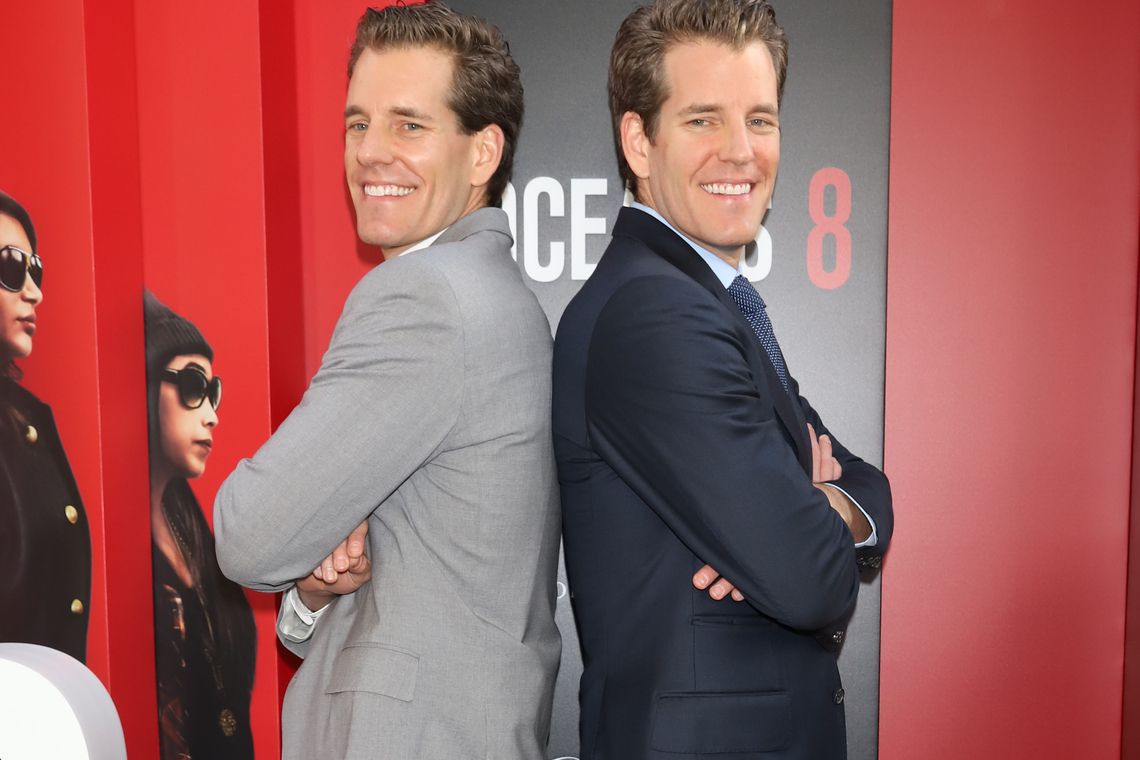

In a recent interview, Cameron and Tyler Winklevoss expressed that the cryptocurrency market needs to focus on trust and regulation to keep growing.

The Winklevoss brothers are among the most well-known names in the cryptocurrency world, today. The brothers famously claimed that they held approximately 1 percent of all Bitcoin (BTC) in existence in 2013. They are currently the leaders of the Gemini Trust exchange, a digital and fiat exchange platform. As early adopters and large-scale hodlers, the twins have a strong voice in the Bitcoin marketplace.

Of course, the simple reality is that cryptocurrency has come on hard times. In recent months, the news of QuadrigaCX’s CEO, Gerry Cotten, dying with private keys has caused a stir. With more than $190 million in lost coins and a host of angry clients, exchanges are on the rocks.

This is just one of many problems the industry is facing. Starting with Mt. Gox and winding through a host of hacks and thefts, crypto is hard to trust. This Wild West mentality has to change, according to the Winklevoss team. Trust has to grow if adoption is to continue.

Don’t Trust — Verify

The question of who to trust in the cryptocurrency world is a difficult one. The brothers believe that the best choice is the federal government. To that end, they are suggesting that the best option is to move toward increased regulation and away from the free spirit and autonomy that Bitcoin (BTC) was based on. Cameron Winklevoss said Friday at the South by Southwest conference in Austin, Texas:There are a lot of carcasses on the road of crypto that we’ve seen and learned from. At the end of the day it’s really a trust problem. You need some kind of regulation to promote positive outcomes.Others would, of course, disagree. Federal oversight is rarely the friend of business and never a friend of autonomy. With inflation rates and an economic slowdown, many in the crypto community think the government should be the last option. Trust, they would argue, is built on mathematics — not government.

A Sign of the Times

The brothers also suggested that cryptocurrencies are the best and only way to bring banking to the underprivileged. With over a billion people lacking access to traditional banking, Bitcoin may provide the necessary solution. Cameron said:With a crypto address and a smartphone, all of a sudden you are in the system. We are really just trying to extend the financial system, so you can send dollars anywhere in the world.Of course, this makes one wonder — how can a borderless system of payment require nationalized regulation for trust? The brothers didn’t have an answer for this dilemma. However, they were quick to point out that the movement of technology also demands digital currency. The movement towards an Internet of Things, artificial intelligence, and digital transaction grids will require digital currency. Gemini hopes to be there to help make that happen. Of course, a host of other companies want to do the same. Ripple’s XRP is already in place for banking transactions and the newly minted but rarely-used JPMorgan token (JPM) looks to dominate. Regardless, the twins are hoping that federal regulation, coupled with a broad user base, will increase adoption. The appeal for trust may seem more tied to self-serving business principles than actual fundamentals. A simple appeal to Satoshi’s original vision could solve the issue for the long haul. Think the Winklevoss twins are right about regulation, or should the market rely on Satoshi’s original trustless system? Let us know in the comments below!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored