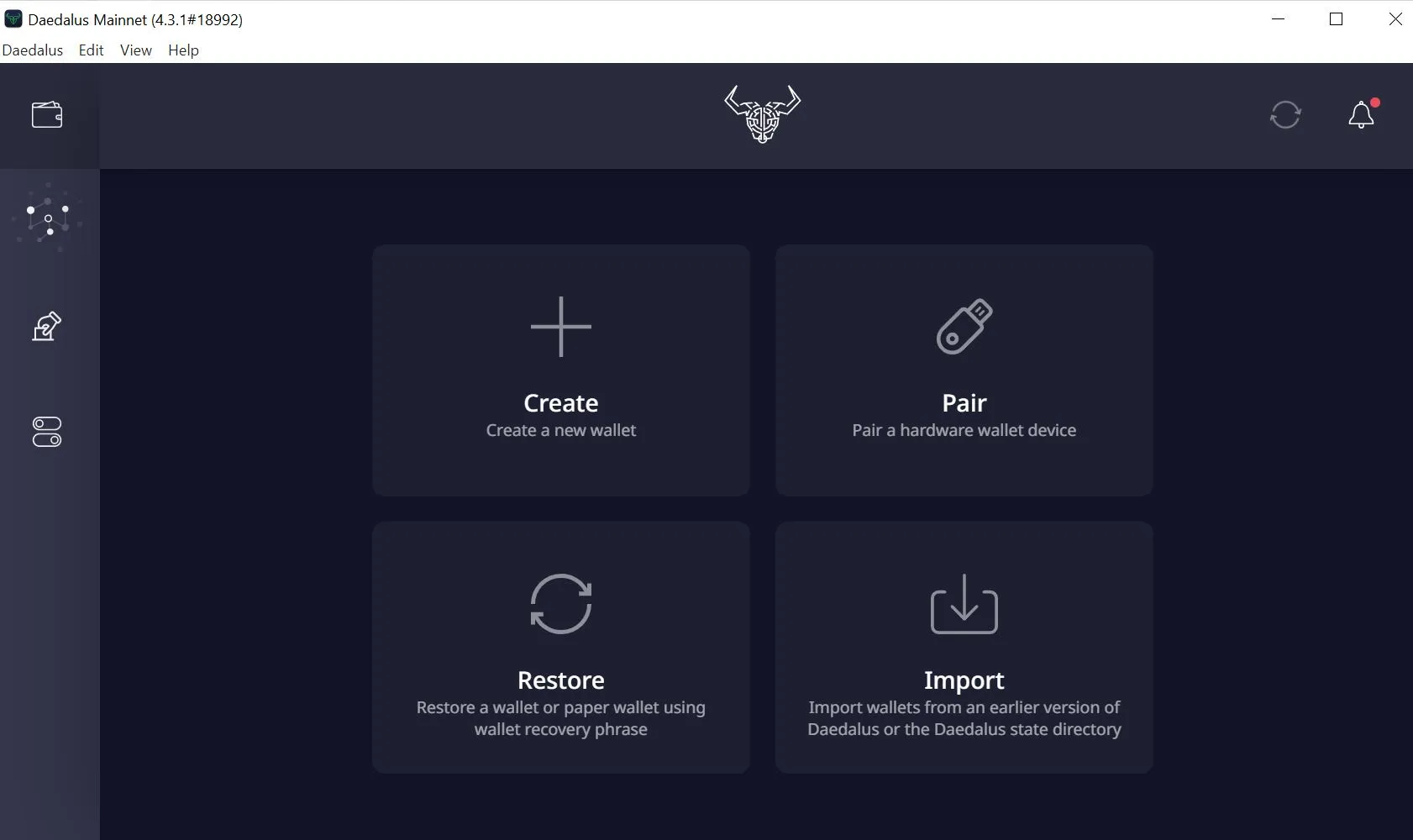

2. Create or restore a wallet. You can create, pair, restore, or import a wallet in Daedalus.

3. Assuming you don’t have a Daedalus wallet, create one by clicking on “Create.”

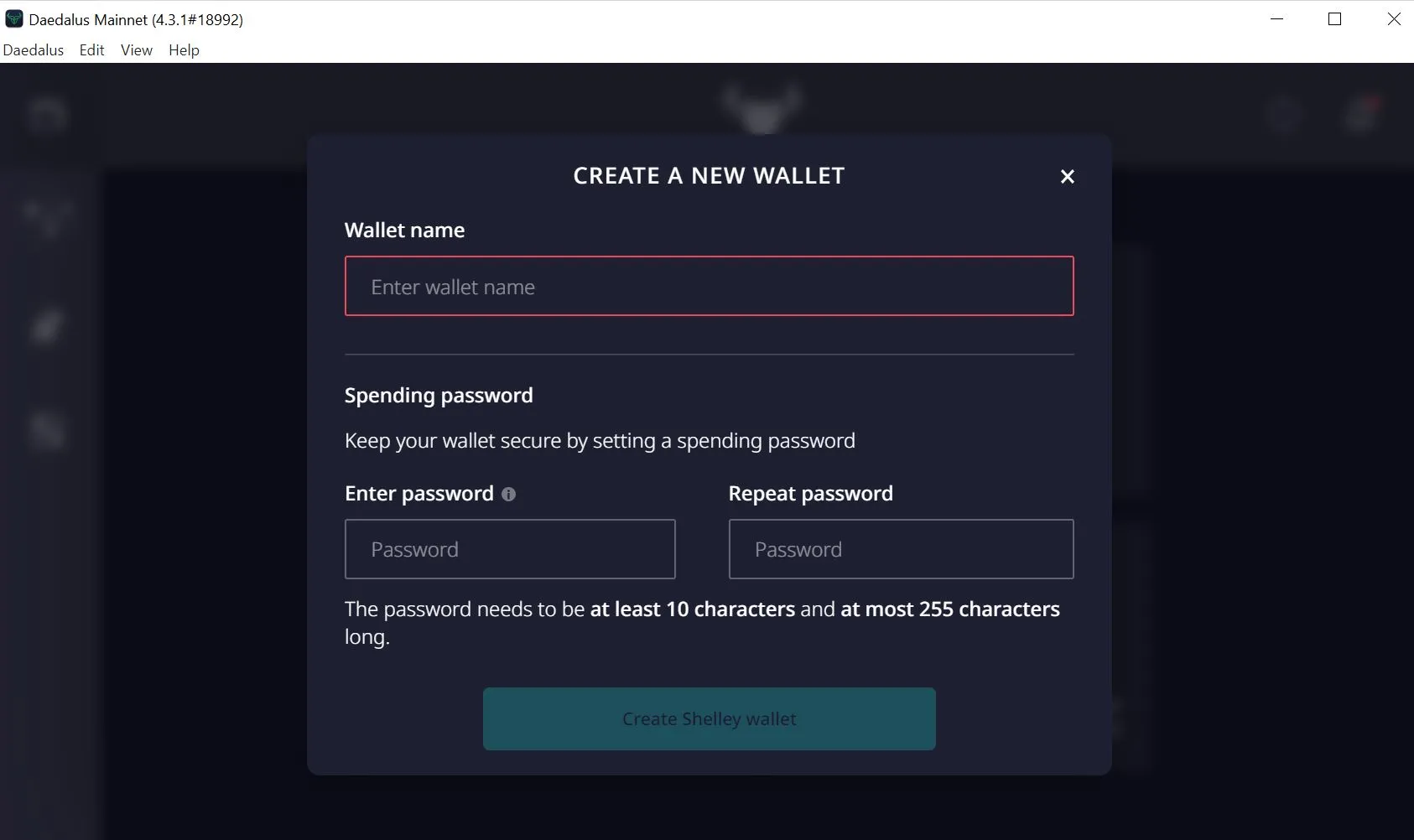

Here, you have to set your wallet’s name and spending password to keep it secure.

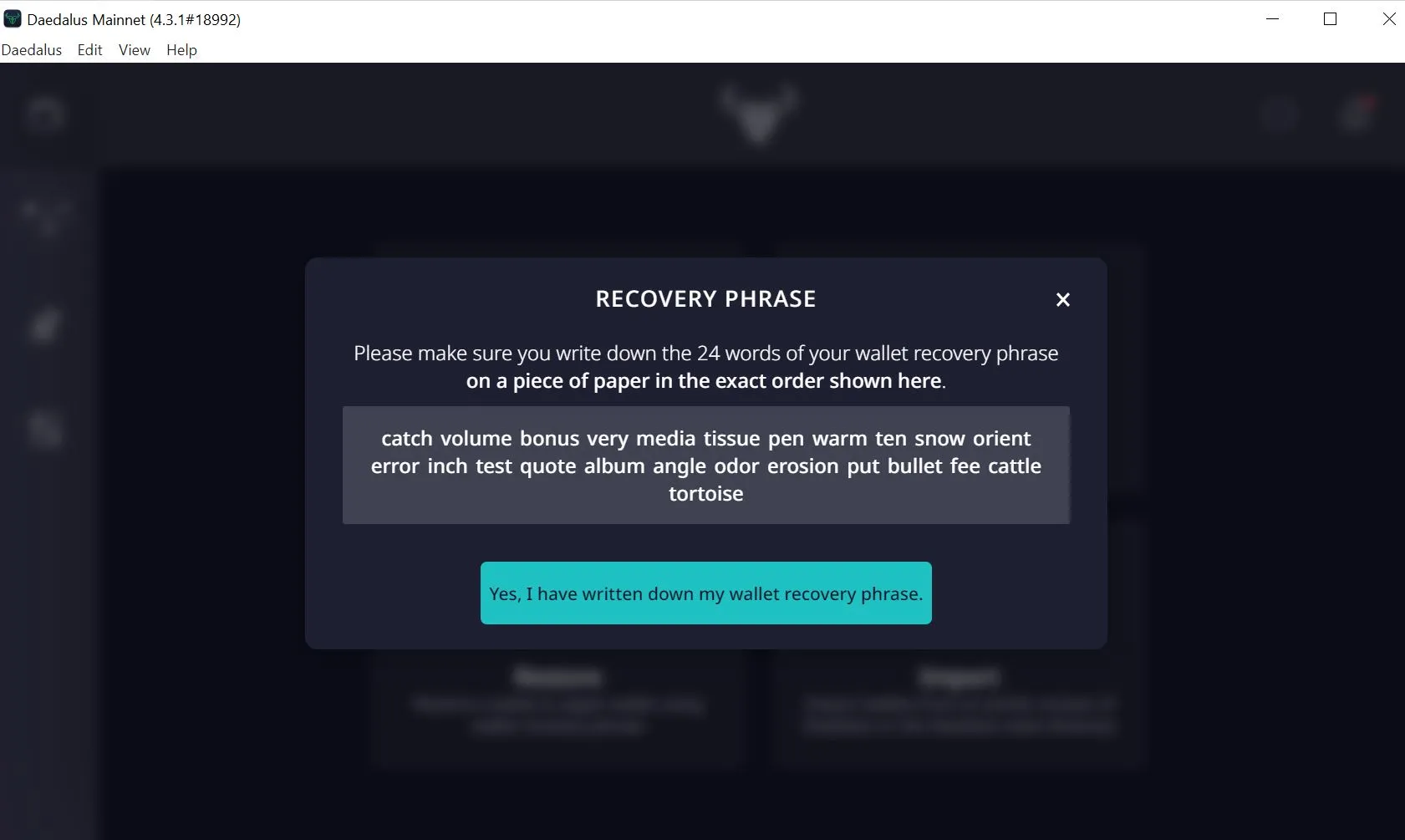

4. Next, you will be given a 24-word recovery phrase, which is all you will need to recover your wallet.

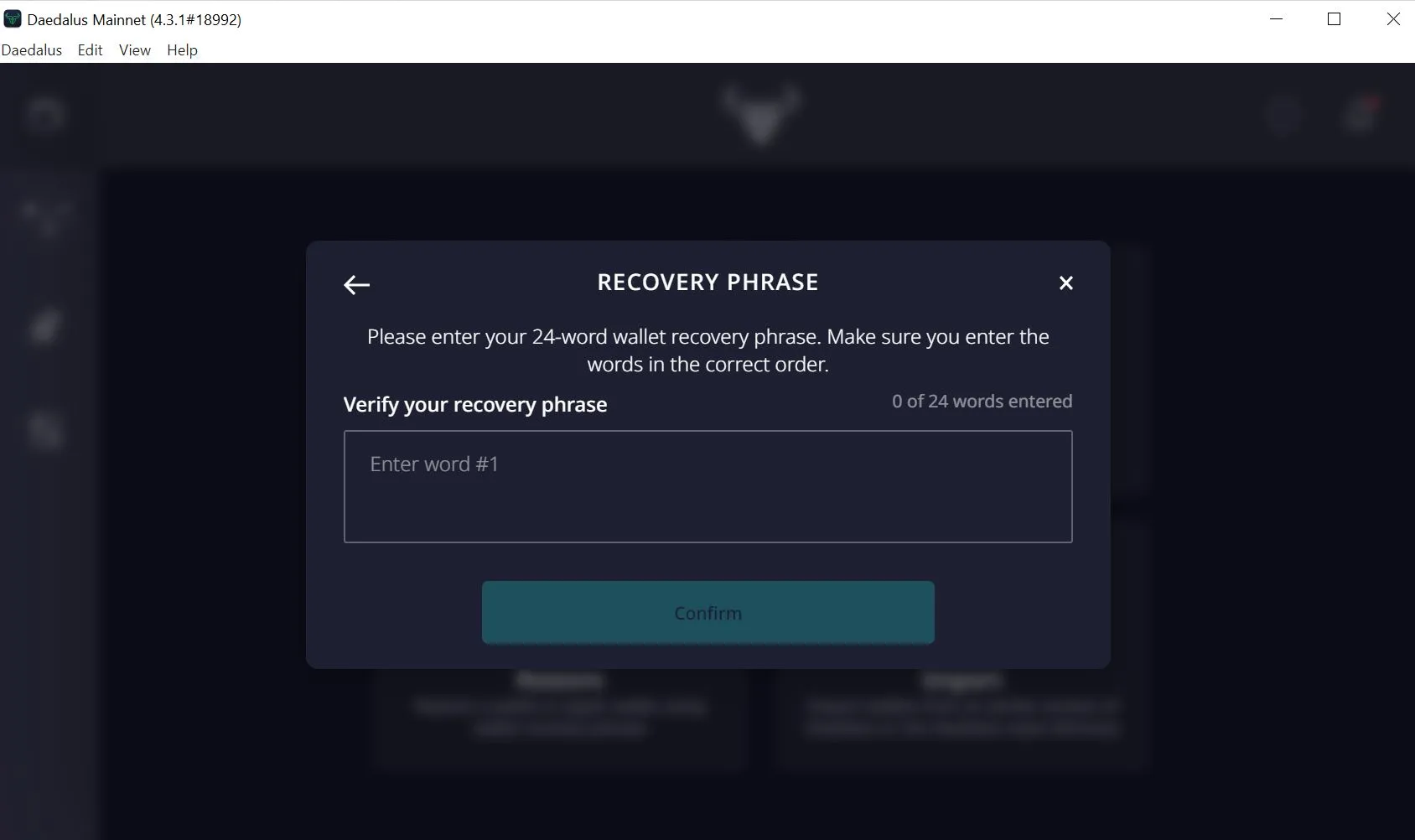

5. After you write down your phrase, you will be prompted to write the recovery phrase to ensure that you can regain access to your wallet.

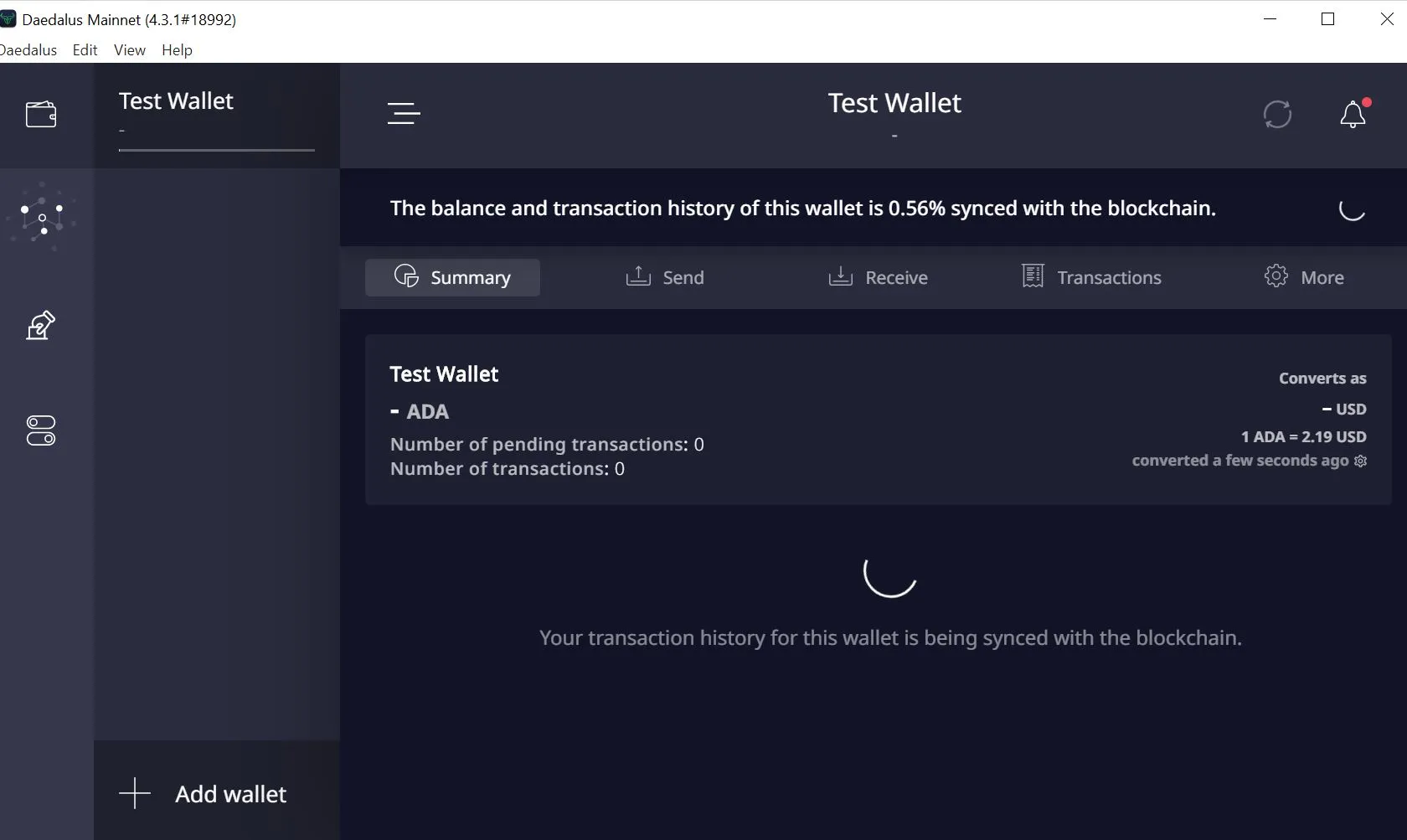

6. After confirming the recovery phrase, the Daedalus wallet takes you to its dashboard. Here, you will also find the “Receive” tab, which explains how to transfer ADA funds to your new wallet.

After the Daedalus wallet synchronizes with the Cardano blockchain, you will see the available stake pools and can start staking Cardano. Keep in mind that the synchronization process may take some time.

Staking Cardano on Binance

Cardano can be staked on leading exchanges like Binance, Bittrex, KuCoin, and Kraken. When staking Cardano directly on a cryptocurrency exchange, the exchange is the staking pool and gives users the rewards directly in their exchange wallet.

Unlike staking using a crypto wallet, users who choose to stake Cardano using a crypto exchange cannot stake ADA on multiple staking pools.

You will need to have ADA in your Binance account before you can start staking Cardano.

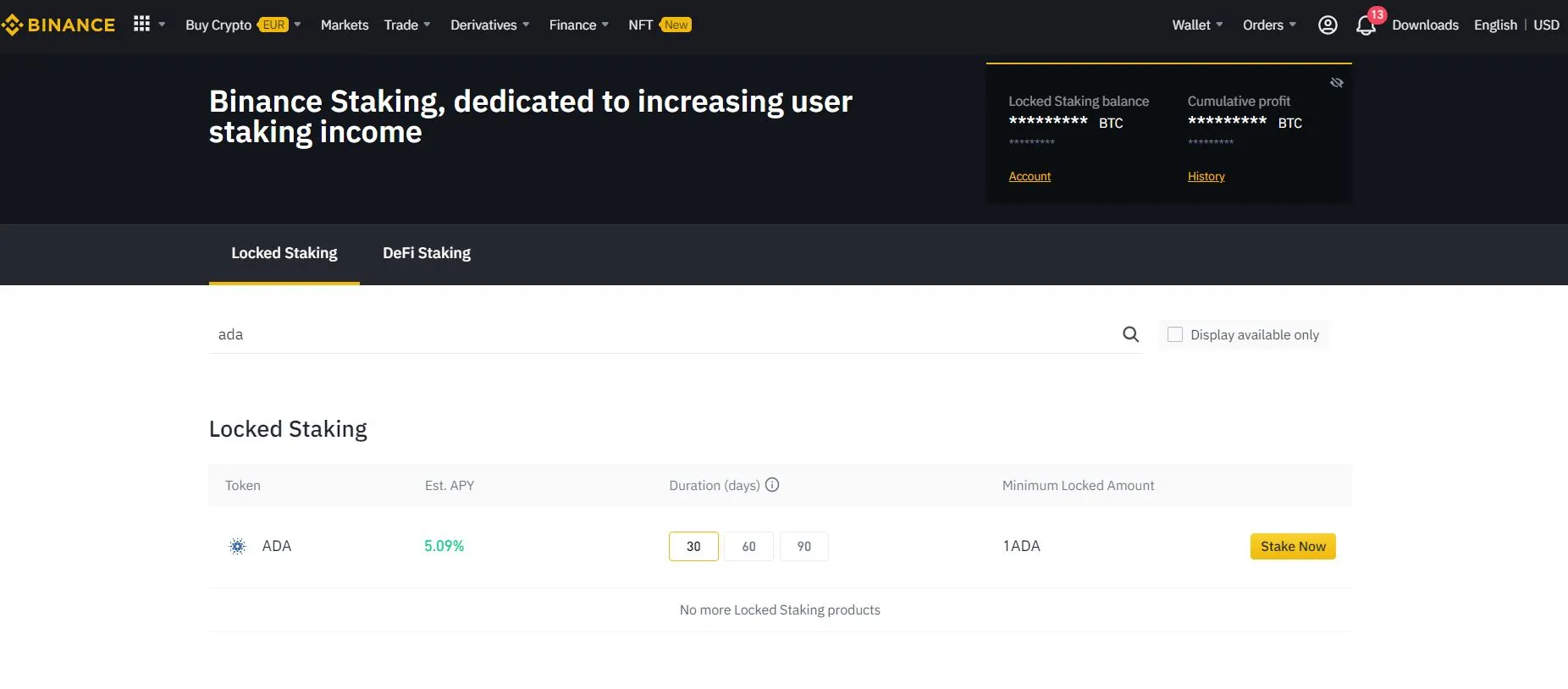

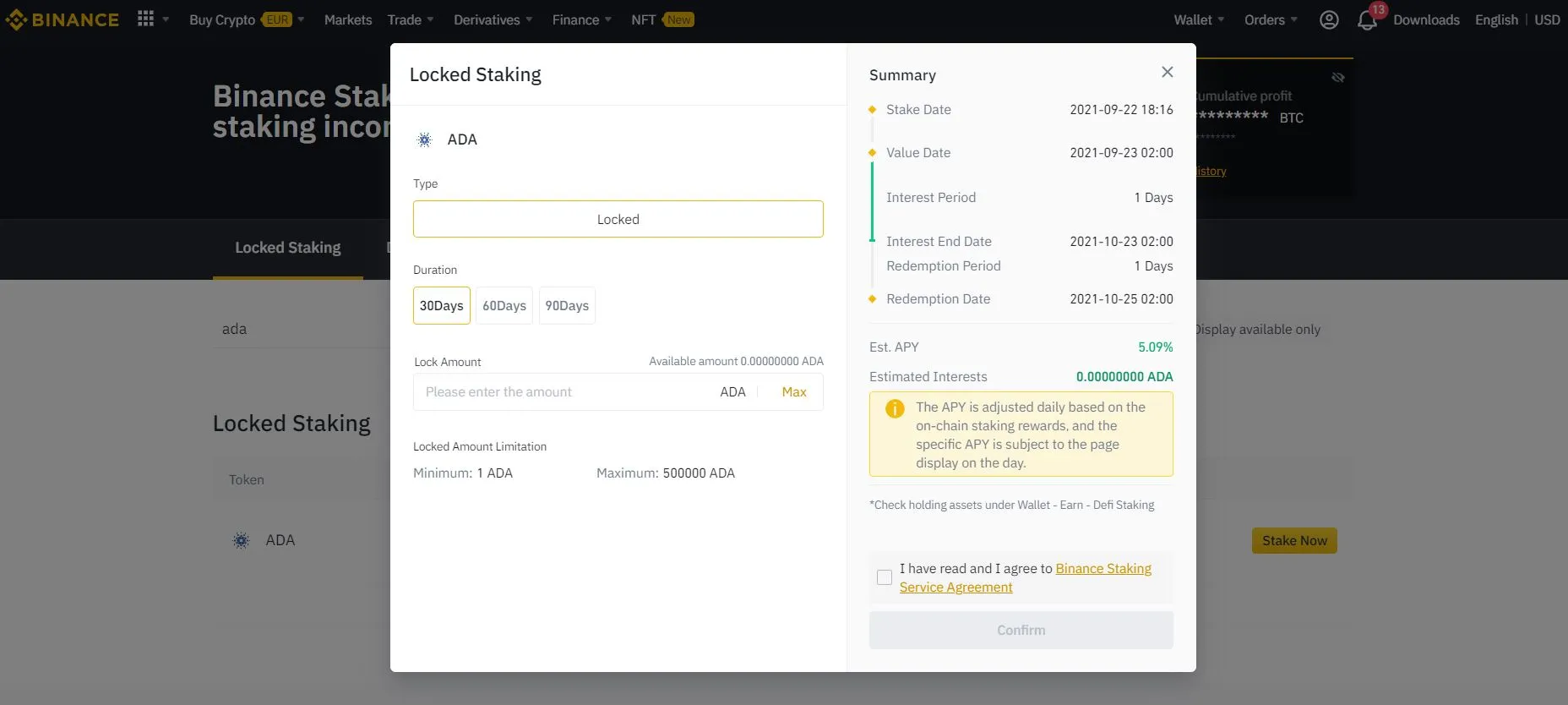

1. Go to Binance Staking Pools. You will need to find Binance Staking and search for ADA.

2. Click “Stake now” and choose how much you would like to stake. Set all the other options, such as staking duration (30, 60, or 90 days), check the terms and conditions checkbox, and confirm the action.

Your rewards will be ready to claim after the staking duration has ended.

It’s worth noting that crypto exchanges have a lower APY rate than crypto wallets.

Cardano’s ecosystem

Charles Hoskinson launched Cardano in 2017 as an open-source blockchain designed for creating smart contracts and developing decentralized applications (DApps). He also co-founded Ethereum.

Cardano achieves consensus through the proof-of-stake (PoS) mechanism. This allows users to stake Cardano and earn a passive interest in the network’s native cryptocurrency, ADA.

The platform enables quick processing times compared to its main competitor, Ethereum. This is because the network is the first peer-reviewed blockchain.

ADA, the native asset, helps fulfil the PoS consensus mechanism of the network through a process called staking. This process validates and secures the Cardano blockchain.

Cardano’s proof-of-stake

The PoS mechanism is an alternative to Bitcoin’s more famous proof-of-work (PoW) mechanism. PoS helps maintain network integrity by validating transactions and blocks.

The PoW mechanism consumes a large amount of computational power and electricity to maintain the network. Validators solve complex mathematical problems to confirm each block.

As a result, scaling the network has become nearly impossible.

Unlike PoW, PoS requires certain validators to stake cardano to help validate transactions. By doing so, validators who staked their crypto also earn an incentive, and that’s how the network functions.

Cardano’s PoS mechanism is the Ouroboros algorithm. This mechanism saves electricity, has a high transaction speed, and makes Cardano an eco-friendly blockchain.

Ouroboros uses technology and a mathematical mechanism based on behavioral psychology and economic philosophy to establish a sustainable blockchain. Thus, Cardano benefits from global propagation and a permissionless network with low-energy requirements.

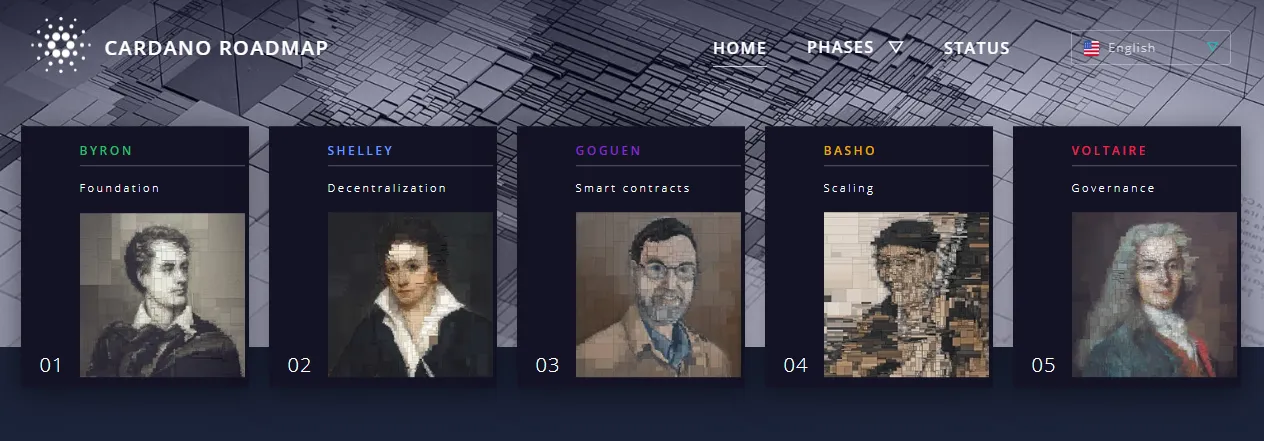

The Cardano roadmap is split into six different eras, as follows:

- Byron: Users can buy and sell ADA, the network’s native token.

- Shelly: Users receive incentives for setting up their own nodes, which helps decentralize the network by staking ADA.

- Goguen: Developers can build DApps on Cardano using smart contracts.

- Basho: Scales the Cardano network and introduces sidechains for improved functionality.

- Voltaire: The voting and treasury system establishes a self-sustaining governance model. Users can stake Cardano to influence the network’s future decisions.

In 2024, Cardano has reached the Goguen era, which introduces smart contracts and allows DApps. Additionally, it permits multi-currency ledgers and the creation of new digital assets, such as NFTs. The team announces all development updates on the roadmap status update page.

Smart contracts on Cardano

Smart contracts are the core feature of any programmable blockchain and allow the development of decentralized applications (DApps). The Cardano blockchain can support smart contracts and DApps after the Alonzo hard fork, which took place in September 2021. This development allows Cardano to position itself as an alternative to Ethereum, attracting DeFi developers with its lower transaction fees.

With the release of the smart contracts functionality on Cardano, the network is an adequate environment for DeFi projects. The network aims to keep its decentralization through user governance. It also offers multi-chain support and cost predictability.

What is Cardano staking?

Staking on Cardano serves as the verification mechanism for its PoS consensus, which provides an alternative way to earn crypto.

Cardano investors can stake ADA to validate transactions and keep the network decentralized, for which they are rewarded in ADA. Staking cardano can be used as a method to earn passive income.

ADA holders can earn by delegating tokens to a stake pool, run by someone else, or by running their own. The consensus mechanism used by Cardano is the Ouroboros protocol, which consists of stake pool operators (SPOs) and delegators.

