Ripple XRP’s $0.50 support gave way on April 20 as the bears forced a downswing to $0.47. But declining NVT ratio and resilient whales give hope of an imminent rebound. Can the XRP price rally surpass $0.60?

Following industry-wide retracement, XRP slumped 12%, losing the $0.50 support level for the first time in April 2023. However, the on-chain fundamentals suggest that the bearish downswing could be shortlived.

XRP is Undervalued at Current Prices

The Network Value to Transaction Volume ratio indicates that XRP may be undervalued at current prices. NVT ratio evaluates an asset’s fundamental value by comparing the market capitalization growth to the transaction volumes.

The red line in the chart below shows that the XRP NVT ratio has been trending downward since the start of the week. Between April 15 and April 21, it dropped 80% from 355.87 to 79.85.

NVT ratio is an important tool for investors to evaluate the fundamental value of a cryptocurrency and assess its growth potential. When it declines considerably, it could indicate a high adoption rate growth compared to the current volume of transactional activity.

Currently, the low values of the XRP NVT ratio imply that the coin is undervalued. And strategic investors will likely interpret this as perfect timing to buy.

XRP Whales Are Standing Firm With 8 Billion Coins

Crypto Whales that hold between 100,000 to 100 million XRP have maintained their support despite the recent volatility in the altcoin markets.

Santiment’s on-chain data shows that the whale cohort has maintained cumulative wallet balances above 8 billion XRP coins since late March.

Looking at the chart below, their current aggregate balance of 8.07 billion coins is a 250 million increase from the 7.82 billion XRP recorded on March 24.

The newly-added 250 million coins are worth nearly $120 million at current market value. If the whales maintain their optimistic outlook in the coming days, XRP will likely hold the $0.45 support.

XRP Price Prediction: The Bulls Can Hold the $0.45 Support Level

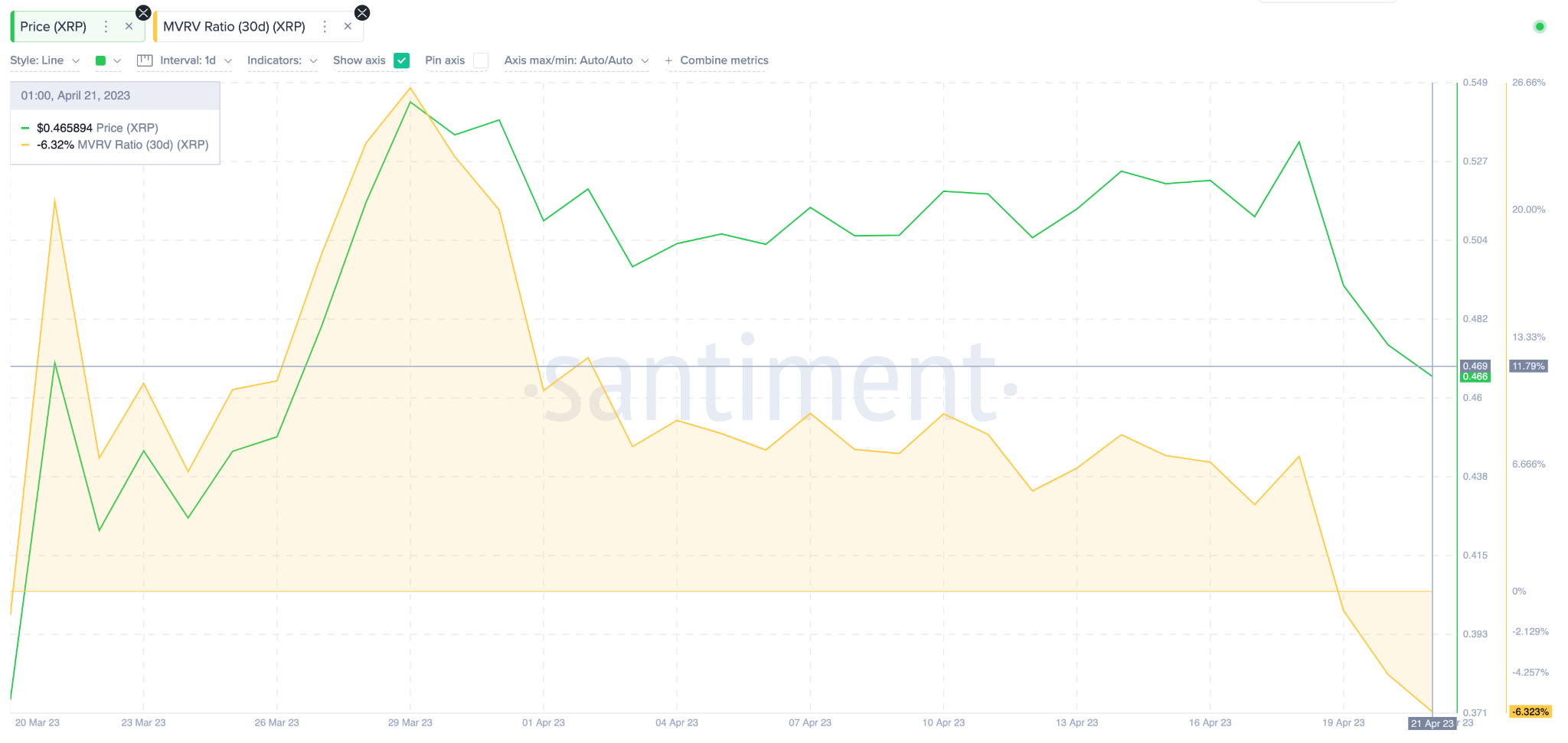

Over the past week, Bullish XRP holders have defended the $0.45 support level. According to Santiment’s Market-Value to Realized-Value (MVRV) data, a price rebound may be imminent.

Currently, most XRP holders who purchased within the last 30 days are 6% underwater. Historical data suggest they will likely stop selling at this zone to prevent further losses. If that happens, the price could rebound 13% toward $0.52 before Ripple investors start selling.

And If XRP manages to break through this resistance level, the bulls may drive the rally toward the $0.60 zone before book profits.

Still, the bears could turn the tide in their favor if the XRP price drops below $0.45. Nevertheless, some investors who wish to keep their losses below the 10% range may offer support at this level.

Should the $0.45 support level fail, XRP could decline toward the 18% loss range at $0.39. But in this case, some holders may cut their losses, inadvertently triggering a rebound.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.