Chiliz (CHZ) price crashed 8% on April 20 despite a series of token burns across the Socios fan token ecosystem. Bearish concerns are growing as Chiliz holders pile on sell-pressure on exchanges. Can CHZ hold the $0.12 support level?

Chiliz (CHZ) is the native token of the Chiliz blockchain that powers the Socios sports fan token ecosystem. The team announced token burns on a series of fan tokens on April 18 and 19. The company also announced its upcoming launch of its own sports blockchain scheduled for May. Yet, on April 20, the CHZ price crashed 8%, sparking bearish concerns among investors.

A deeper dive into the underlying on-chain data shows that CHZ could experience more downside in the coming days.

Chilliz Holders Are Flooding the Market

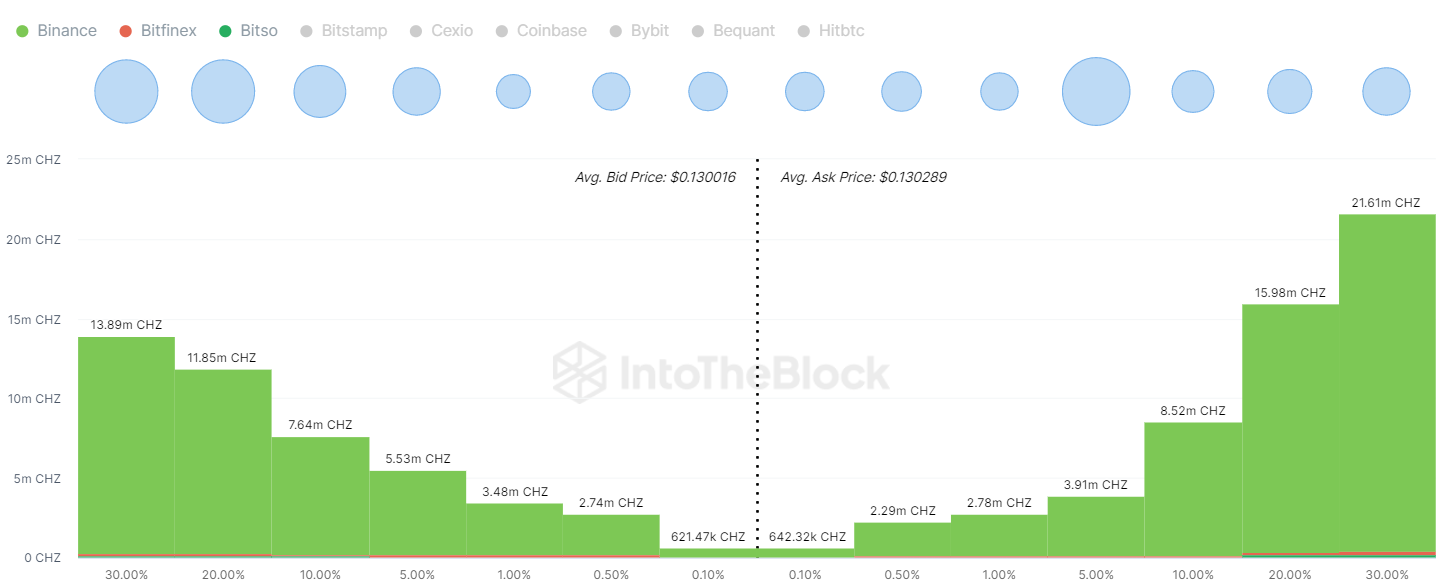

Looking at the market orders currently placed by CHZ holders across top crypto exchanges, it appears that supply critically exceeds demand. The aggregate data provided by IntoTheBlock below shows that bearish traders have offered 56 million CHZ, while there are only 45 million CHZ buy orders.

When the supply of an asset outpaces demand, it typically creates downward pressure on the price. Hence, Chiliz’ demand short-fall of 11 million tokens provides considerable wiggle room for buyers to drive a hard bargain and push down the price.

CHZ Could Struggle to Find New Demand

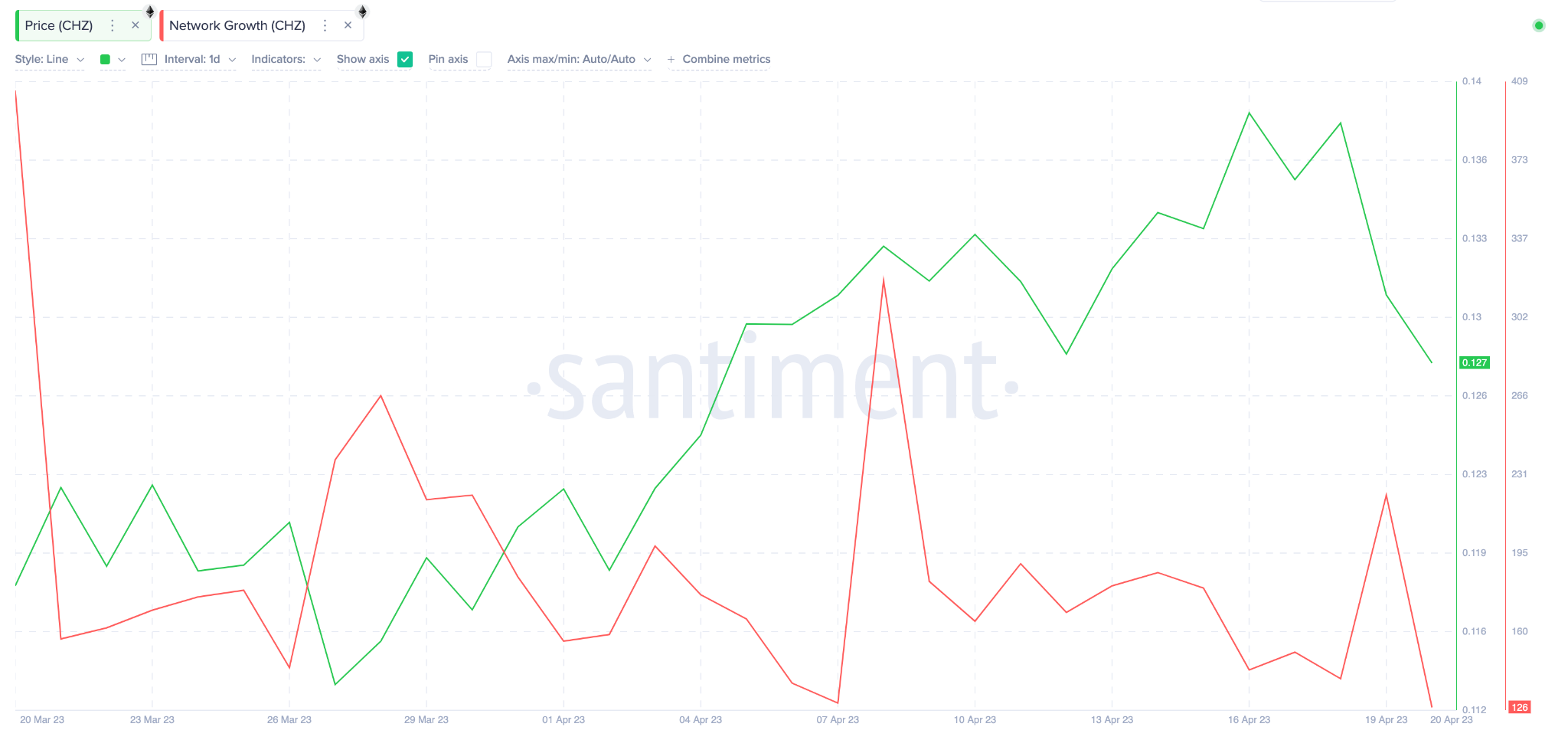

The number of new investors joining the Chiliz ecosystem has dwindled considerably in recent weeks. The Chiliz Network growth, according to data compiled by Santiment, shows a decline of 60% between April 5 and April 20.

The red line in the chart below depicts how the number of daily new CHZ wallet addresses dropped from 319 to 126 by Apr 20.

Slowing Network Growth implies that the Chiliz ecosystem is losing traction. And if the trend continues, CHZ may struggle to find new demand to propel the price out of the current slump.

CHZ Price Prediction: A Drop Below $0.08 Looms

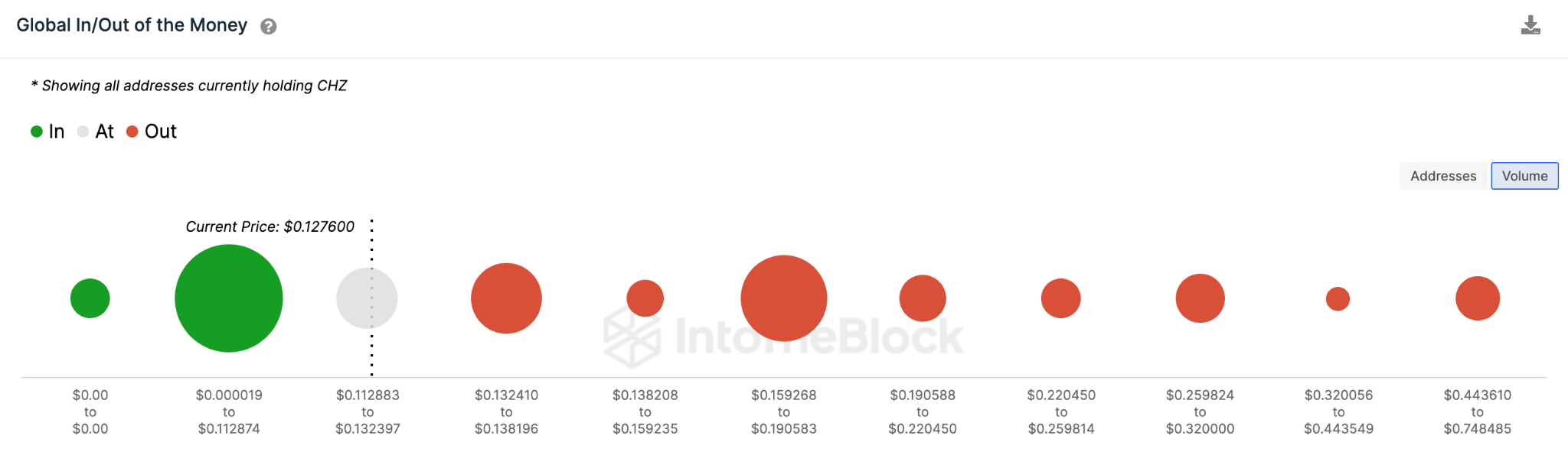

With bearish sentiment surrounding the Chiliz ecosystem, CHZ looks set to lose its current support level at $0.12. Although, IntoTheBlock’s Global In/Out of Money data shows 9,000 addresses that bought 745 million coins around that price could attempt to prevent the drop.

If the support does not hold, the next resistance zone is at $0.08. At that average price point, a cluster of nearly 11,000 addresses holding 3.57 billion coin, equivalent to $462 million. The cluster represents a huge level of resistance around $0.08 and would need to face huge selling pressure to break down the price further.

Still, the market could turn green if CHZ can cross the $0.13 zone. But as seen above, a sell-off from a cluster of 9,000 addresses that bought 745 million coins here could halt the rally.

But if the token is able to break above that level, Chiliz price could rise above $0.14 before hitting a more significant sell-wall.

Furthermore, the in the money metric indicates only 12.58% of CHZ holders are in profit. While a staggering 79.25% remain out of the money, or at a loss with the current price.

Only 8.17% remain in the break even zone.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.