Litecoin (LTC), an altcoin that uses the proof-of-work consensus mechanism and was once called “digital silver,” is working to regain its former glory. Fundamental factors strengthen the network’s resilience and utility, but the price does not reflect those underlying values.

A few signals suggest that Litecoin’s momentum is reviving and growing in the year’s final quarter.

Average Transaction Value, Litecoin ETF, and More

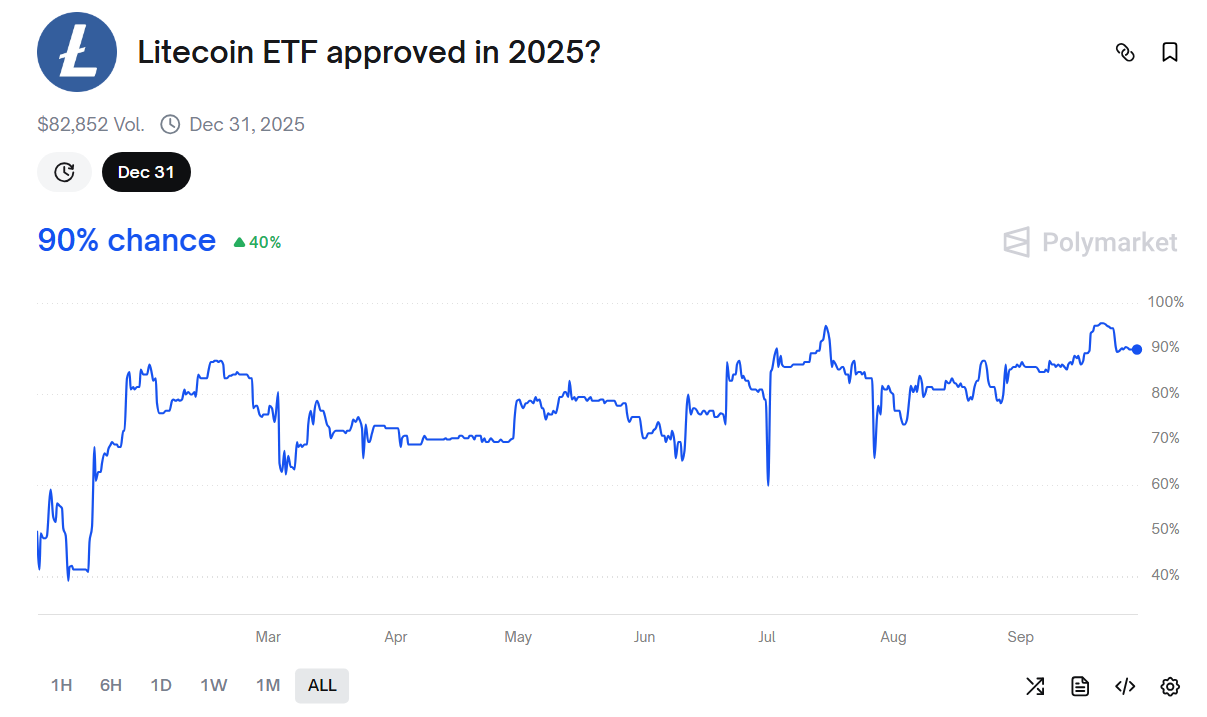

According to expert Nate Geraci, the US Securities and Exchange Commission (SEC) will soon issue final decisions on spot crypto ETF applications in the coming weeks.

The Canary Litecoin ETF application is the first in line. A decision is expected this week on October 2, followed by rulings on other altcoins such as SOL, DOGE, XRP, ADA, and HBAR.

Prediction platform Polymarket currently assigns a 90% probability that regulators will approve a Litecoin ETF in 2025. Investors show strong confidence in this outcome.

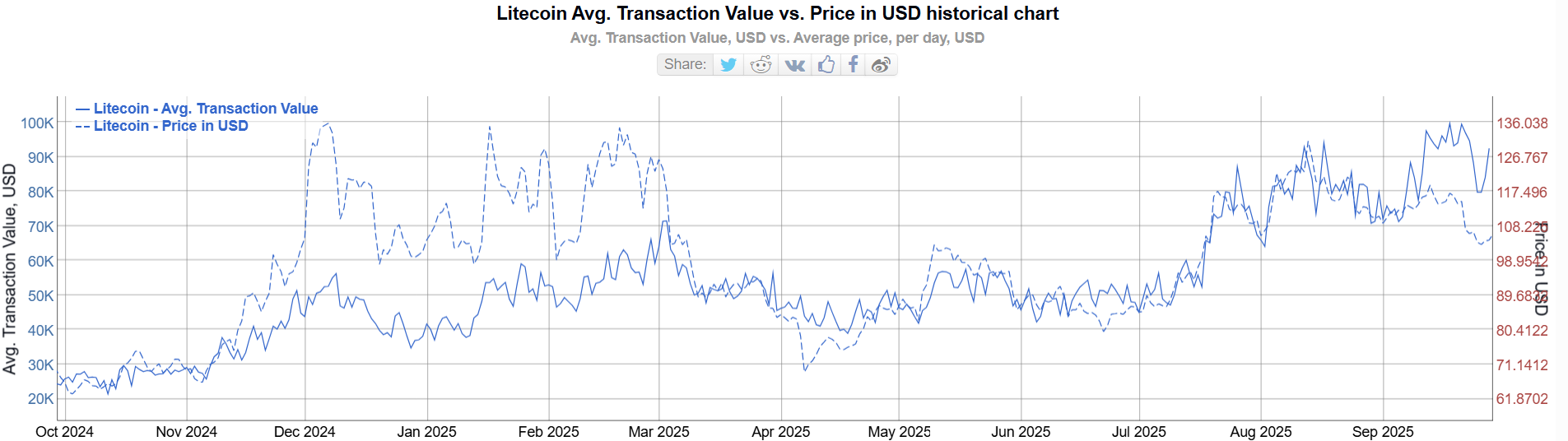

Second, Litecoin’s average transaction value has reached a two-year high, signaling a surge in large transactions across the network.

Data from BitInfoCharts shows that the average transaction value (solid line) climbed from $25,000 at the end of 2023 to nearly $100,000 in September 2025, four times higher and the highest level in two years.

The rise is noteworthy because LTC’s price remained stable at around $100 without hitting new highs. This suggests more LTC is moving across the network. These could be payment transactions or accumulation moves.

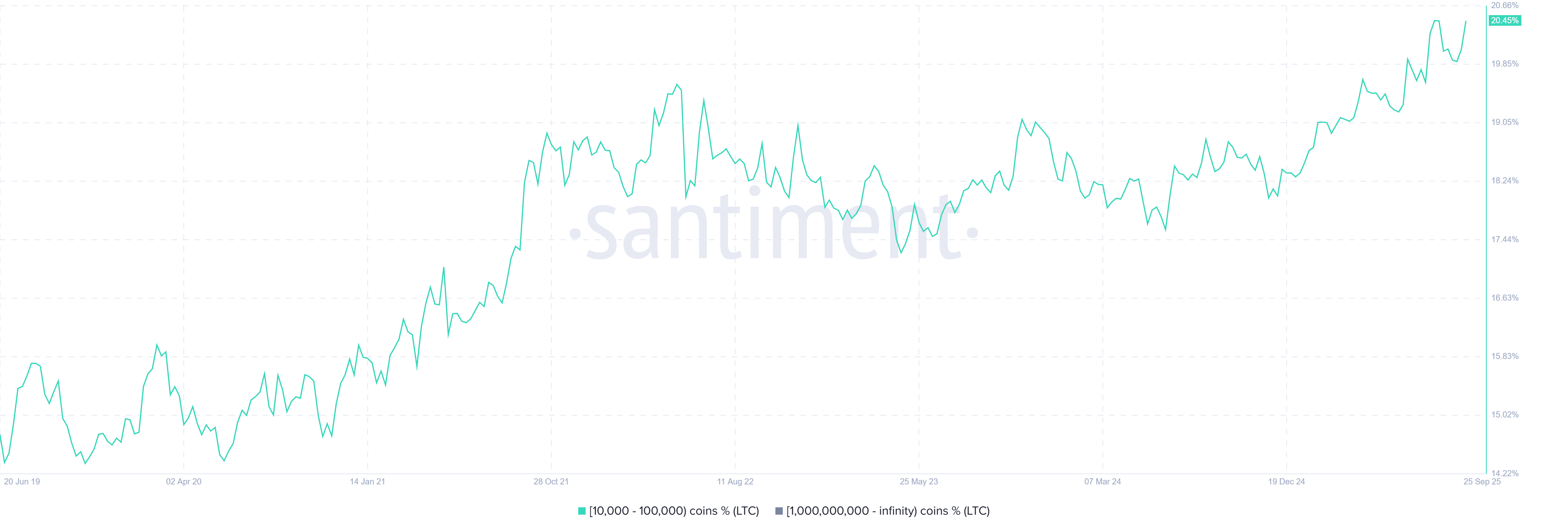

Recent Santiment data support the accumulation thesis. Wallet addresses holding between 10,000 and 100,000 LTC have grown steadily over the past five years, accounting for more than 20% of the supply.

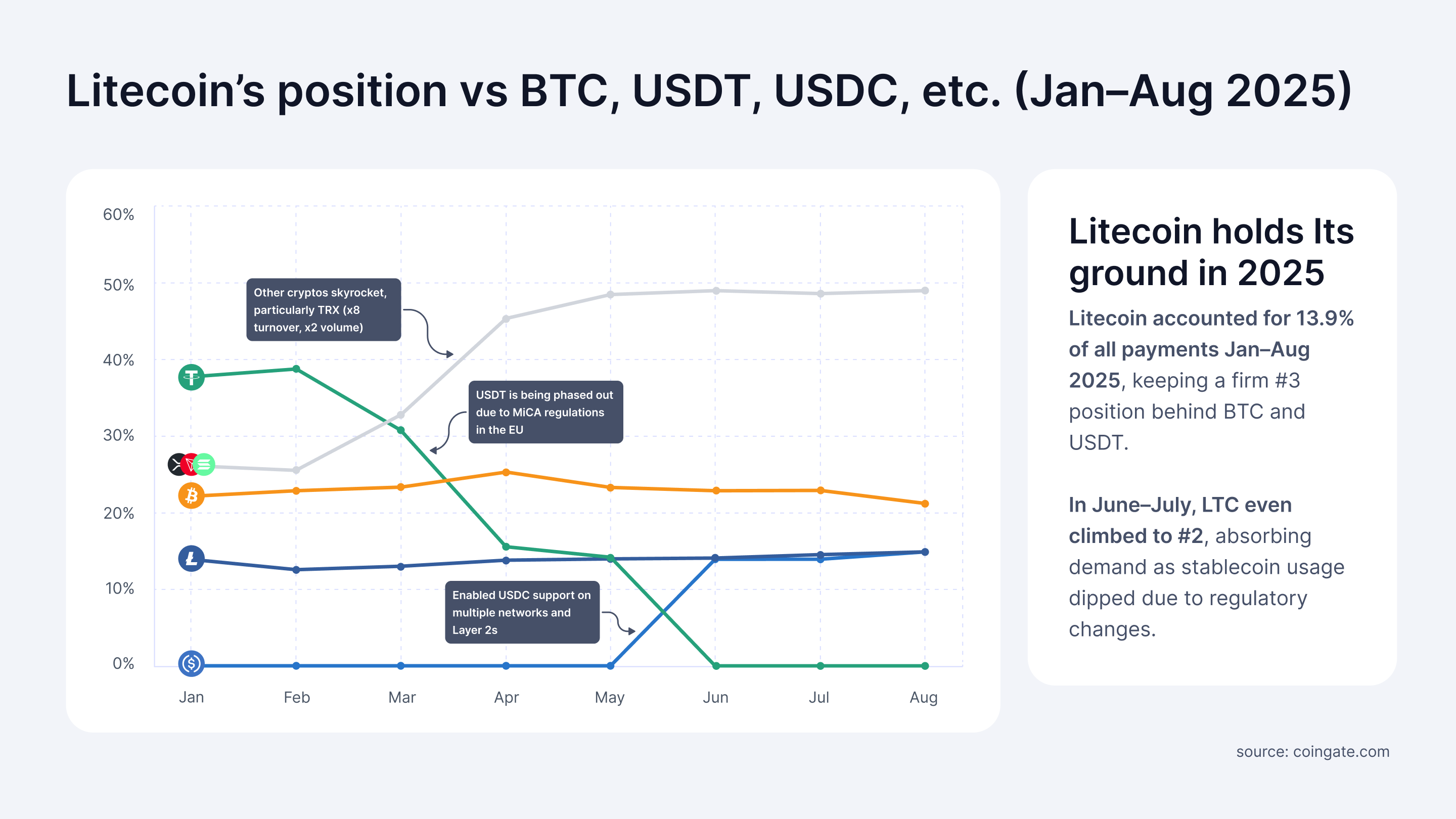

Third, a report from CoinGate highlights Litecoin’s dominance in consumer payments on its platform. From January to August 2025, LTC represented 13.9% of all transactions, ranking third behind Bitcoin (23%) and USDT (21.2%).

“Litecoin payments remain steady across the year, with higher usage when competing assets face headwinds. Rather than being a marginal alternative, Litecoin has proven it can capture meaningful share when circumstances change, which is a clear sign of resilience and user trust,” CoinGate reported.

These positive signs of adoption lead many analysts to argue that LTC is undervalued compared to the utility its network delivers.

“Litecoin is at least 50x undervalued… it’s actually more once price goes vertical and it catches the next wave of adoption, likely sending it another 10x… so 500x undervalued,” analyst Master predicted.

However, competition remains fierce. Other altcoins, such as ETH, SOL, XRP, and XLM, are also cementing their roles in the growth of DeFi and global payments. Investors, therefore, may find strong alternatives for their portfolios beyond LTC.