21Shares has unveiled its latest crypto product, the Injective Staking Exchange-Traded Product (ETP) – AINJ. This product aims to enable investors to engage in the crypto market via traditional financial avenues.

Investors will also get exposure to Injective staking rewards.

Is an Injective Exchange-Traded Fund (ETF) on the Horizon?

AINJ allows investors to buy into the Injective token (INJ) through traditional exchanges and brokerage. These include interactive Brokers, Saxo Bank, Swissquote, and eToro, simplifying the typical complexities associated with crypto investments. AINJ is trading on Euronext Amsterdam (AINJ NA) and Euronext Paris (AINJ FP) exchanges.

“The introduction of AINJ is a significant milestone for institutional adoption, opening new gateways for large-scale entities to engage with INJ,” Injective announced.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

21Shares manages over $3 billion in assets under its Bitcoin ETF proposal with Cathie Wood’s Ark Invest. The introduction of AINJ taps into 21Shares’ framework for creating transparent, regulated investment vehicles.

AINJ is physically backed ETP, meaning it holds actual INJ tokens in cold storage. This setup offers investors direct exposure to INJ’s performance without direct ownership or the security risks tied to it. Additionally, the ETP captures staking yields from the INJ staking process, which secures the Injective network and reinvests them, potentially boosting investor returns.

The ETP sector is growing, with more investors seeking exposure to diversified assets through instruments that combine the liquidity and ease of trading of stocks with the advantages of mutual funds. AINJ fits neatly into this category, providing a regulated way to invest in digital assets. It stands alongside a selective group of crypto assets that have associated ETPs.

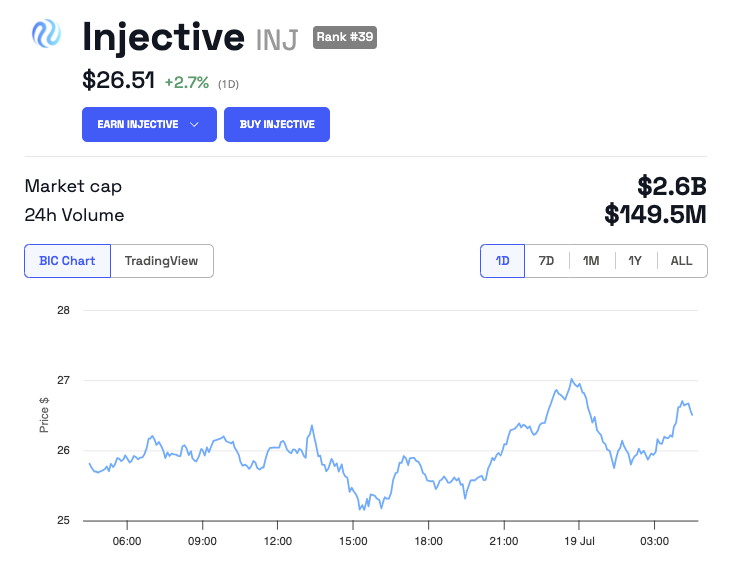

Despite its potential to draw significant institutional interest, the market reaction has been muted. INJ’s price rose just 2.7% in the last 24 hours, now trading at $26.51.

21Shares has also filed for a Solana ETF with the US Securities and Exchange Commission (SEC). Hence, some speculate that the more institution-friendly products like ETPs will lead to an Injective ETF.

“Ok, this is huge. INJ is on the right way. ETF soon,” an X user speculated.

Read more: Solana ETF Explained: What It Is and How It Works

However, it is worth noting that 21Shares has introduced ETPs for over 40 altcoins. Hence, an ETF might not be the immediate next step. As market experts note, issuing a staking ETP in Europe and launching an ETF in the US is a completely different thing. The rules to adhere to are governed by entirely different jurisdictions, so there isn’t a strong link between the two processes.

“Staking products have been available in Europe for years and continue to expand in terms of assets wrapped into yield-bearing products. Obtaining approval in the US will be a slow process, requiring each asset to be evaluated individually. This process will likely begin with Solana, followed by other prominent altcoins that meet the necessary criteria for liquidity, trading volume, and market capitalisation,” Matteo Greco, Research Analyst at Fineqia, told BeInCrypto.