An unnamed XRP exchange operator, identified as Mr. A, received an eight-year prison sentence. He was convicted of embezzling approximately 4.6 billion Korean won (around $3.3 million).

This decision highlights South Korea’s stringent approach to crypto fraud, reflecting the growing legal scrutiny in the sector.

How XRP Exchange Operator Cheated South Korean Citizens

According to a local outlet, Mr. A had been a central figure in the South Korean crypto market since 2015. He has been exploiting his role to defraud investors by promising to purchase Ripple’s XRP tokens at below-market rates.

In 2015, Mr. A convinced an investor, Mr. B, to give him 200 million won (approximately $145,947), promising XRP acquisitions at about 20% below the going rate. Furthermore, in 2017, he misled another investor, Mr. C, by taking 2.35 million XRP and pledging a high return that was never realized.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Additionally, Mr. A engaged in more direct theft. He acquired the crypto wallet information of another victim, Mr. D, under false pretenses. Subsequently, he swapped Mr. D’s 4 million XRP for Bitcoin and transferred these to a Bitcoin account under his son’s name, culminating in losses valued at 3.5 billion won (about $2.5 million).

The appellate court’s decision to reduce Mr. A’s sentence from the initial 12 years reflects his partial repayment to one of the victims. However, the presiding judge stressed the severity of Mr. A’s actions and his apparent disregard for legal consequences.

“The defended has shown no signs of remorse. He has also shown serious disregard for the law, so he needs to be punished severely,” the Judge said.

Moreover, Mr. A attempted to manipulate the judicial process. He requested sentencing postponements and sought additional time to compensate victims, only to use these opportunities to flee from justice. His recapture after two years marked the end of his evasion efforts.

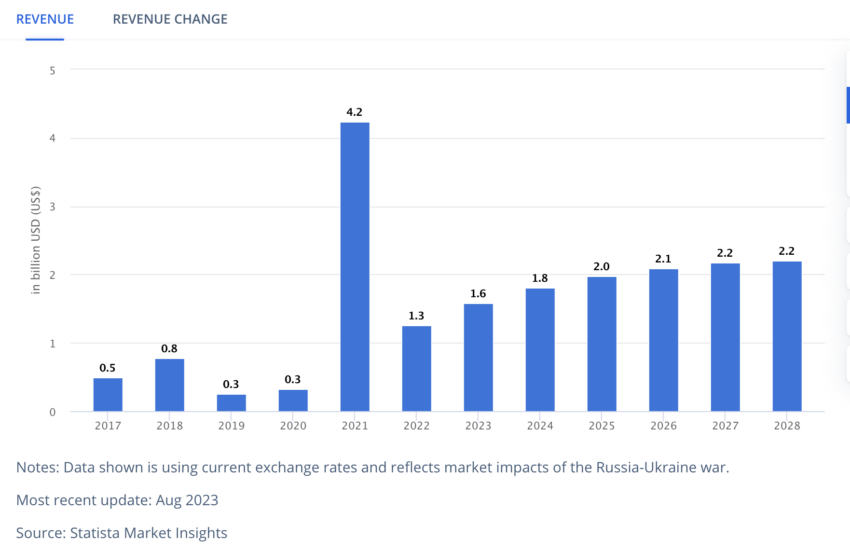

This case occurs within a broader context of rising crypto market activities in South Korea, projected to generate $2.2 billion in revenue by 2028.

As the market expands, so does the incidence of crypto-related crimes, prompting a robust regulatory response. In April 2024, in response to the increasing complexities of virtual asset crimes, South Korea announced the establishment of a new investigative unit.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This specialized team, stationed at the Seoul Southern District Prosecutors’ Office, includes experts from prosecution, finance, and intelligence sectors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.