The third Bitcoin halving event, which will see the reward for each newly mined block reduced to just 6.25 BTC, is now less than 100 days away.

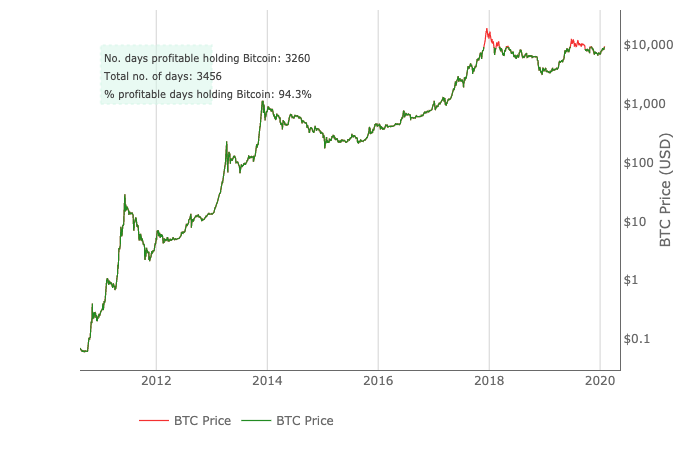

Historically, Bitcoin has witnessed striking growth in the months surrounding earlier block reward halving events and has already gained more than 32 percent in the last month.

Likewise, according to the prominent trader and technical analyst Rekt Capital, Bitcoin rallied 13,378 percent and 12,160 percent, respectively, as a result of its first and second halving events. As such, if Bitcoin achieves similar performance a third time, it could achieve a value between $385,000 and $400,000 in the near future

Should history repeat itself once more, anybody purchasing Bitcoin at its current price of ~$9,200 could be due to turn a serious profit. With that in mind, let’s examine three ways to gain exposure to Bitcoin prior to the halving.

Go Long with Bitcoin Futures

In brief, futures are a type of financial contract known as a derivative. In the case of Bitcoin futures, these contracts track the market value of Bitcoin and allow buyers and sellers to agree on a price and date to later execute a trade with one another, regardless of what the current spot value of Bitcoin is at the time. Because of this, if you think Bitcoin is currently undervalued and is likely to rise in the future, then futures contracts can potentially allow you to buy Bitcoin at lower than the market rate on the expiration date. For example, if Bitcoin increases by 30 percent by the time the contract expires, you will still be sold BTC at the rate specified on the futures contract.

Dollar-Cost Average Your Way In

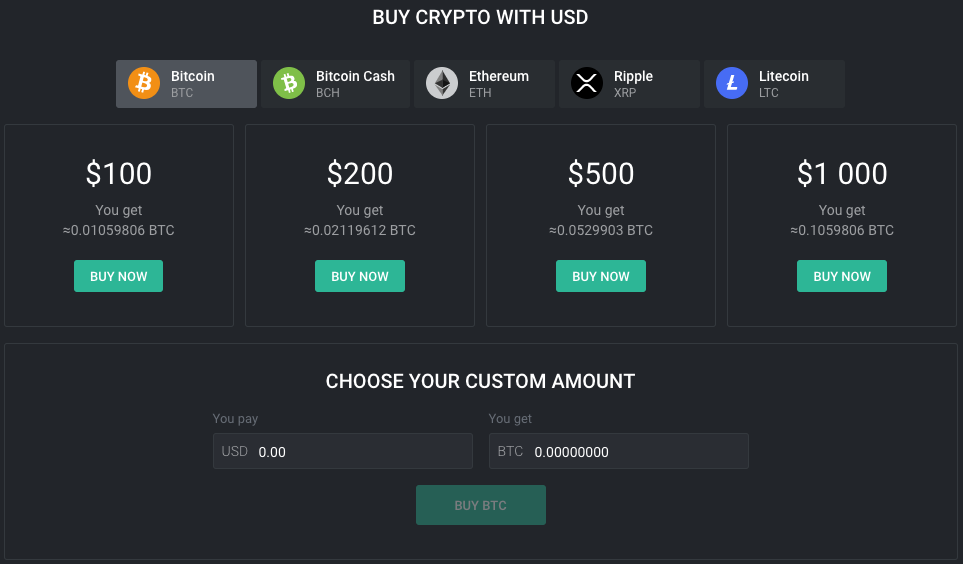

Although it can be tempting to simply invest a large lump sum in Bitcoin before holding for the medium to long-term, doing so can expose you to Bitcoin’s notorious volatility. Instead, if you gradually invest regular sums into Bitcoin, you can avoid the risk of unwittingly investing a large sum when Bitcoin is at a price peak — thereby making it more difficult to see a positive return in investment. As such, making regular investments in Bitcoin allows you to average out your entry price, helping you avoid accidentally buying the top.

Invest in an Index

Oftentimes, investors either have a limited amount of funds to play with or simply lack the time to properly assess the different crypto assets available to invest in. As such, these investors might be tempted to simply go all-in on a single cryptocurrency, hoping that they made the right choice and that their investment will pay off in the long-run. However, as we have seen time and time again, Bitcoin isn’t always the most profitable cryptocurrency. For example, in the last six months, numerous cryptocurrencies, including Ethereum Classic (ETC), Tezos (XTZ) and Cosmos (ATOM) have all performed better than Bitcoin. Because of this, anybody looking to invest in Bitcoin might actually see better returns if this investment is also combined with investments in a variety of other cryptocurrencies.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored