The Binance Coin (BNB) price is trading inside a crucial support area, but technical indicator readings are entirely neutral.

BNB is the native token of the Binance Exchange. It is used to receive a discount on trading fees. The BNB price has decreased since reaching a high of $398.3 (red icon). The rejection created a long upper wick and bearish candlestick. Additionally, it validated the $335 horizontal area as resistance. This is a crucial level since it had previously acted as support since Aug. 2021.

Currently, the Binance coin price is trading near $270. The closest support area is $225. Therefore, BNB is trading in the middle of the current range.

Moreover, the weekly RSI is at 50, a sign of an undetermined trend. Therefore, the technical analysis readings from the weekly time frame are insufficient to determine the future trend’s direction.

FUD Scaring Binance Users

It is worth mentioning that withdrawals from the Binance exchange are at a negative $1.9 Billion (Bn). This is still lower than the $2.3 Billion during the FTX collapse. In order to calm the markets, Justin Sun tweeted that he has deposited $100 million into the Binance exchange. Both the Binance CEO and Tron CEO appear to have added their commentary on the situation in order to reduce the current market panic related to the mass withdrawals from Binance. The world’s largest cryptocurrency exchange has seen over $3.7 Billion in withdrawals over the last week, leading users to echo a similar situation that began with the now-defunct FTX Exchange. The increase in outflows has also affected the price of Binance coin (BNB) negatively.

BNB Price Bounces at Support

The daily chart shows that the BNB price is trading inside the $270 horizontal support area. While it decreased below it today, it bounced afterward, creating a long lower wick (green icon). This is considered a sign of buying pressure.

It is possible that the drop occurred after the Binance exchange temporarily halted USDC withdrawals. According to Changpeng Zhao, this occurred because of a token swap involving USDC and is a minor issue that will be fixed in a short amount of time.

Similarly to the daily timeframe, the weekly RSI is below 50 and has yet to generate any bullish divergence.

Therefore, the daily time frame also fails to provide a clear direction for the future trend.

Will BNB Break Out or Falter?

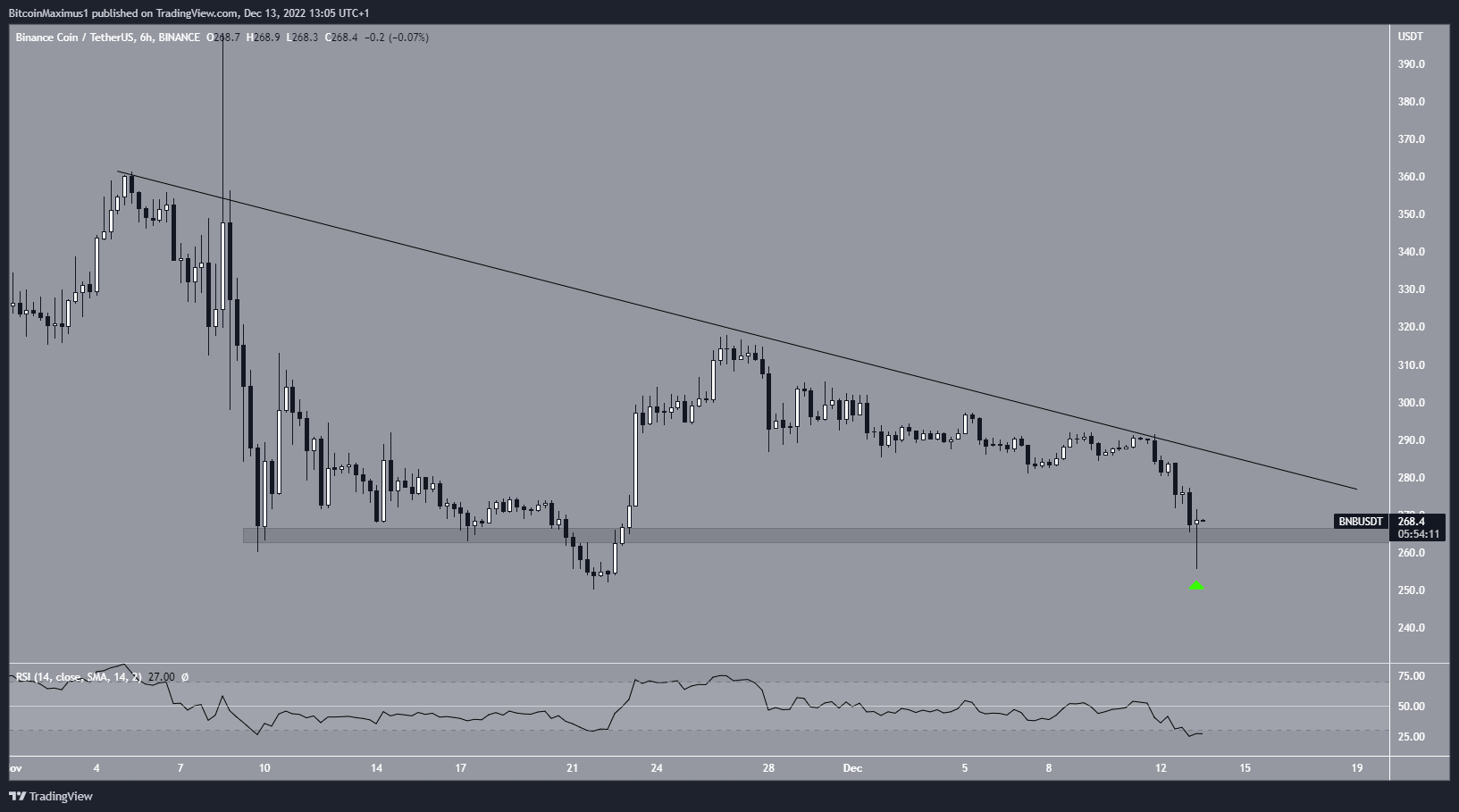

Finally, the six-hour chart shows that the BNB price has decreased underneath a descending resistance line since Nov. 5. Even though BNB decreased over the past 24 hours, it is currently in the process of bouncing (green icon).

An interesting reading comes from the six-hour RSI, which fell to its lowest value in two months. However, the indicator has not generated any bullish divergence.

As a result, whether the BNB price breaks out above the resistance line or breaks down below the $265 area instead will likely determine the future trend.

For BeInCrypto’s latest crypto market analysis, click here.