As Bitcoin hits a two-month low of $57,500, numerous crypto investors are strategically exiting volatile meme coins. The broader market downturn has notably affected these digital assets, known for their speculative nature, leading to significant sell-offs.

This week, some of the investors have started booking profits. Yet, they still hold a significant amount of meme coins, awaiting market recovery.

Crypto Investors Sold Pepe, Dogwifhat, and MICHI

“Dimethyltryptamine.eth,” who owns the wallet address 0x4a2, returned after 10 months of dormancy. According to Spot On Chain, this crypto whale exchanged 10 billion Pepe (PEPE) for $112,000, converting them into 32.73 Ethereum (ETH) at a rate of $0.0000112118.

Despite the market’s volatility, this investor still possesses 1.99 trillion PEPE, currently valued at $22.35 million, which represents a staggering 59,600% increase in value.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Moreover, this investor holds substantial amounts of other meme coins. Their portfolio includes 711.7 million Wojak (WOJAK) and 147.5 billion Mog Coin (MOG), with unrealized profits of $457,000 and $824,000 respectively. These figures highlight the considerable gains still possible in the fluctuating meme coin market.

In another significant movement, BxPMj transferred 900,000 Dogwifhat (WIF) tokens, valued at $1.64 million, to the centralized exchange Bybit. Despite the market’s downturn, BxPMj’s remaining holdings in WIF are estimated at $1.76 million.

Additionally, the owner of a Solana (SOL) wallet, J2GcK, sold 8.6 million michi (MICHI) for $1.34 million, realizing a profit of $1.24 million. Initially, J2GcK had invested 578 SOL, worth $103,000, to purchase these tokens between April 8 and April 15. At their peak, the MICHI tokens were valued at over $5 million, demonstrating the high volatility and potential profits in meme coin investments.

Previously, in an interview with BeInCrypto, Tristan Dickinson, the CMO of EOS Network, discussed the behavior of crypto whales.

“Whales follow market trends and capitalize where they see an opportunity. As easily as they can liquidate, putting downward pressure on the market, they can hodl if they see an opportunity,” Dickinson told BeInCrypto

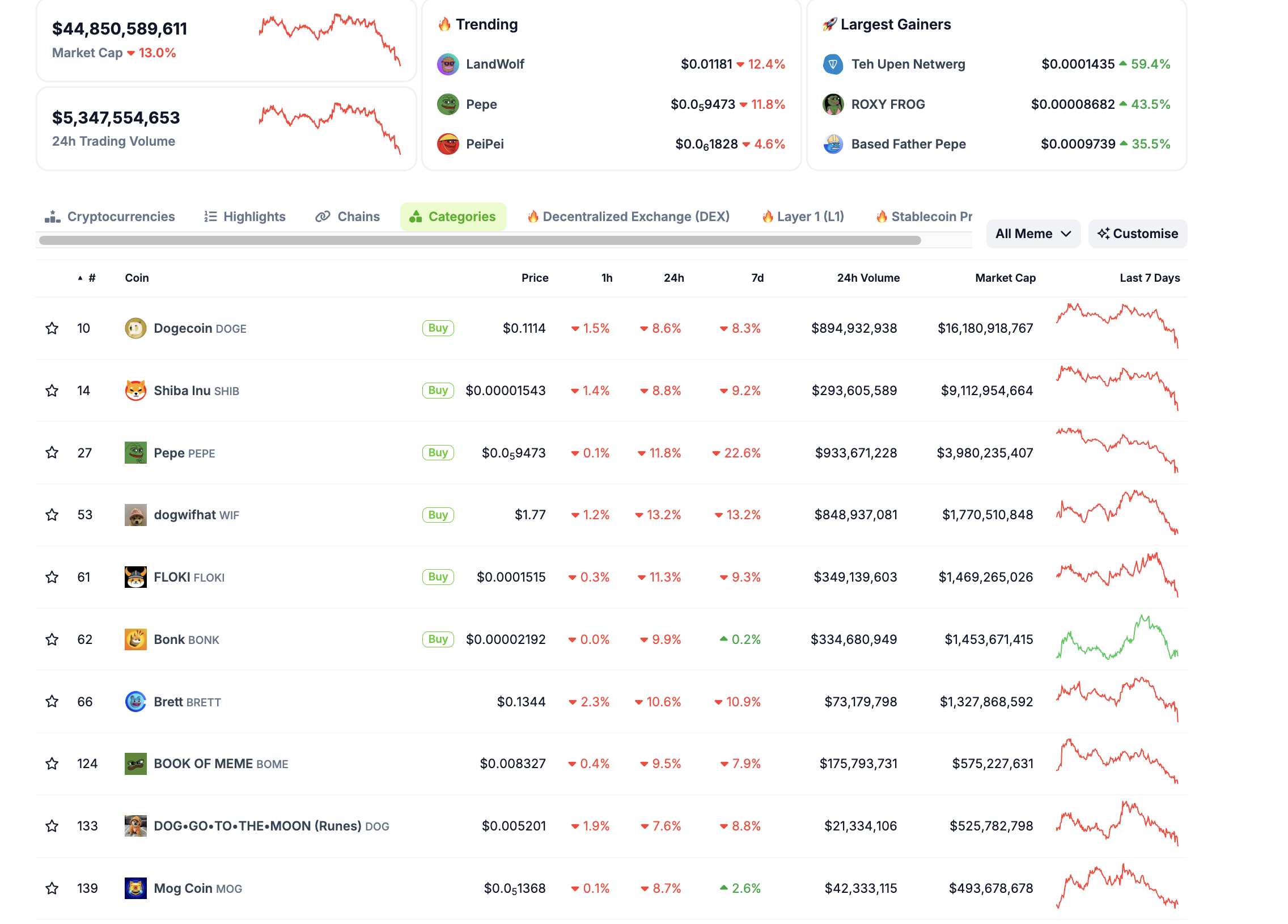

Currently, the meme coin sector has declined by approximately 13% in the last 24 hours. WIF, among the top 10 meme coins, experienced the most significant drop, declining by 13.2%.

Read more: 11 Top Solana Meme Coins to Watch in July 2024

Conversely, meme coins such as Dogecoin (DOGE) and DOG•GO•TO•THE•MOON have faced less severe impacts, with reductions of 8.6% and 7.6% respectively.