XRP price has moved just 2% over the last seven days, struggling to sustain levels above $2.50 in recent days. Its market cap has now fallen to $140 billion, and its trading volume is up 47% in the last 24 hours, reaching $5.6 billion.

While the Chaikin Money Flow (CMF) has turned positive, signaling increased buying pressure, network activity has declined. Meanwhile, XRP’s EMA lines still indicate a bearish setup, with price trading in a key range that could determine whether it rebounds toward $3 or faces a 26% correction.

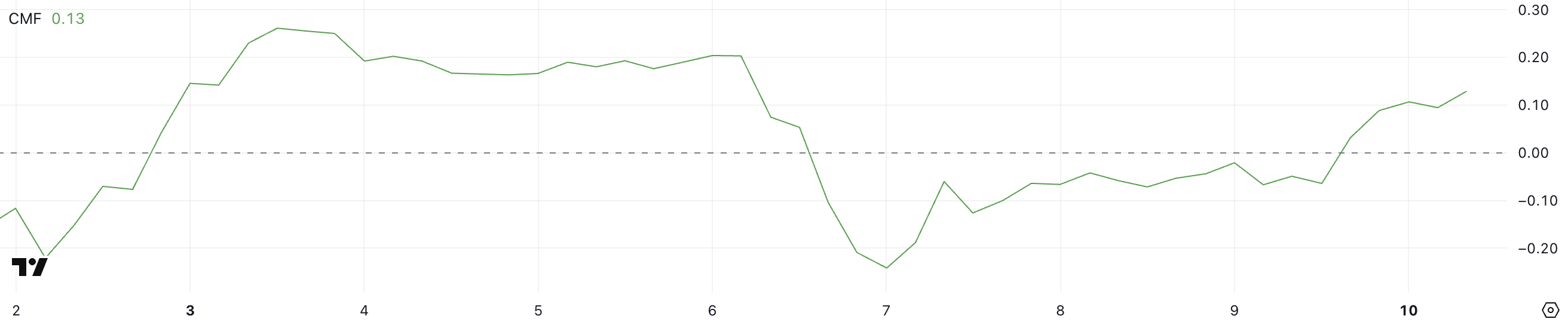

XRP CMF Is Increasing Fast

XRP Chaikin Money Flow (CMF) is currently at 0.13, a sharp rise from -0.06 just one day ago. This shift marks a return to positive territory after remaining negative for three consecutive days, indicating increased buying pressure.

A move from negative to positive suggests that more money is flowing into XRP rather than out, potentially signaling renewed interest from buyers.

The CMF measures the volume-weighted flow of money into or out of an asset, ranging from -1 to 1. Values above 0 indicate accumulation, while negative values suggest distribution.

With XRP CMF now at 0.13, buying pressure has returned, which could support further price stability or even upward movement if sustained. However, if CMF fails to hold above zero, selling pressure could resume, weakening bullish momentum.

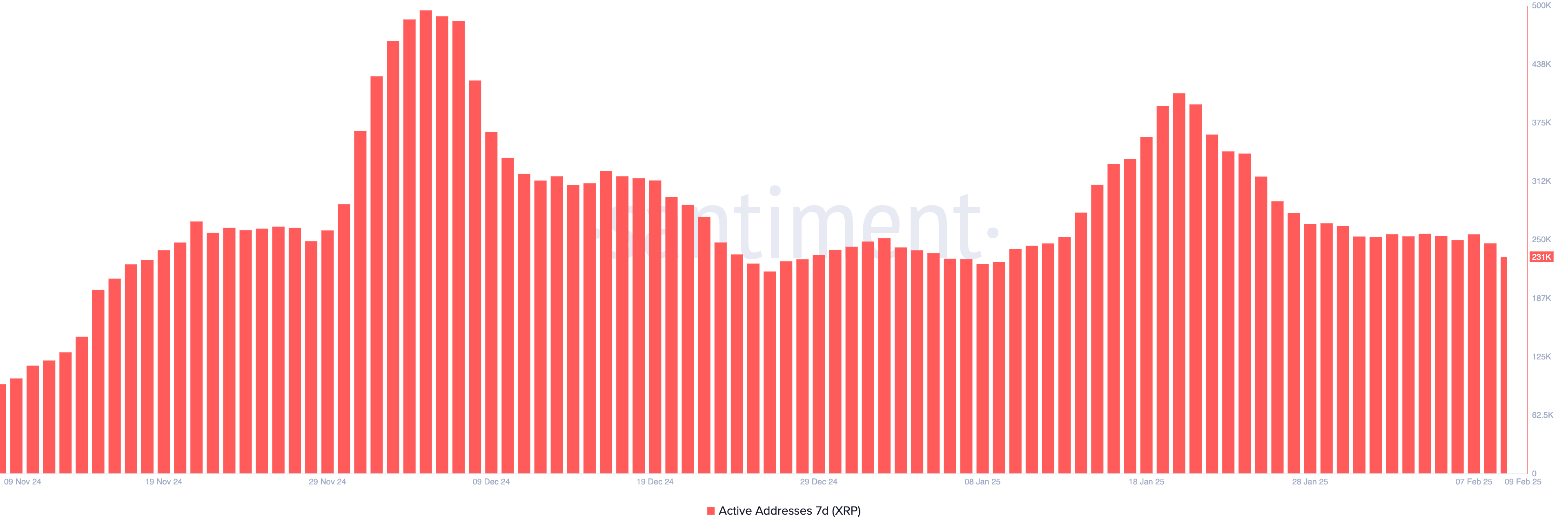

XRP Active Addresses Just Hit a Month-Low

XRP’s 7-day active addresses recently peaked at 495,000 on December 5, 2024, before declining. Another surge occurred in mid-January 2025, reaching 407,000 on January 20, but activity has steadily decreased since then.

The metric is currently at 231,000, marking its lowest point in a month. This decline suggests a slowdown in network engagement, which could have implications for price movement.

Tracking active addresses is crucial because it reflects user participation and overall demand for the asset. A sustained drop in active addresses often indicates reduced transaction activity, which can lead to lower liquidity and weaker buying pressure.

With XRP active addresses now at a monthly low, it suggests waning interest, potentially limiting price growth unless activity picks up again.

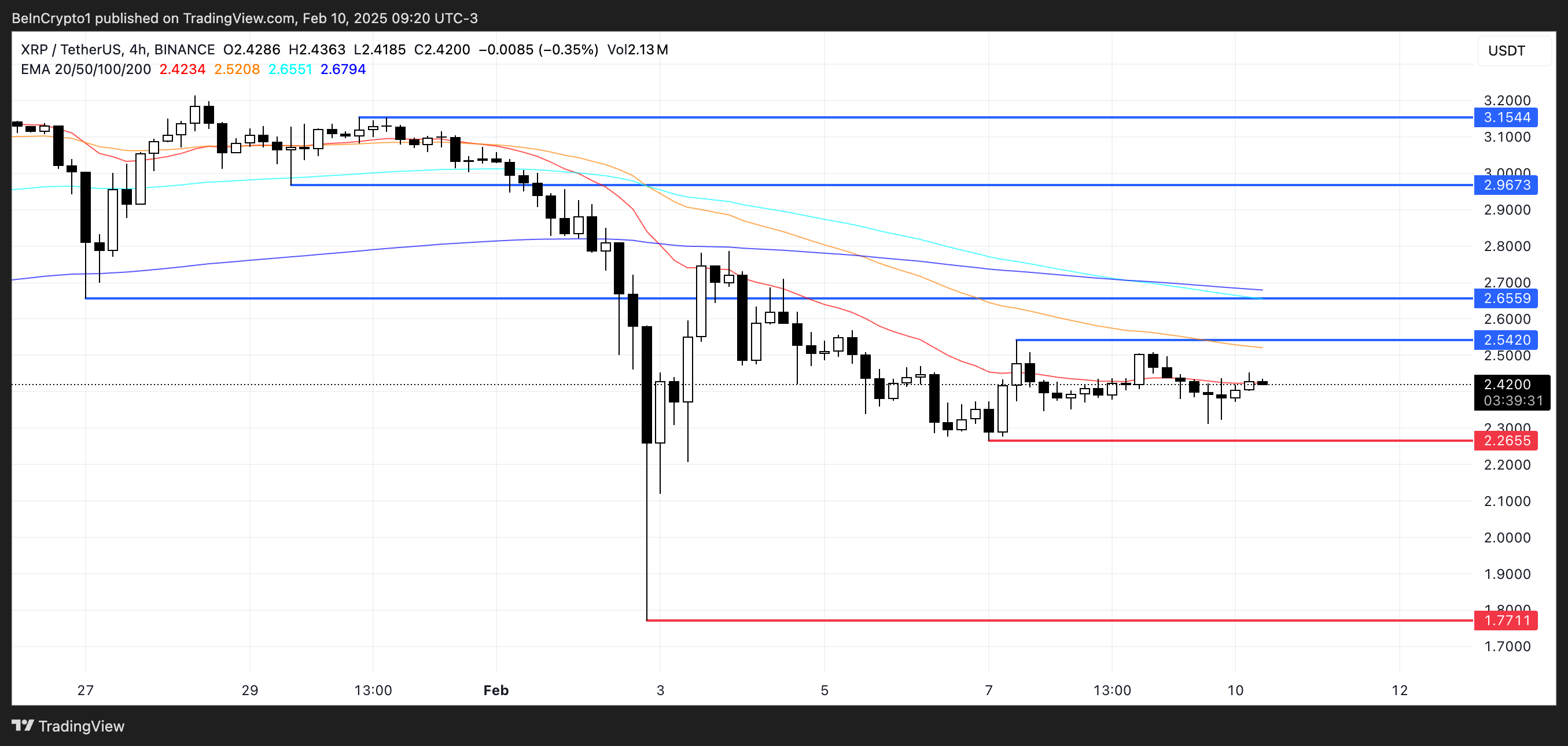

XRP Price Prediction: Will XRP Correct By 26% In February?

XRP’s EMA lines continue to show a bearish setup, with short-term moving averages positioned below long-term ones. Price is currently trading between a support level at $2.26 and a resistance at $2.54, indicating a critical range.

If bearish momentum increases and the $2.26 support fails, XRP price could see a significant drop toward $1.77, representing a potential 26% correction.

However, if buying pressure strengthens and an uptrend emerges, XRP price could push toward the $2.54 resistance. A breakout above that level could open the door for a test of $2.65. If momentum continues, XRP may even challenge $2.96.

Increased network activity would further support bullish momentum, as well as XRP ETF getting finally approved, potentially allowing XRP to break above $3 and test the next major resistance at $3.15.