While the broader crypto market faced a downturn throughout June, Mog Coin (MOG) soared, registering a 50% increase in value. This remarkable performance catapulted MOG into the limelight, positioning it among the top 100 cryptocurrencies by market capitalization.

As the meme coin hovers around its all-time high, analysis suggests that it may have been in the overbought territory.

MOG Outperforms the Broader Crypto Market

While stalwarts like Bitcoin (BTC) faltered, MOG thrived. Its climb to its all-time highs during a broader market correction reflects a divergent path that has caught the attention of market participants.

After outpacing the Book of Meme (BOME), MOG now holds the 94th spot with a market valuation exceeding $700 million. Moreover, it ranks as the eighth-largest meme coin.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

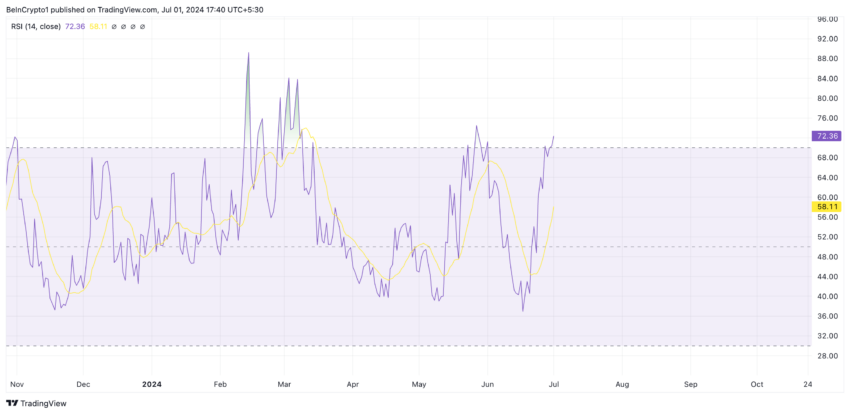

Substantial market demand underpins the surge in MOG’s price. The Relative Strength Index (RSI), a key indicator of market sentiment, supports this view. Currently, the RSI for MOG stands at 72.36. However, traditionally, an RSI above 70 suggests that a correction could be on the horizon.

“I’ll definitely be looking for a [MOG] retracement to get in on the action,” crypto analyst Altcoin Miyagi said.

Consequently, this strategy could allow investors to capitalize on the coin’s popularity while mitigating the risks associated with its current high valuation.

This demand was vividly illustrated when an investor who owns the crypto wallet – 0x8bf engaged in a significant transaction. He purchased 276.3 billion MOG tokens for over $524,000.

Fear of missing out (FOMO) may have fueled the move, especially significant considering that just a day before, 0x8bf had sold 252 billion MOG at a lower price. The rapid buy-back at a higher price point highlights the volatile yet enticing nature of meme coins like MOG.

“Currently, 0x8bf holds 749.698 billion MOG worth $1.45 million with an estimated total profit of $497,000 (+36.4%) from the token,” Spot On Chain said.

Furthermore, the intrigue around MOG is also fueled by its position within the meme coin niche—a segment of the cryptocurrency market that often thrives on community engagement and viral trends rather than solely on fundamental value.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.