In May, the Bitcoin (BTC) price experienced a minor decrease, fluctuating between $25,800 and $30,000. However, the monthly opening and closing prices were significantly closer, which brings us to the BTC price May prediction: even though the price action was contained, the future trajectory remains uncertain and intriguing

These four analysts employed different means to predict the market volatility but arrived at a similarly accurate result.

Elliott Wave Count Correctly Predicts Downturn

Elliott Wave theory involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend. In May, the trading method accurately predicted the local top and ensuing downturn.

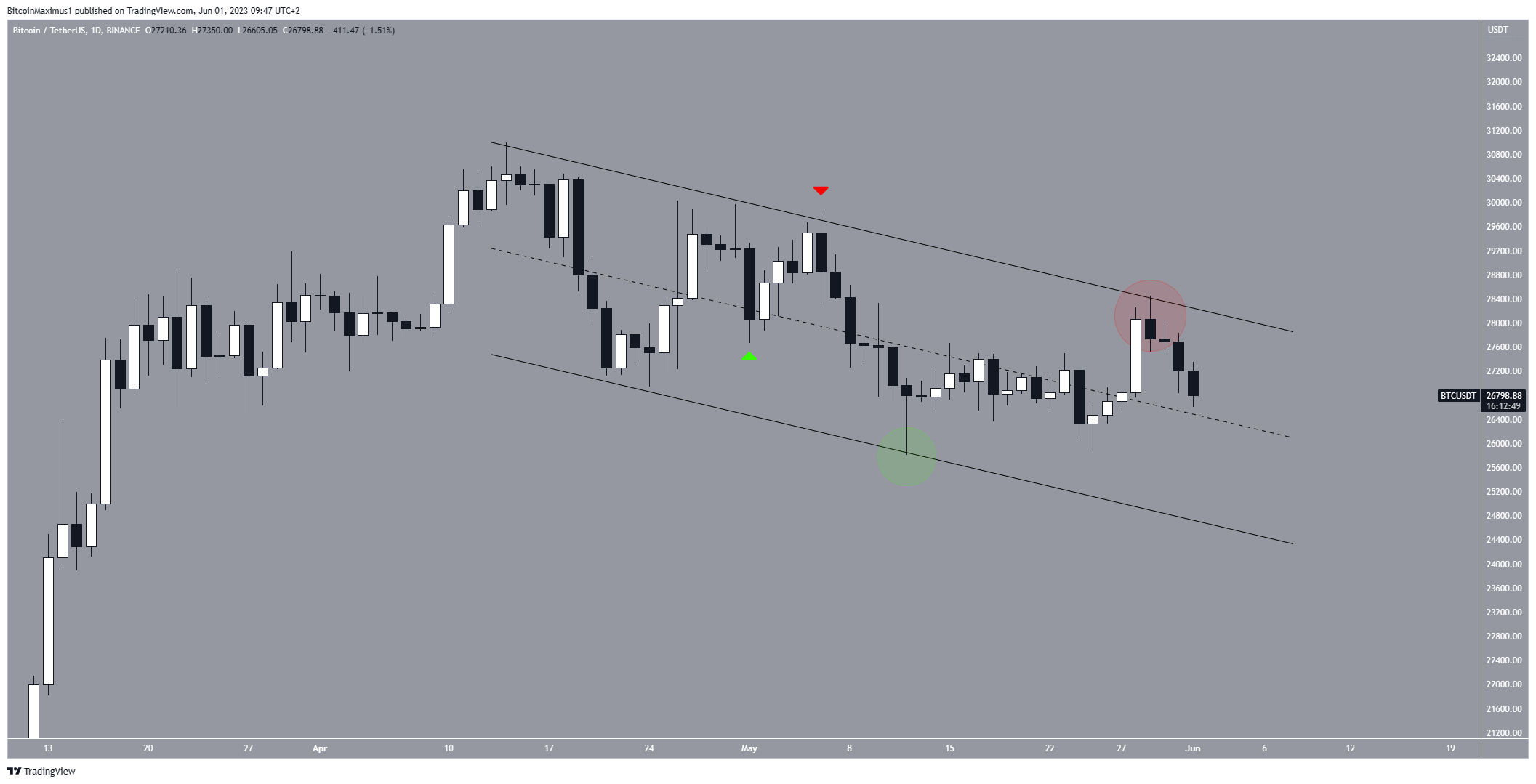

At the beginning of May, Elliott Wave specialist @TheTradingHubb tweeted that the price would reach a local top near $30,000 before falling toward $26,500.

The price did bounce on May 1 (green icon) and reached a local top near $30,000 (red icon) as predicted.

Afterward, well-known trader @Altstreetbet tweeted that the price will initiate another bounce (green circle) before the final capitulation towards $20,000. While the sharp capitulation has yet to occur, the weak bounce and a downturn (red circle) have already transpired.

Due to the descending parallel channel, a decrease to its support line at $25,000 is likely. However, a breakdown of it will be required in order for the price to fall to $20,000.

A breakout from the channel will invalidate this bearish BTC price prediction. In that case, an upward movement to $30,000 could transpire.

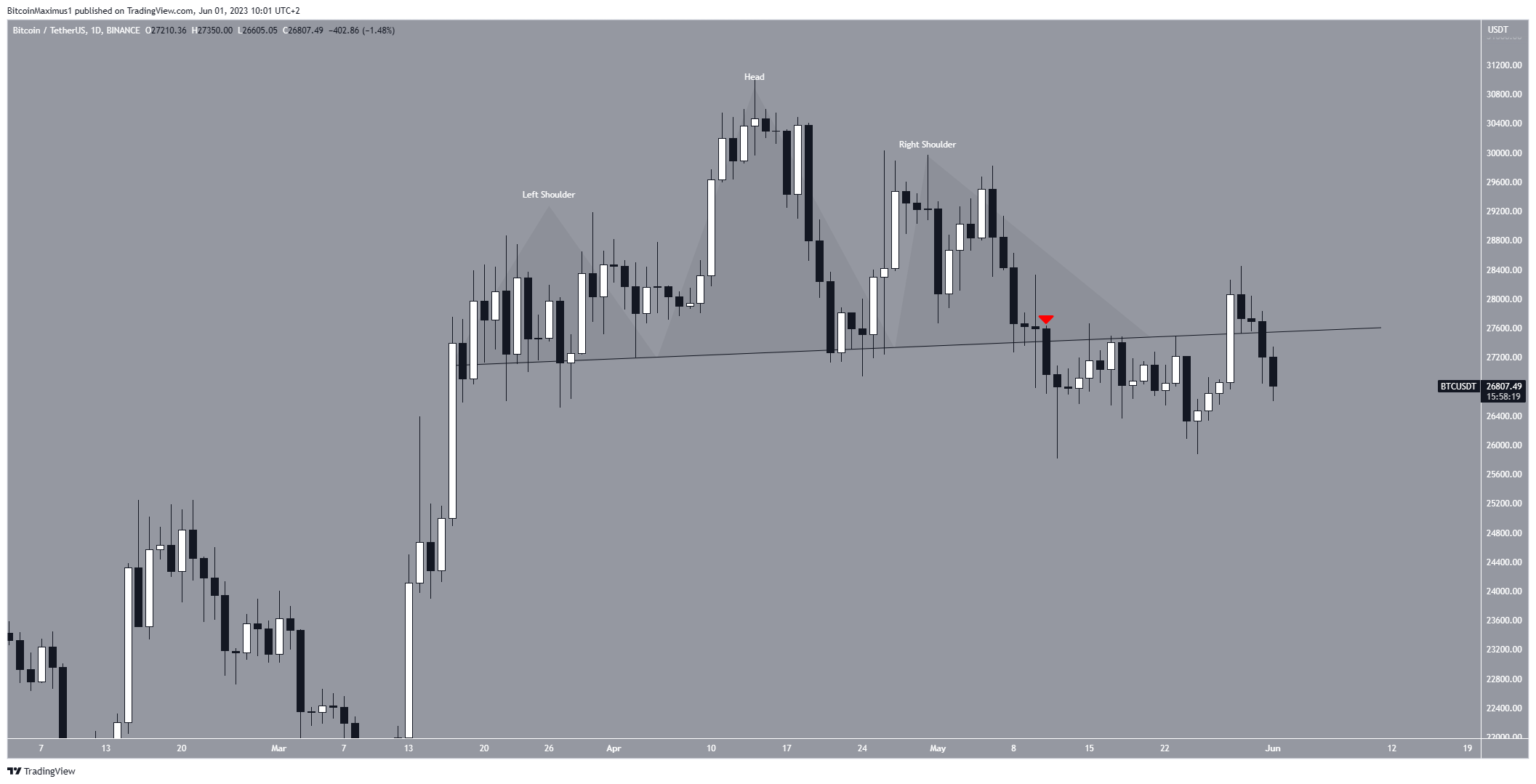

Head And Shoulders Pattern Catalyzes Breakdown

Cryptocurrency trader @Anbessa100 tweeted a head and shoulders pattern. The pattern suggested that the BTC price will break down and fall towards $25,000.

While the price did not reach the $25,000 target, it did break down (red icon), falling to a low of $25,800.

A similar outlook was given by @LomaCrypto, who simply used horizontal levels to determine the ensuing bottom.

The ensuing bounce was strong but insufficient to reclaim the pattern’s neckline. As long as BTC trades below the line, the trend is bearish. This outlook also fits with the previously outlined descending parallel channel.

A movement above the neckline would not confirm the bullish reversal since the price would still be below the channel’s resistance line. So, a close above $28,500 will confirm the bullish reversal.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.