Contrary to previous anticipation and predictions, the several spot Ethereum (ETH) ETFs did not launch on July 2. While analysts have set the new expected date for July 8, the optimism around the event is waning.

Even though some market participants think the event will positively influence ETH, on-chain analysis and comments show that there is no clear path yet.

Investments Into Ethereum Plummet

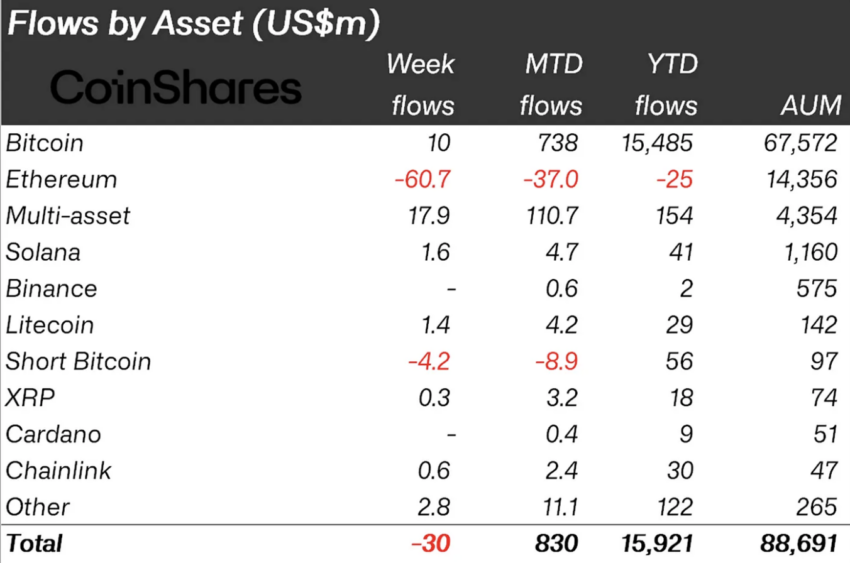

According to CoinShares’ digital fund flows report, Ethereum recorded its largest outflows in almost two years.

The report, which tracks capital inflows into crypto-related investment products, noted that the altcoin became the worst-performing asset in terms of net flow.

“Ethereum saw the largest outflows since August 2022, totaling US$61m. This brings the last two weeks of outflows to US$119m, making it the worst-performing asset year-to-date regarding net flows.

James Butterfill, CoinShares Head of Research, explained.

Based on our findings, the delay in the approval and return of the S-1 forms caused uncertainty among investors, which led to a plunge in inflows.

ETH’s price was not spared either. Trading at $3,291, the cryptocurrency’s value has decreased by 4.45% in the last 24 hours.

This decline, among other things, was one reason the sentiment around Ethereum changed. Last week, we reported that long-term hodlers and short-term holders were bullish on ETH.

Leverage Trading Jumps, But Some Prefer the Sidelines

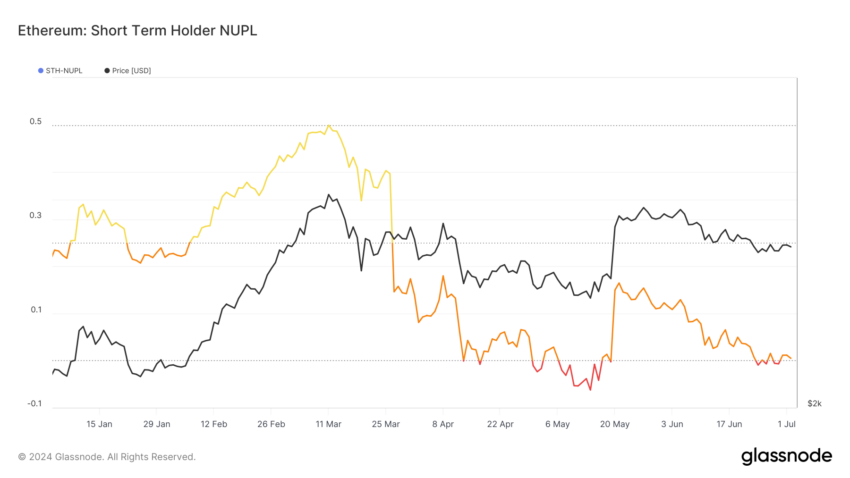

As of this writing, that perception is no longer true, as shown by the STH-NUPL. The STH-NUPL stands for Short-Term Holder—Net Unrealized Profit/Loss.

It considers the behavior of short-term investors — specifically those who have held for less than 155 days.

According to Glassnode, Ethereum’s STH-NUPL has moved from optimism to fear, reinforcing that the broader market is not as excited about the ETFs as they were during the weeks before.

If this continues, demand for ETH may not be as intense as previously predicted when the ETFs receive the final go-ahead.

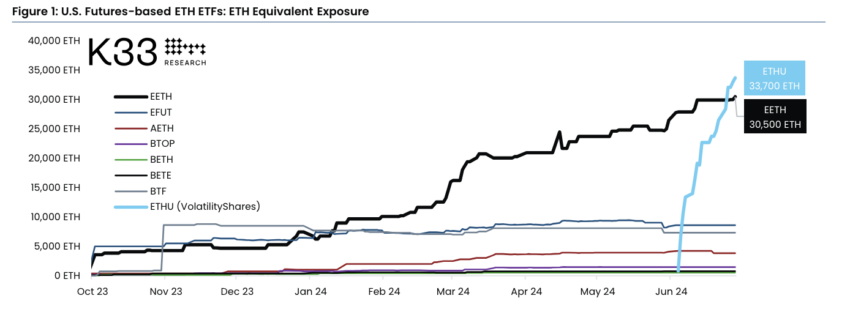

But on K33 Research’s part, it is a different ball game, according to K33 Research. In its “Ahead of the Curve” report, released July 2, the digital asset brokerage firm reveals that interest in futures Ethereum ETFs has been surging.

Read More: How to Invest in Ethereum ETFs

As shown above, K33 Research added that the spike in speculation on the future price of ETH is proof that institutional interest is evidently present.

“This is seen in the demand for leveraged ETH exposure. VolatilityShares 2x leveraged ETH ETF needed only 15 trading days to become the largest futures-based ETH ETF measured by ETH equivalent exposure (2nd largest measured in AUM).”

The K33 Research report stated.

However, it remains uncertain if the interest in futures would translate into a cascade of inflows for the spot Ethereum ETFs.

If that happens, then the price of ETH will jump within a short period. If not, the altcoin price may slip below $3,200. Despite the underwhelming price performance, some analysts on X believe that the current market condition is “perfect” for the launch.

An example of those with this bias is crypto investor Quinten Francois. According to Francois, the lack of hype and retail interest may allow Ethereum to prove naysayers wrong.

ETH Price Analysis Reveals Possible Decline Below $3,200

Per the short-term price action, ETH may find it challenging to reach $3,5000. BeInCrypto observes this after analyzing the In/Out of Money Around Price (IOMAP).

The IOMAP identifies crucial buying and selling spots that can act as support or resistance. If there is a large cluster of addresses in the money, the price range will likely provide support.

However, a large cluster of addresses out of the money will provide resistance. At press time, the IOMAP shows that 3.06 million addresses purchased 1.71 million ETH between $3,290 and $3,386. This group is out of the money.

On the other hand, 2.06 million bought 863,020 ETH in the $3,190 to $3,285 region and are in the money. Since there is a high concentration of addresses and potential sellers, the $3,386 region could act as resistance for ETH.

Read More: Ethereum ETF Explained: What It Is and How It Works

As such, ETH’s price could slide below $3,200 in the short term. To invalidate this thesis, inflows in the first week of the product’s launch need to reach billions of dollars.

If this happens, then the cryptocurrency can trade above $3,500. Another factor that can help ETH’s price breakout is if the demand in the spot market has to improve.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.