The Ouroboros protocol chooses the validator to add the next block on the blockchain based on the amount of stake delegated to a given pool. Whoever is chosen to validate the block receives an incentive in the form of ADA.

The more crypto that is staked by a pool, the more likely it is that it will be chosen to validate the block and receive the reward. The incentives are split with those who delegated their stake in that pool, according to the amount each delegated.

Stake Pool Operators (SPOs)

The network’s stake pool operators are giving the community full control over Cardano’s blockchain, ensuring decentralization.

Stake Pool Operators (SPOs) create efficient and reliable decentralized connections between the network’s nodes. SPOs increase efficiency by supporting automatic node communications.

SPOs act as the nodes of the network and help validate transactions. A certain SPO is chosen to validate the next block based on the amount of ADA staked in their pool.

Anyone can operate a stake pool, but it requires more advanced skills, such as development and operations experience and server operation and maintenance skills. The instructions for installing a stake pool operator script (SPOS) can be found here.

Those operating the pool charge a fee taken from the ADA received when validating a new block on the network. Luckily, ADA can be delegated to others’ staking pools. This is how every Cardano user can contribute to the development of the network.

Cardano’s delegators setup

Delegation is easy and can be done by anyone who owns ADA. Users can delegate their stake by joining a stake pool on Cardano. Their incentives are proportional to the amount of stake delegated.

When delegating ADA to a certain staking pool, you are increasing the chances of that pool being elected to validate the next node and thus receive the reward. The rewards, often called incentives, are split between the SPO and the delegators.

Did you know: Cardano users can delegate their stake using Daedalus, a full-node wallet, or Yoroi, a browser-based wallet.

Why stake cardano?

Two large benefits of staking cardano are passive income and network decentralization. Staking ADA is a great way to earn interest on your crypto holdings. When staking Cardano, you just specify the Cardano wallet address you want to use while your ADA remains fully accessible.

Earning a passive income with Cardano

ADA holders can earn passive income by delegating ADA to a stake pool or by operating their own stake pool. If you have a lot of ADA and possess the skills to launch a pool, consider doing so. It makes most sense to create a private stake pool and not share the rewards with others.

Holders with smaller amounts of ADA can earn a passive income on Cardano by staking their funds to a public staking pool, which usually retains a fee from the reward received by the staking pool.

The more ADA you stake, the more coins you receive as a reward. Depending on the staking pool you choose and how you stake cardano, you can expect to earn anywhere between 1.9% to over 7% APY (annual rewards yield).

Keep the Cardano network decentralized

Assuming you are truly interested in the network’s development, staking cardano helps keep the network decentralized and impenetrable by an attack or double-spending. That’s why Cardano’s staking pools are rather small, to prevent a single pool from taking over and controlling the blockchain.

What are the drawbacks of staking ADA?

Staking Cardano does come with some risks. If you stake via a wallet and then lose access to that wallet, for example by misplacing your seed phrase, you will lose your staked funds.

Note that If you’re using the Daedalus or Yoroi crypto wallets to stake cardano, your funds will stay in your wallet, as you only delegate the power of your wallet’s balance to the staking pool.

There are a few other things to keep in mind.

1. Saturated staking pools

The point of staking cardano and having multiple staking pools from all over the world is to keep the network decentralized. Having a staking pool to which everyone wants to send their stake would compromise that very principle.

That’s why there is a delegation criterion, after which a pool cannot receive any higher rewards for more delegations. If a larger stake were delegated to that staking pool, the rewards of each delegator would be reduced.

The delegation criterion is calculated following the total circulating supply/nOpt.

Delegating to a pool close to the saturation point sounds optimal, but there is a chance that it can become oversaturated, which will decrease the rewards. This is a criterion when choosing a staking pool.

2. Staking pool fees

Delegating your stake to a public staking pool will incur a fee deducted from the reward. This is because the SPO managing the staking pool will incur costs to maintain the pool.

Remember, the pool deducts its fee from the reward before distributing it to the delegators.

As a delegator, here is what you should pay attention to when deciding to stake Cardano:

- Pool pledge: This is similar to the pool owner’s promise to maintain the pool. IOHK has a staking calculator on which you can see the different rewards for different pledge parameters.

- Pool fixed costs.

- Pool margin.: The rewards that a pool can make from the total rewards pot in the form of a percentage.

- Performance: How much a pool thinks it will make versus how much it actually makes.

- Wallet ranking.

Earning passive income through staking

As demonstrated in this guide, even beginners can stake Cardano. While staking comes with minimal risk since your funds remain in your wallet, it’s essential to choose reliable staking pools for consistent returns. Remember that staking returns are heavily impacted by the market’s health, and profits are not guaranteed.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Proceed with caution when buying and staking crypto, including ADA.

Frequently asked questions

What is Cardano?

How does Cardano work?

What is Cardano’s governance model?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.