Recent hits to the crypto markets have caused many holders to lose confidence in this digital asset class. Many factors contribute to this decline in trust. Such as market volatility, fraud, scams, crypto exchanges’ bankruptcy, hacking incidents, and regulatory and environmental concerns.

Cryptocurrencies have been making headlines for years, with many people considering the asset class as the future of finance. However, recent hits to the cryptocurrency markets have bred disillusionment in this digital asset class. Various factors fuel the loss of trust.

One of the most important factors affecting the value of cryptocurrencies is market volatility. Cryptocurrency markets are notoriously volatile, with prices fluctuating rapidly in response to news events, regulatory changes, and investor sentiment. This volatility can be incredibly challenging for investors unfamiliar with the crypto market’s intricacies, leading them to panic sell and incur severe losses.

The regulatory landscape surrounding cryptocurrencies is also a factor in dwindling confidence. Governments and regulators worldwide have been increasingly scrutinizing the cryptocurrency industry, and many have expressed concerns about its potential for money laundering and other illegal activities. The lack of clear guidelines has left many investors needing clarification about the future of cryptocurrencies.

Taking Hits From All Sides

The bankruptcy of cryptocurrency exchanges and hacking incidents have also contributed to falling confidence in the market. Several prominent exchanges have gone bankrupt recently, resulting in huge investor losses. Hacking incidents have also increased, with hackers targeting individual investors and exchanges to steal funds. These incidents have bred distrust of the security of cryptocurrency investments.

Moreover, environmental concerns have also caused investors to lose faith in cryptocurrencies. The mining of cryptocurrencies requires a significant amount of computing power, which in turn requires much energy. The vast amount of energy needed has led to concerns about the environmental impact of cryptocurrencies, especially with climate change a growing global concern.

Social media has played a role in shaping public perception of cryptocurrencies. Platforms like Twitter and Reddit have been used to spread both positive and negative news about cryptocurrencies, with some people using these platforms to manipulate the market. This has led to concerns about the accuracy of the information on social media, further contributing to a loss of confidence in cryptocurrency markets.

Losing All

Another factor is the prevalence of fraud and scams. While cryptocurrencies are not inherently fraudulent, the lack of regulation and oversight has led to increased fraudulent activities related to cryptocurrencies.

Scams like phishing attacks, fake ICOs, and Ponzi schemes have duped many investors, resulting in a loss of trust in the cryptocurrency market. Recently, a Hong Kong-based investor lost her entire savings, worth nearly HK$7 million. It is reported that she fell victim to an online cryptocurrency investment scam. Many scenarios involving such illicit activities have come to light.

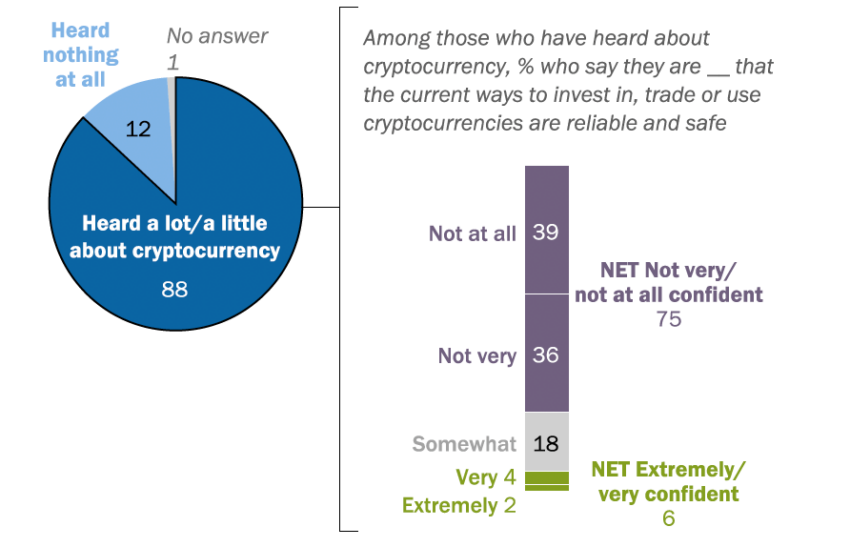

Several scenarios have crippled investors’ morale regarding crypto-related activities. A Pew Research Center study shared with BeInCrypto highlighted one dimension of the issue. The report revealed that the majority of Americans lack confidence in the safety and reliability of cryptocurrency.

“Among the vast majority of Americans who say they have heard at least a little about cryptocurrency (88%), three-quarters say they are not confident that current ways to invest in, trade or use cryptocurrencies are reliable and safe,” the report stated.

Surprisingly, just 2% of the American participants are “extremely confident” when dealing with cryptocurrencies, while 4% are “very confident.” The survey also found significant differences in confidence levels among different demographic groups. Men were more likely to express confidence in cryptocurrency than women, with 28% of men feeling very confident compared to only 11% of women.

Similarly, younger Americans were more likely to express confidence in cryptocurrency, with 27% of those under 30 feeling very confident, compared to only 11% of those over 65.

Crypto Investments Hurt Portfolios

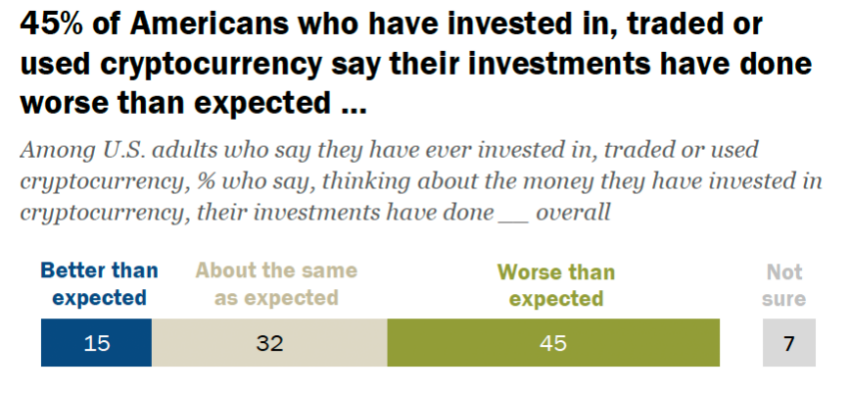

Additionally, a significant chunk of respondents (45%) asserted that crypto investments have performed worse than expected.

The statistic doesn’t come as a surprise, given that the crypto market value has dropped significantly. Nonetheless, diversifying the portfolio can certainly help minimize the losses. For instance, allocating no more than 5% of total savings to crypto is a conservative approach. While cryptocurrency has the potential for high returns, it is also a highly volatile and risky asset class.

Investors should consider their risk tolerance, investment goals, and financial situation before deciding on an allocation to cryptocurrency. It is vital to have a diversified portfolio that includes different asset classes, such as stocks, bonds, real estate, and cryptocurrency. However, it is worth noting that cryptocurrencies are still a new and evolving asset class, and how these challenges will be addressed over time remains to be seen.

As such, investors must conduct their research and approach cryptocurrency investments cautiously.

Restoring Confidence and Faith

Restoring confidence in the safety and reliability of cryptocurrency investments can be challenging, but several steps can be taken to address this issue:

- Regulation: One of the biggest challenges with cryptocurrencies is the need for more regulation. Governments and regulatory bodies should collaborate to build a regulatory framework to protect investors and prevent fraud.

- Security: Another of the biggest concerns is security. Investors must feel confident that their investments are safe from theft and hacking. Companies that provide cryptocurrency wallets and exchanges should prioritize safety and implement best practices to protect users’ assets.

- Education: There still needs to be more understanding of how cryptocurrencies work and how to invest in them. Investors should be provided with clear information about the risks and benefits of investing in cryptocurrencies and guidance on how to store and trade their assets safely.

- Transparency: Companies that issue cryptocurrencies should be transparent about their operations and financials. This can include publishing regular reports on the state of their assets and disclosing any potential conflicts of interest.

- Community: Building a solid community around cryptocurrencies can help to restore confidence in their safety and reliability. Investors can connect with others who share their interests and concerns, share information and resources, and work together to hold companies accountable.

Overall, restoring confidence in the safety and reliability of cryptocurrency investments will require a collaborative effort from governments, companies, and investors.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.