XRP price charted a 15% uptick from the $0.45 level over the past week. Ripple has picked up the pace and is now oscillating near the $0.53 mark at press time.

As a new week began, XRP price was among the top gainers on the daily as well as weekly charts, rallying 21.40% over the past 7 days and outperforming BTC price. Despite macro fears regarding Federal Reserve policies, optimism stemming from the SEC vs Ripple case provided much-needed relief to the XRP price.

Renewed hopes for the XRP price

Sunday saw the XRP price rise by 3.8% to an intraday high of $0.540, as the sixth-largest cryptocurrency by market cap witnessed higher social volumes. At press time, Ripple XRP price was trading at $0.534, up 4.23% on the daily chart.

Nonetheless, a strong positive sentiment was missing from the scene, indicative of the pullback seen in the weighted social sentiment due to XRP news.

From a technical point of view, XRP price daily RSI was in the overbought region, indicative of higher buying pressure from retail traders. However, mellowed-down trade volumes presented some skepticism among buyers as social euphoria still lacked.

Furthermore, the funding rate heading into the positive territory indicates a bullish bias in the futures market, showing higher hopes for the XRP price in the near future.

Is the Ripple price bottom in?

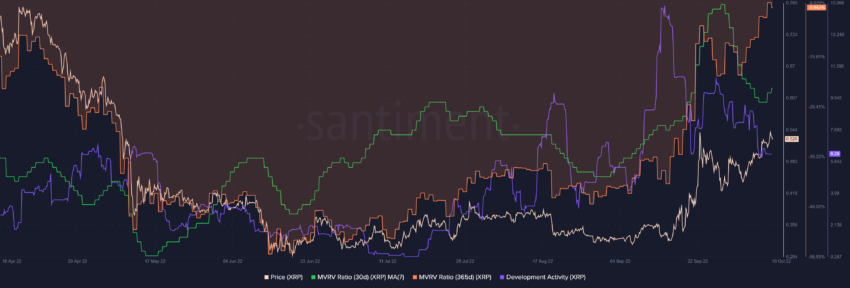

While XRP’s trajectory seemed to be gaining momentum from a price perspective, the MVRV ratio (365d) made a local high, showing an increased supply relative to realized value (cost basis). Higher MVRV values indicate a larger degree of unrealized profit in the market and increase the probability that investors will sell coins to lock in profits.

While MVRV lows made on the short-term and long-term show that the $0.31 level has acted as a local bottom, it still cannot be concluded that XRP’s long-term bottom is in.

Additionally, Ripple is seeing dwindling development activity after making a peak in mid-September.

In the near term, owing to the high social anticipation and its bullish price trajectory, a continuing uptrend is likely.

The next crucial resistance for the XRP price is found at the $0.60 mark and will be eyed by bulls in the short term. However, an invalidation and pullback phase at this level could still occur.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.