The global crypto market has demonstrated a sharp bearish reversal with most altcoins including Decentraland (MANA) trading in red.

MANA charted a multi-week high of $0.74 on Nov. 5, but weekend gains reversed as bears took control of price action. Nonetheless, MANA on-chain health presented a skeptical picture with few metrics spelling trouble for Decentraland prices.

Why MANA Price Can Continue to Dump

On Nov. 8, MANA traded at $0.6223 showing over 6% daily losses. While the recent price pullback was largely due to the larger market’s bearish trajectory, the same had significantly affected MANA recent gains.

Decentraland price charted a solid 15% run over the weekend, recovering from the end of Sept. and Oct. losses.

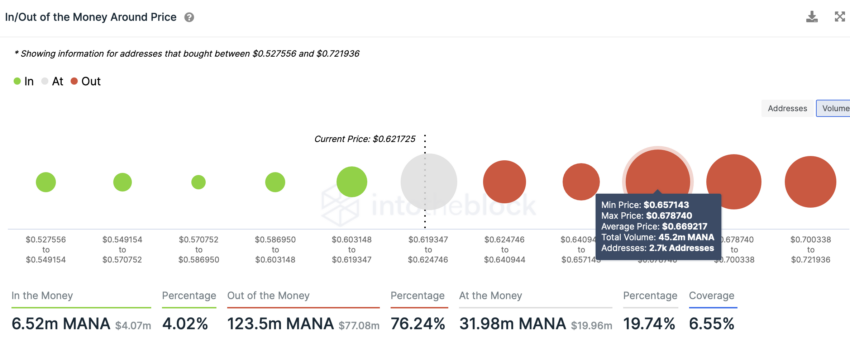

Decentraland price saw a major resistance at the $0.70 mark. Notably, data from IntoTheBlock’s In and Out of Money Around Price (IOMAP) Indicator presented that the next significant resistance for MANA price could be at the $0.66 mark where 45.20 million MANA tokens are held by 2700 addresses.

For now, though, a worrying fact was that there was no major support for MANA price once prices fell below the $0.61 level.

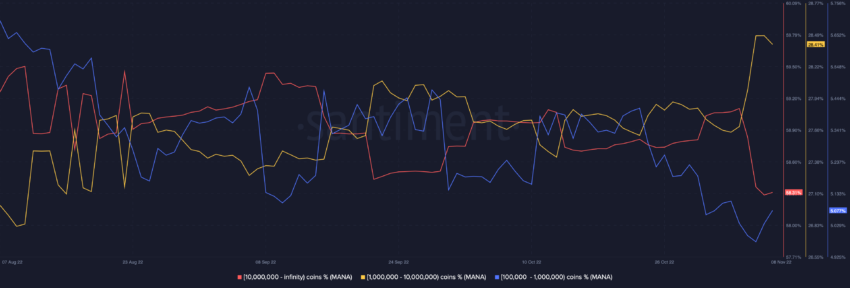

In addition to that, a look at supply held by balance of addresses suggested that two of MANA biggest whale cohorts holding 100,000 – 1 million coins (%) and 10 million to infinite coins (%) are reducing their holdings.

MANA holders with 100,000 – 1 million coins (%) now held just 5% of the supply as opposed to 5.5% in August. Holders with 10 million to infinite coins (%) also reduced their bags over the last week. Both the whale cohorts have been reducing their holdings.

While whales with 1 million – 10 million coins (%) accumulated from Nov. 4 to Nov. 7 there was a slight drop in their holding on Nov. 8.

Despite whales reducing their bags, there were a few metrics that suggested a MANA recovery could be swift in case bulls decide to take the wheel.

Can New Participants Save Decentraland?

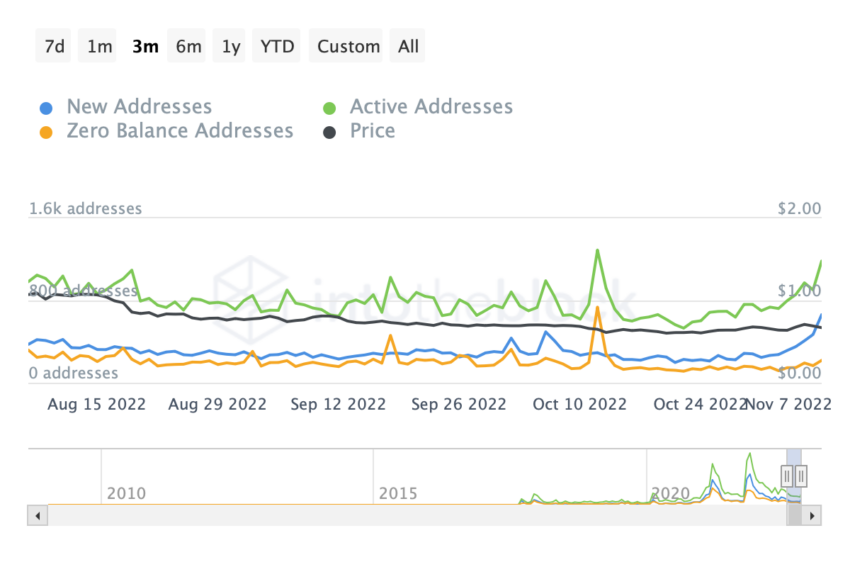

One of the most bullish trends for Decentraland price over the last week was that seven-day new addresses spiked by almost 169.11%. Active addresses also saw a healthy 68.9% uptick over the last week.

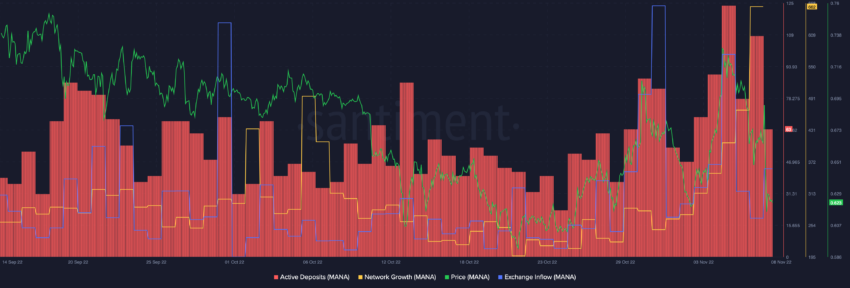

New participants flocking to a network is often considered a bullish trend and helps in price recovery. However, MANA’s exchange inflows and active deposits noted a major spike pointing towards a bearish sentiment for Decentraland among traders and investors.

When active deposits spike alongside exchange inflows the same can point towards major sell-offs. While MANA network growth has shown one of the most notable upticks seen to date, with bears taking over the market, there isn’t much network growth can offer in terms of price appreciation.

For bulls, it will be crucial to keep prices above the $0.61 level, since IOMAP Indicator suggested no major support for the token below the price. However, in case the bearish invalidation a retest of the upper $0.70 mark can be expected.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.