When it comes to cryptocurrency trading, skill, luck, and excellent timing are crucial to turning a regular profit.

Fortunately, there are now more ways than ever before to better grasp the current market situation and extract profits from price movements that other, less-equipped traders might miss out on.

With that in mind, let’s take a look at the five easiest ways to boost your trading profits in 2020 and beyond!

Trade With a Multiplier

Cryptocurrencies are known to be incredibly volatile and this volatility is a large part of the reason they are so popular as trading instruments. After all, a cryptocurrency that can fluctuate by as much as 10 percent in a day can present a large number of profitable trading opportunities. Nonetheless, thanks to the introduction of cryptocurrency derivatives instruments such as futures, options, and swaps, it is now possible to turn a relatively small market movement into a chunky profit due to the ability to trade on margin. Margin trading essentially allows traders to temporarily borrow funds in order to open trades much larger than they would otherwise be able to — this can be as much as 150x their account balance at some of the more advanced derivatives trading platforms, such as StormGain.

Putting this into perspective, when trading with 150x leverage, a simple one percent market movement in your favor will result in a 150 percent profit (150 * 1 percent).

With that said, traders will need to be selective when deciding to trade using such high leverage, since a small move in the wrong direction can cause automatic liquidation. As such, it is best to trade with low leverage when the market is less certain, while high leverage is best reserved for times where the direction of the market can be easily predicted.

Margin trading essentially allows traders to temporarily borrow funds in order to open trades much larger than they would otherwise be able to — this can be as much as 150x their account balance at some of the more advanced derivatives trading platforms, such as StormGain.

Putting this into perspective, when trading with 150x leverage, a simple one percent market movement in your favor will result in a 150 percent profit (150 * 1 percent).

With that said, traders will need to be selective when deciding to trade using such high leverage, since a small move in the wrong direction can cause automatic liquidation. As such, it is best to trade with low leverage when the market is less certain, while high leverage is best reserved for times where the direction of the market can be easily predicted.

Trade on the Short Side

As we mentioned previously, cryptocurrency derivatives trading platforms enable trading strategies that are either impractical or downright impossible at spot trading platforms. Among the additional possibilities enabled by cryptocurrency derivatives exchange, the ability to trade on the short side is perhaps the most important. Although it is true that many major cryptocurrencies have experienced incredible growth across their lifetime, this hasn’t been without periods of decline. Because of this, the ability to short cryptocurrencies massively increases the number of potentially profitable trading opportunities, since traders are able to easily go long during bullish periods and switch to shorting the market when things go south. This also enables cryptocurrency traders to extract regular profits from markets that are almost perpetually bearish or have been on the decline for a long time. Moreover, the ability to short makes it much simpler for traders to employ risk management strategies to protect their spot investments. One of these strategies, known as a short hedge, can be used to minimize price risk by locking in the price of a cryptocurrency to be delivered sometime in the future — ideal for those in a long term long position.

Set up Automatic Alerts

What if there was a way to be automatically alerted when a specific market moves according to specific rules? Such a tool wouldn’t just save time, but it could also be used to detect trading opportunities — perfect for the scalpers out there. Fortunately, there are now a variety of tools available to accomplish just this, allowing users to set alerts for a wide range of possible scenarios, such as if Bitcoin (BTC) crosses below a certain threshold or if Ethereum (ETH) gains or loses a certain percent of its value over a defined period of time. These alerts can often be chosen to activate if the aforementioned scenario occurs within a pre-defined time range — or at any point in the future. As it stands, TradingView is the most popular online tool used for this purpose, since it offers one of the most customizable alert tools on the market, allowing users to receive alerts as browser-based visual popups and audio signals, as well as through email and SMS. Beyond this, Coinigy is also a popular choice and offers most of the same functionality as TradingView, including both email and SMS alert options. With that said, although both TradingView and Coinigy offer basic alert functionality to free users, customers will need to upgrade to a paid plan costing at least $14.95/month to unlock the full range of alert features — this might be necessary for traders looking to set a large number of alerts or for those who need SMS delivery options. Overall, automatic alerts are useful tools for any trader that expects to spend some time away from their main computer, since alerts can help them stay on top of the market without the need to track it manually.

Use All the Available Tools and More

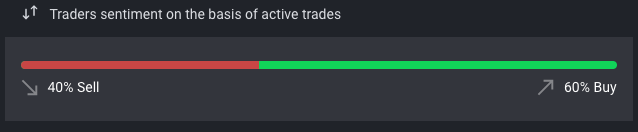

For the most part, cryptocurrency exchanges tend to offer a range of tools traders can use to improve their trading profitability. Among these, the great majority of cryptocurrency exchanges offer charting tools, which allow traders to perform technical analysis on a market. By combining simple charting tools like trend lines, built-in indicators and oscillators together, it is often possible to extract additional insight on the current market situation and plot how things are likely to progress. As such, exchanges that offer a wide variety of charting tools can be said to better equip traders that use technical analysis as the basis of their trade decisions. Beyond this, there are dozens of external tools available that can help with making profitable trade decisions, including Omenics — a platform that aggregates a variety of indicators to produce a single market sentiment score, as well as alternative.me’s Crypto Fear & Greed Index, which can be used to help spot buying/selling opportunities. StormGain and several other newer exchanges have also taken the opportunity to implement built-in sentiment indicators, helping traders make informed trade decisions with needing to rely on external tools.

With that said, sentiment indicators like these are not absolutely fool-proof, so it is wise to combine these insights with broader market analysis before trading.

StormGain and several other newer exchanges have also taken the opportunity to implement built-in sentiment indicators, helping traders make informed trade decisions with needing to rely on external tools.

With that said, sentiment indicators like these are not absolutely fool-proof, so it is wise to combine these insights with broader market analysis before trading.

Cut Down Your Fees

Although it is true that skill, determination, and experience are absolutely critical to succeed in the world of cryptocurrency trading, there is one simple change that many traders can make to significantly improve their profitability — cutting down trading fees! Unfortunately, cryptocurrency traders can be a stubborn bunch. After finding a cryptocurrency exchange that works for them, they typically stick with it, even if there are better platforms out there. Because of this, a huge proportion of traders are paying far more in commission fees than necessary, which can have a knock-on effect on their trading profitability. With that said, low fees aren’t everything. Instead, traders should be looking for a platform that has the right balance of features and fair fees. Similarly, although many traders are careful to trade on exchange platforms with acceptable maker and taker fees, few take into consideration, other, less obvious fees when trading. Among these, the trading spread often goes unnoticed. As the difference between the lowest ‘ask’ order and the highest ‘bid’ order, a low spread means lower operating costs, whereas a high spread means traders need to offset this with high profitability trades. In light of this, we have created a simple widget that can be used to quickly identify the full commission charges (including the spread) for the most popular cryptocurrency margin exchanges.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored