Yearn Finance’s YFI token fell by more than 40% within the last 24 hours, resulting in a significant liquidation of approximately $5 million. The sudden price decline led to speculation of whether suspicious things were happening to the protocol.

Data from BeInCrypto shows that Yearn Finance’s price fell sharply from $14,519 to $8,915 within a few hours. But, YFI has recovered to over $9,000 as of press time.

YFI’s Market Cap Free Falls

The sudden sell-off resulted in Yearn Finance’s market cap dropping by approximately $200 million, from $482 million to $296 million.

Meanwhile, Coinglass data indicates that crypto traders who held positions in YFI were liquidated roughly $5 million during this period, comprising $3.5 million from long positions and $1.42 million from short positions.

Additionally, the DeFi token saw a 26% increase in its derivatives trading volume to around $2 billion and a surge in open interest to about $162.54 million. Notably, major exchanges, including Binance, have seen significant declines in YFI token open interest positions alongside the liquidations.

Read more: Identify & Explore Risk on DeFi Lending Protocols

The sell-offs also resulted in the total value of assets locked in the project dropping by around $6 million to $329.5 million, according to data from DeFiLlama.

Why Did Yearn Finance Crash?

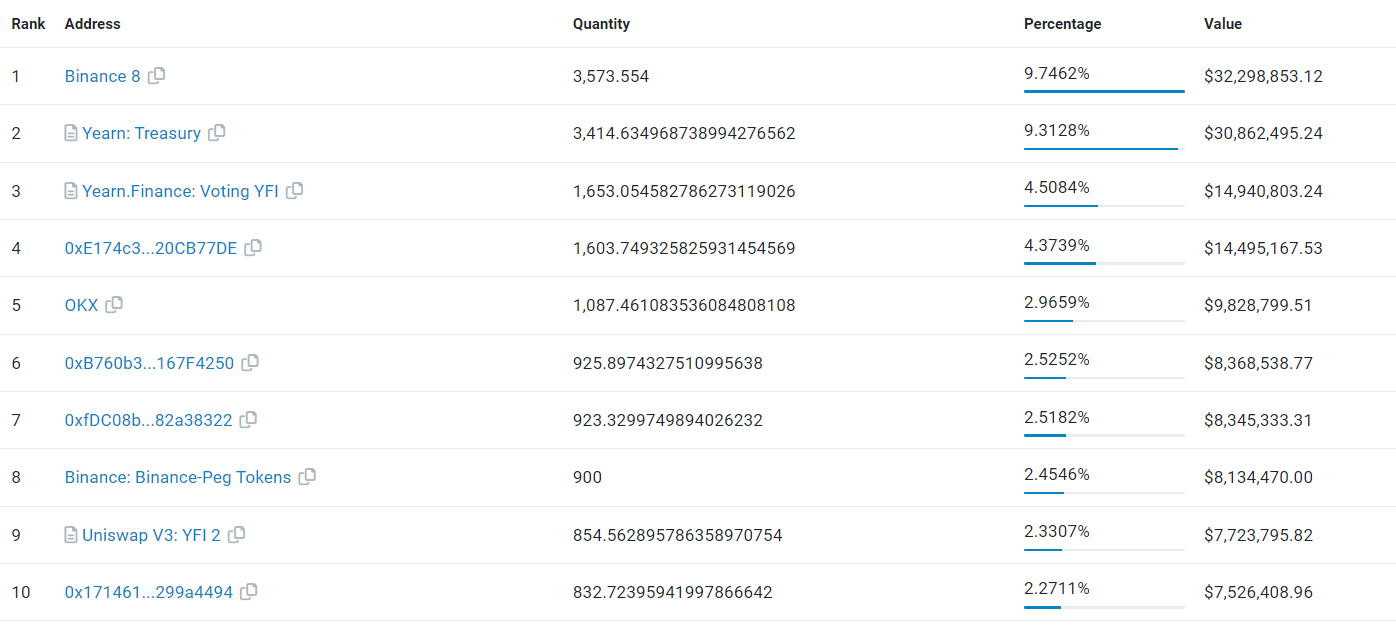

Observers have suggested that the project insiders caused the selling pressure, as nearly half of YFI’s supply is held in 10 wallets.

Crypto trader Skew described the YFI’s price movement as a “pretty deliberate rug.”

“Prior to the rug, fairly obvious spot was being sold into price as well significant short exposure. Most of that short OI closed out here which halted the sell off ~ $8500,” the trader stated.

Read more: How To Evaluate Cryptocurrencies with On-chain & Fundamental Analysis

Furthermore, on-chain analyst LookOnchain reported a significant whale transfer involving a wallet, “0x48f9,” moving 446 YFI worth roughly $5.8 million, most of which was deposited into exchanges. Despite this withdrawal, LookOnchain noted that a whale profited from the transactions before the crash.

This issue is coming on the heels of the project’s domain registrar issues in September. At the time, the DeFi protocol users could not access the protocol through Yearn.fi URL. However, the issue was subsequently corrected.

Yearn Finance is one of the largest DeFi protocols within the ecosystem. At its 2021 peak, the protocol had a TVL of more than $7 billion.