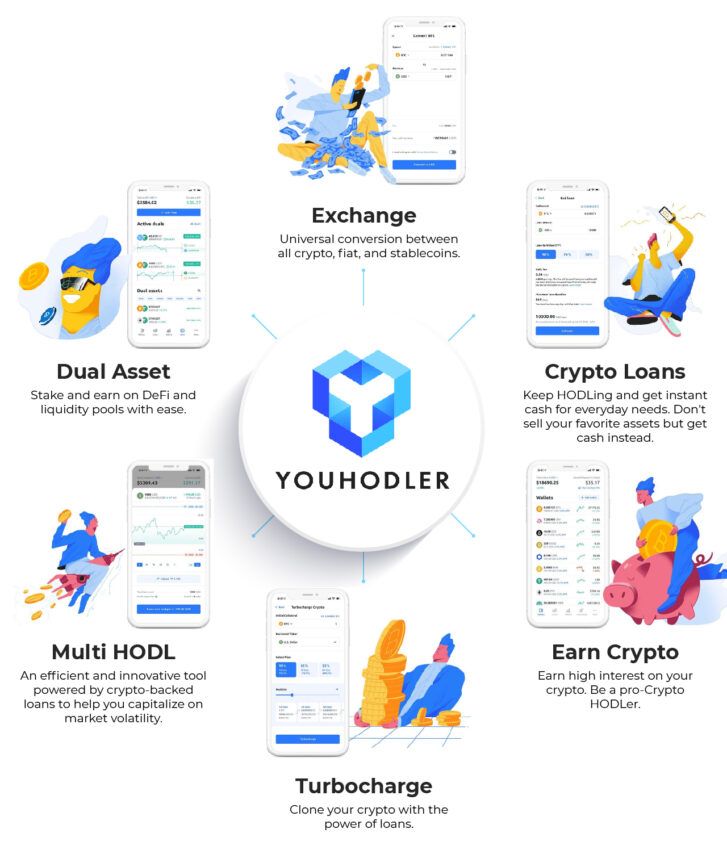

Hailing from Switzerland, YouHodler prides itself as a next-generation fintech platform where users can make the most out of their crypto stash. It is a cryptocurrency exchange and lender where you can buy/sell/exchange crypto and earn interest on crypto deposits. Additionally, you can also take short-term loans by keeping cryptocurrencies as collateral.

Whether you are a hodler keen on earning passive income from your long-term crypto investments or a trader looking for a trading platform with advanced tools, YouHodler promises to always have your back.

YouHodler: An overview

Just because you’re hodling for the long haul doesn’t mean that you can’t use your crypto stash to generate passive income now or manage your immediate financial needs. That is what YouHodler emphasizes while promising users the most competitive interest rates in the market.

YouHodler is a hybrid platform that runs a cryptocurrency exchange alongside a lending program. Additionally, it also offers crypto savings options with high yields.

The crypto loan desk offers loans in several major fiat currencies and cryptocurrencies including stablecoins. Meanwhile, the crypto saving feature, which is basically a new-generation crypto banking platform, offers up to 10.3% yearly interest on crypto savings accounts.

This is lower than what the platform used to offer a few months earlier, but still convincingly beats the interest rates offered by most competitors. (Details below).

YouHodler crypto banking services

Borrow using your crypto as collateral

If you’re in need of cash but don’tii want to sell your crypto, YouHodler’s lending program presents itself as an attractive option to mull over. The lending program lets you borrow cash by keeping your crypto as collateral.

The loan-to-value ratio, or LTV, is comparatively high. For those out of the loop, the LTV of a lending program represents the percentage of the collateral you can borrow. For example, a lending program with an LTV of 70 lets you borrow $70 against $100 worth of collateral.

YouHodler currently offers an LTV of 90, which means if you have a cryptocurrency worth $100, you can borrow $90 against it. Note that this is a secured loan and therefore, no credit checks are required. The approval process is also pretty fast — in fact, almost instantaneous.

You also get the option to borrow in USD, GBP, EUR, CHF, or stablecoins and other cryptocurrency.

Earn interest on your crypto

Hodling is no doubt a reliiable way for long-term investors to navigate the crypto market’s volatility and tap on its long-term potential. With a platform like YouHodler, however, hodling doesn’t mean sitting on a quasi illiquid asset.

That’s because the platform offers you up to 8% annual interest on assets such as BTC, ETH, SOL, DOT, AVAX, and PAXG. And if you hold stablecoins such as (e.g. USDT, USDC, USDP, BUSD, DAI, HUSD, TUSD, and EURS using YouHoderl’s crypto banking services, the annual interest rate goes as high as 10.3%.

Interests compound weekly and we can withdraw funds at any time. It is worth noting here that all interests are paid in the same currency as the one you are holding. For example, if you are holding bitcoin, your interest will be paid in bitcoin (as opposed to fiat or some other cryptocurrency).

Another interesting bit about the platform is that it doesn’t have a native token. That means you could rest assured knowing that there will be no shilling of any over-promising and potentially under-delivering shitcoin.

Trading with YouHodler

For starters, one of the biggest advantages of YouHodler is that it allows you to directly convert any cryptocurrency available on the platform to another. To elaborate, in most conventional crypto exchanges you might have to execute a conversation in two steps. For example, while converting Solana to Cardano, you might have to first exchange SOL to USDT and then buy ADA with that USDT. In YouHodler, however, you can convert SOL straight into ADA.

With YouHodler, you can trade Bitcoin and other cryptocurrencies on up to 50x multiplier.

Multi HODL

Multi HODL is a rewarding but risky service for anyone looking to make hefty profits from market volatility. It is a user-friendly service with fast execution.

Basically, Multi HODL gives you an opportunity to capitalize on market movements. You can use this service to play with your crypto whether the price of a cryptocurrency will increase or decrease (going “long” or “short”).

You can use a multiplier of up to x50 to drastically increase your margin of profit. While YouHodler suggests various methods to manage risks and never use 100% of your funds, keep in mind that trading on leverage will always increase risk levels proportionately.

YouHodler Turbocharge

Turbocharge is a unique feature built on the so-called “cascade of loans” principle. Here, you can clone your collateral to earn sizable profits in case of continuing price growth.

Turbocharge lets you clone your crypto up to eight times with an LTV of 90% (7-day tariff). The platform charges only a flat fee — no rollover fees or other hidden surcharges whatsoever. You can set a “take profit” price and make the most out of a bull run. On the flip side, however, there is an element of risk (as is the case with most high-risk, high-gain investments).

For perspective, let’s assume you put down 0.5 BTC on a 30-day loan at an LTV of 90%. You get a loan of 0.4 BTC, meaning now you have a total of 0.9 BTC.

Now, imagine that the market takes a beating and the BTC price falls 15% over the next few days. This may cause your original BTC to be sold to cover your debt, which means you will be left with fewer BTC than you began with. (Note that this is an over-simplistic explanation of the risk associated with Turbocharge). YouHodler lets you Turbocharge your loan anywhere between 3-10 times.

YouHodler Dual Assets

The Dual Asset service is a simple way to stake crypto or stablecoins and earn high-interest rates. It’s a multi-faceted, “win-win” solution for users that want to participate in liquidity pools and swap protocols without the complexity of advanced DeFi platforms. The result is an easy-to-use crypto wealth management product for everybody with returns as high as 365% APR.

It’s a brand new service of the platform which was released a few days ago. As the name suggests, Dual Assets involve linking two assets – one cryptocurrency asset and one stablecoin. This gives the user and the market a chance to earn a larger yield based on predicting an asset’s future growth potential.

To earn similar yield percentages on DeFi protocols, one must overcome several steps. For example, you need to create a Metamask wallet, remember your seed phrase, buy your crypto on another exchange, deposit that crypto to Metamask, connect your Metamask wallet to a liquidity pool or DeFi protocol, and confirm you made no mistakes in the process and then start generating yield.

With YouHodler’s Dual Assets, you simply need to deposit crypto to your YouHodler wallets and open a deal using the Dual Assets feature. It’s that simple and the returns are similar. It’s like DeFi but simple and fast.

YouHodler fees and withdrawals

YouHodler assures that it never locks funds and users are free to withdraw at any time. This is indeed a big step towards instilling confidence among its growing user-base

The fees are generally competitive in comparison to other popular crypto exchanges. The pricing structure is relatively straightforward and transparent. Here are a few commonly encountered fees:

- Bank wire withdrawals: EUR (SEPA) – 5 EUR, USD (SWIFT) – 1.5% (min 70 USD)

- Loan Close now fee: 1%

- Reopen Loan: Interest fee + 1% service fee

- Increasing collateral and loan-to-value ratios: 1.5%

Fees levied from fiat-to-crypto conversions and cryptocurrency trading varies depending on the type of the transaction. For example, the fiat-to-bitcoin conversion fee is to the tune of 0.5%. However, if you want to convert BTC to ETH, then the fee will also be in BTC and may vary depending on the BTC price at the time.

The minimum withdrawal limit is $5-$50 for cryptocurrencies (including stablecoins).

Click here to find the details surrounding YouHolder fees.

YouHodler customer support

YouHodler prised itself on its “award-winning” customer service. And from the looks of it, they’re not far off from facts given that the platform seems to draw largely positive feedback from users online.

The website has a lot of learning materials and answers from the YouHodler team on most issues. There is also a chatbot on the Help section of the website just in case you’re unable to find something specific in the tutorials. And if that doesn’t work too, you could always reach out to a customer support agent via online chat or email and get a callback in 2 minutes.

For those interested, here are a few interesting facts about YouHodler’s growing user base.

For more details and regular updates, follow YouHodler on social media:

Twitter | Telegram | Facebook | Instagram | YouTube

Disclaimer

In compliance with the Trust Project guidelines, this guest expert article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.