The Bitcoin price is nearing the resistance area at $9600. Once it reaches it, we believe a corrective period awaits, which could extend the majority of February.

Well-known analyst @CryptoCharles__ outlined some previous anonymous Bitcoin price predictions, which were made on January 21, 2019. While the first two predictions were correct, the third one was invalidated at the end of October, and the fourth one, which states that the Bitcoin price will be at $29,000 by the end of February 2020, and looks like it will also be invalidated.

Let’s take a closer look at the price movement and see if Bitcoin is capable of initiating a strong rally next month and validating the prediction.lmao pic.twitter.com/9YBQoTPRb1

— CryptoCharles (@CryptoCharles__) January 27, 2020

Previous Monthly Increases

The Bitcoin price is currently at $9000. There are four more days until the monthly close, and the closest resistance area is at $9600, so we will split the difference and make the assumption that Bitcoin will close at $9300 by the end of the month. From $9300, a 213% price increase would be required in February for the Bitcoin price to reach $29,000. So, we will take a look at the biggest monthly candles each year to see if such an increase has a precedent. Besides 2011 and 2013, the Bitcoin price increases have gotten smaller, failing to reach 100%. The full table with the highest increase of each month is posted below.

Besides 2011 and 2013, the Bitcoin price increases have gotten smaller, failing to reach 100%. The full table with the highest increase of each month is posted below.

| Year | Month | Increase |

| 2011 | April | 630% |

| 2012 | July | 40% |

| 2013 | November | 461% |

| 2014 | May | 65% |

| 2015 | October | 55% |

| 2016 | June | 42% |

| 2017 | May | 105% |

| 2018 | April | 39% |

| 2019 | May | 66% |

February Bitcoin Price

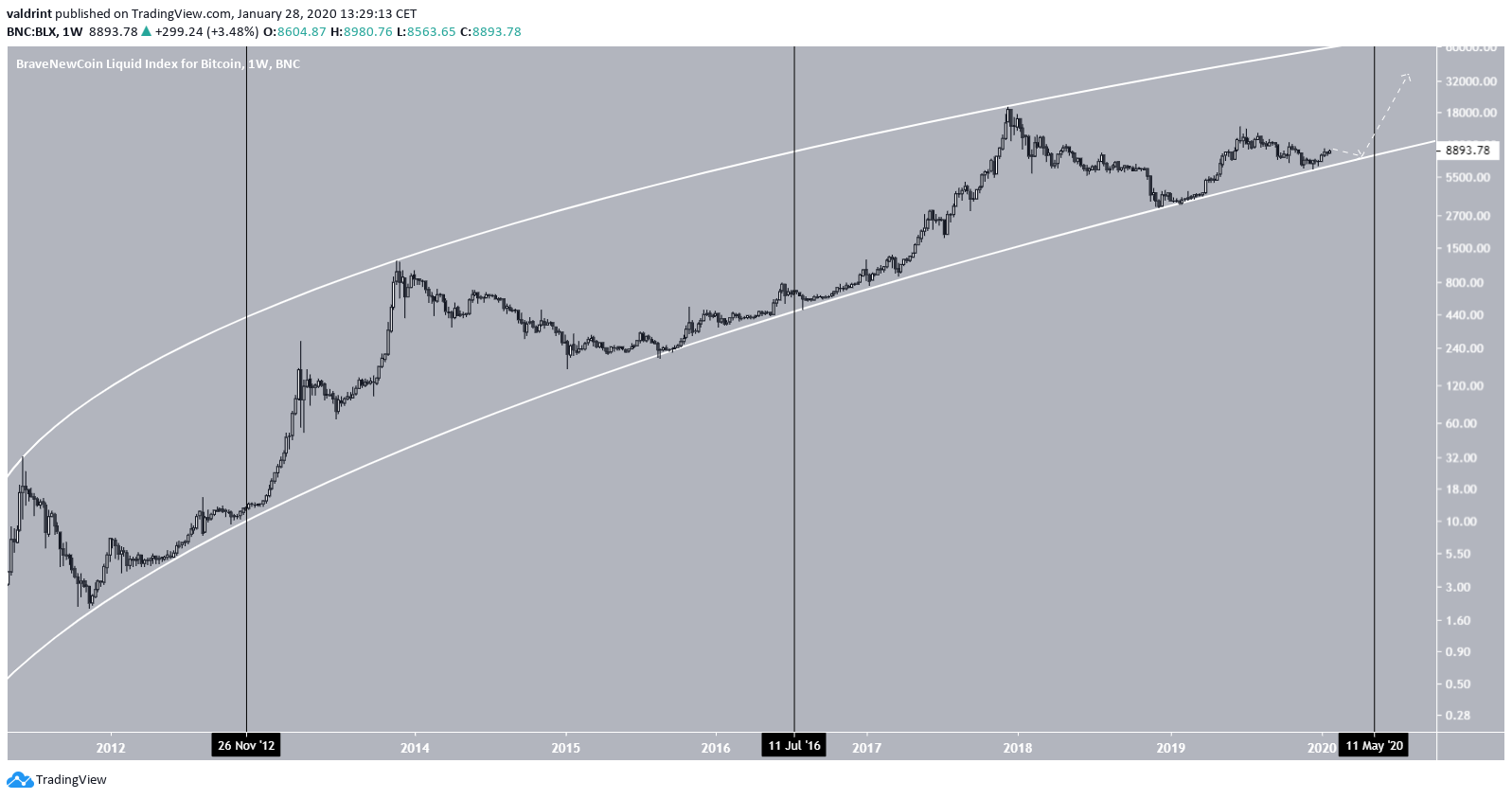

The current upward trend has been in place for 41 days, and it looks as if Bitcoin is very close to completing the fifth and final wave of an Elliott formation. We think the end of the fifth wave should be near since the price is approaching the very significant $9600 resistance area, so let’s assume that the Bitcoin price reaches it after four days. This leaves 28 days until the end of the correction, meaning that even if it is shorter than the upward move, it might not be completed until the end of the month. So, the Bitcoin price is likely to be between $8000-$9000 at the end of February. This fits with the logarithmic support lines and the halvening angle. Before the 1st and 2nd halvenings (vertical lines), the Bitcoin price gradually increased, before the rate of increase accelerated afterward.

Our proposed price movement for February would have the Bitcoin price staying close to the support line until halvening (May 2020), before increasing at an accelerated rate.

This fits with the logarithmic support lines and the halvening angle. Before the 1st and 2nd halvenings (vertical lines), the Bitcoin price gradually increased, before the rate of increase accelerated afterward.

Our proposed price movement for February would have the Bitcoin price staying close to the support line until halvening (May 2020), before increasing at an accelerated rate.

To conclude, the Bitcoin price is likely in the fifth and final wave of a five-wave Elliott formation, which we believe will end near $9600. We think the Bitcoin price will only increase gradually until May before the rate of increase accelerates.

To conclude, the Bitcoin price is likely in the fifth and final wave of a five-wave Elliott formation, which we believe will end near $9600. We think the Bitcoin price will only increase gradually until May before the rate of increase accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored