The community is in turmoil as over $21 million in Solana (SOL) remains locked within Lido’s staking protocol.

This situation has spotlighted the potential risks within decentralized finance (DeFi) systems.

Why Users Are Unable to Withdraw Solana From Lido’s Staking Protocol

Lido, a major player in the DeFi sector, enables users to stake their digital assets in exchange for placeholder tokens. These tokens can be used across different DeFi platforms.

While the broader Lido ecosystem amasses over $31 billion in total value locked (TVL), its Solana service trailed behind competitors like Marinade and Jito.

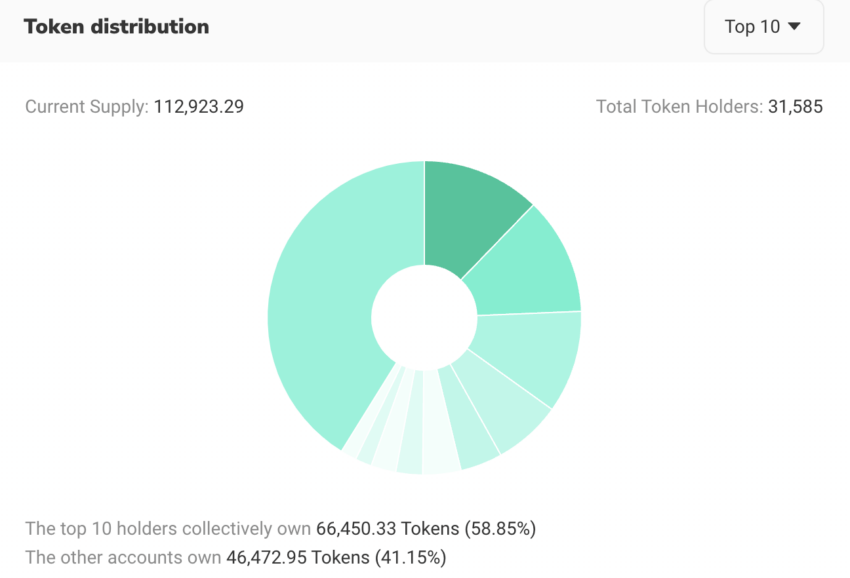

Finally, in October, Lido announced the discontinuation of its Solana service, leading to the removal of its stSOL and SOL exchange interface. Lido formally ceased support on February 4, yet 112,923.29 SOL remains locked, affecting 31,585 users, according to Solscan data.

As per the current market price, the valuation of locked Solana is approximately $21 million.

“Whilst this decision was difficult in the face of numerous strong relationships across the Solana ecosystem, it was deemed a necessity for the continued success of the broader Lido protocol ecosystem,” Lido justified the discontinuation.

Read more: 13 Best Solana (SOL) Wallets To Consider In March 2024

Complicating matters, a bug in Lido’s smart contracts has emerged, hindering users from withdrawing their investments. This flaw, coupled with the end of the user-friendly interface, has forced stakeholders to interact directly with the code, a move fraught with challenges, especially for those with limited technical knowledge.

The transition from a web interface to code-based interactions has elevated the risk of errors and left many investors stranded. Within Lido’s community channels, there’s vocal criticism about the disorder and perceived neglect faced by stSOL holders.

“The Solana channel of the Lido Discord is a mess. stSOL holders trying to unstake completely lost and abandoned. I know stSOL is depreciated, but I don’t think this is the right way to treat users,” a pseudonymous X user wrote.

Despite Lido’s retreat from Solana, the network’s DeFi presence remains strong. Platforms like Marinade Finance and Jito continue to show significant staked assets.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

Solana’s DeFi influence has surged, now holding the fourth-largest spot based on TVL, bolstered by a 61% increase over the last month.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.